EUR/USD

The Euro went back and forth during the course of the week, settling on a neutral looking candle. I think at this point, it’s obvious that the 61.8% Fibonacci retracement level has been offering support. I think at this point, it’s likely that the market continues to go back and forth, showing signs of confusion at this point. I think that the overall attitude of the market is still going to be very short term, so I would not look for major moves in the near term.

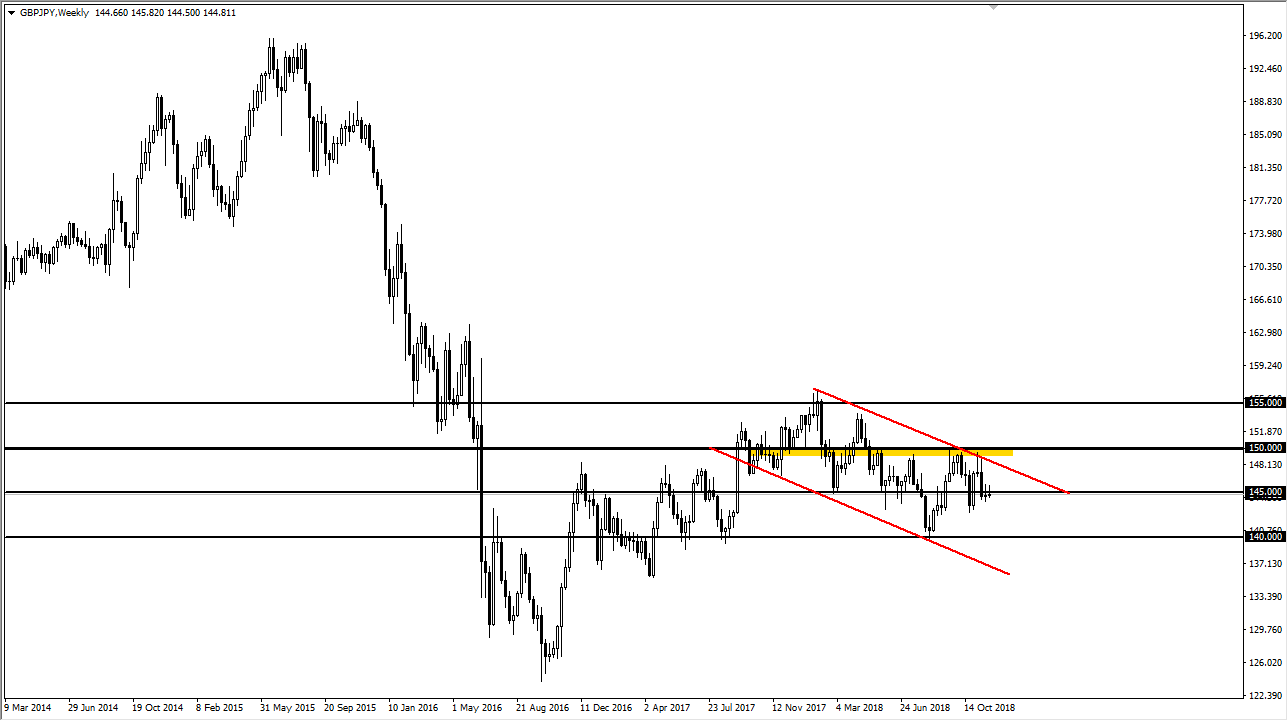

GBP/JPY

The British pound did very little against the Japanese yen during the week, but the previous candle stick is a inverted hammer, preceded by a very negative candle stick as we are continuing to see a lot of trouble with the British pound. Keep in mind that the Brexit continues to weigh upon the currency, and of course this is a major “risk on/risk off” currency pair, so we could see an explosive move to the downside. If we do rally from here, the downtrend line should continue to keep this market down. It’s not until we break above the ¥150 level that I would be concerned about buying.

GBP/USD

The British pound has been grinding towards the 1.27 level for some time. This massive support level should eventually get broken through though, and once we do get below there we could be looking for a move down to the 1.22 handle based upon the measurement of the descending triangle. Rallies at this point should be selling opportunities, and I believe that the British pound will continue to get hammered due to the lack of interest by the British Parliament in signing the agreement.

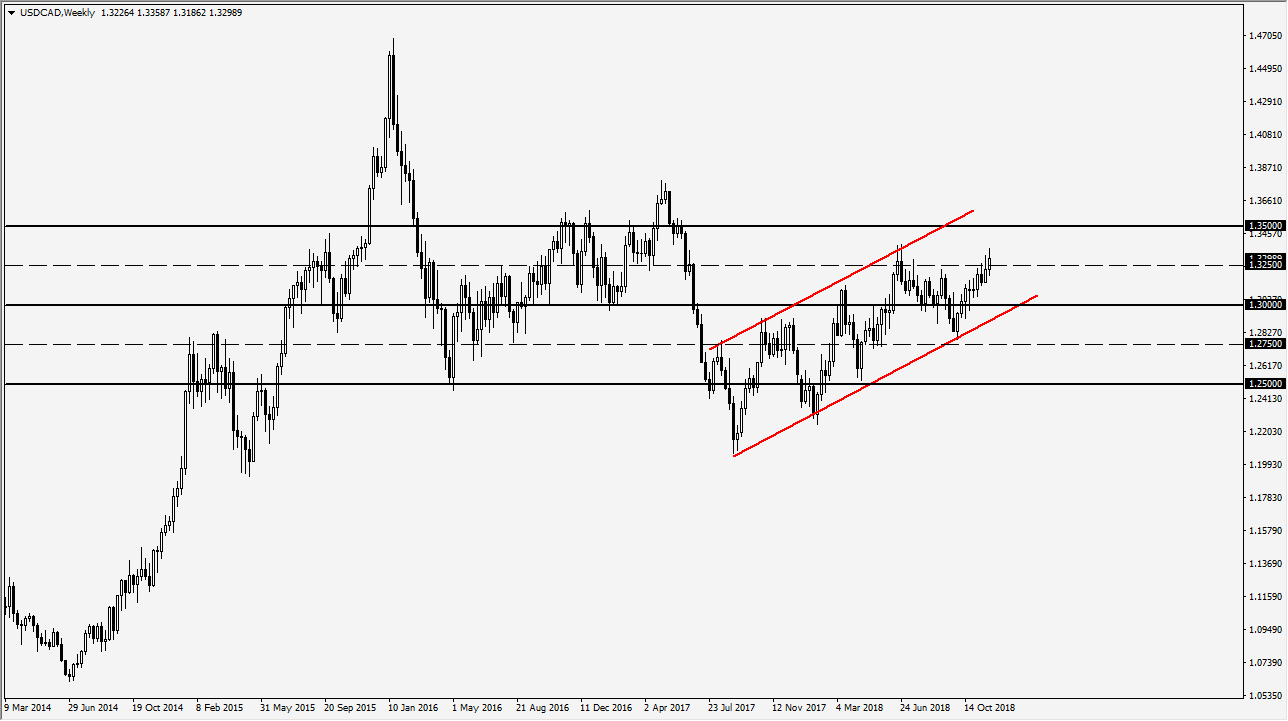

USD/CAD

The US dollar rallied during the week, breaking above the 1.3250 level. It did pull back from the 1.3350 level. However, the question now is whether or not it is going to be a “double top”, or if we are just simply get a pullback to find buyers to grind this market higher based upon the up trending channel. I believe that there should be support underneath at the 1.30 level.