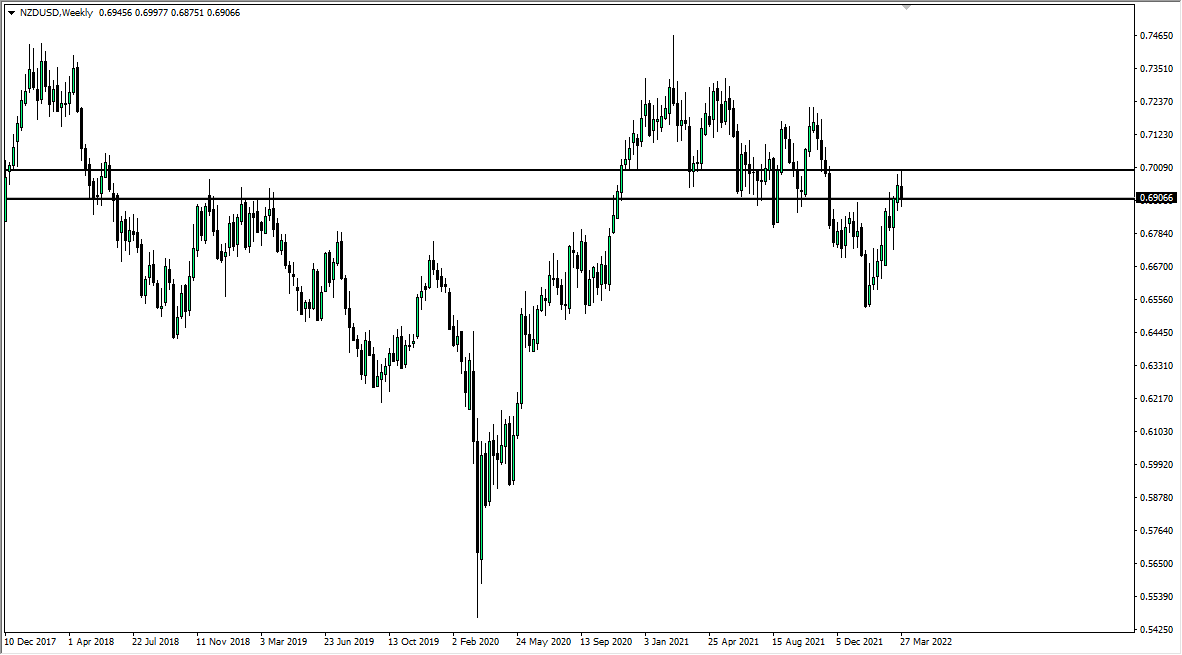

NZD/USD

The New Zealand dollar initially tried to rally during the week, but then rolled over to break through the 0.6750 level, showing signs of real exhaustion. The 50% Fibonacci retracement level held a couple of weeks ago, and it now looks as if although we are approaching a little bit a potential support, it’s minor at best at the 0.67 handle, and I think rallies at this point will continue to be sold as more of a “risk off” attitude envelops of markets overall.

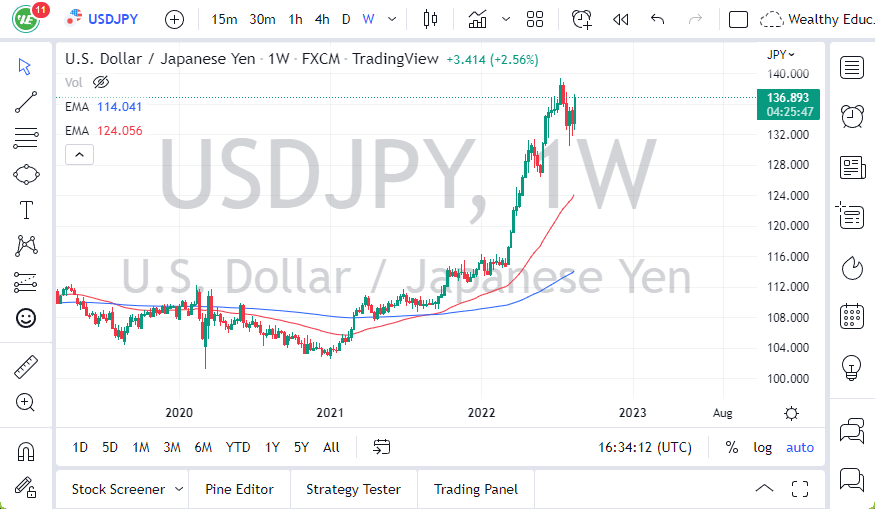

USD/JPY

The US dollar broke down significantly through the uptrend line that has been part of the up trending channel for the last year, and now that we have broken through that, the 200 day EMA on the daily chart, and of course the massive support at ¥111.50, it looks very likely that the market will continue to rollover. The US dollar is going to sell off against the Japanese yen as long as we are in a “risk off” attitude around the world, and I don’t see that change happening anytime soon. Because of this, I continue to fade rallies and I think that this week was the beginning of a much larger move to the downside.

EUR/USD

The Euro initially tried to rally during the week but turned around and fell rather hard. We ended up forming a shooting star, touching the 1.15 handle. This is an area that is extensive resistance above, and I think that the market will continue to break down from there. I think ultimately we will go looking to test the 61.8% Fibonacci retracement level at the 1.12 handle. I believe that we are going to continue to go back and forth more than anything else though.

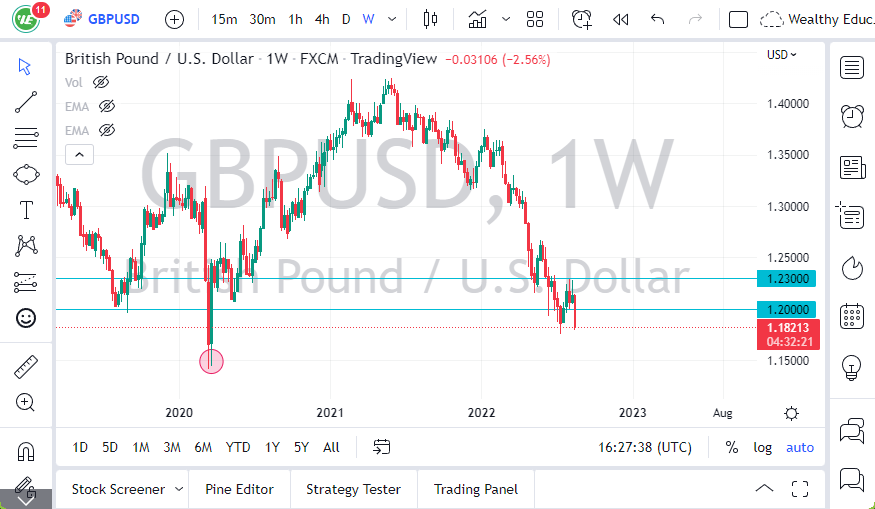

GBP/USD

The British pound try to rally during the week but has shown the 1.27 level to be resistive yet again. Because of this, I think that the market is getting ready to head down towards the 1.22 handle, based upon the descending triangle that I have marked on the chart. Quite frankly, as long as there are concerns about the Brexit, it’s difficult to imagine where the British pound rallies with any significant sustainable momentum.