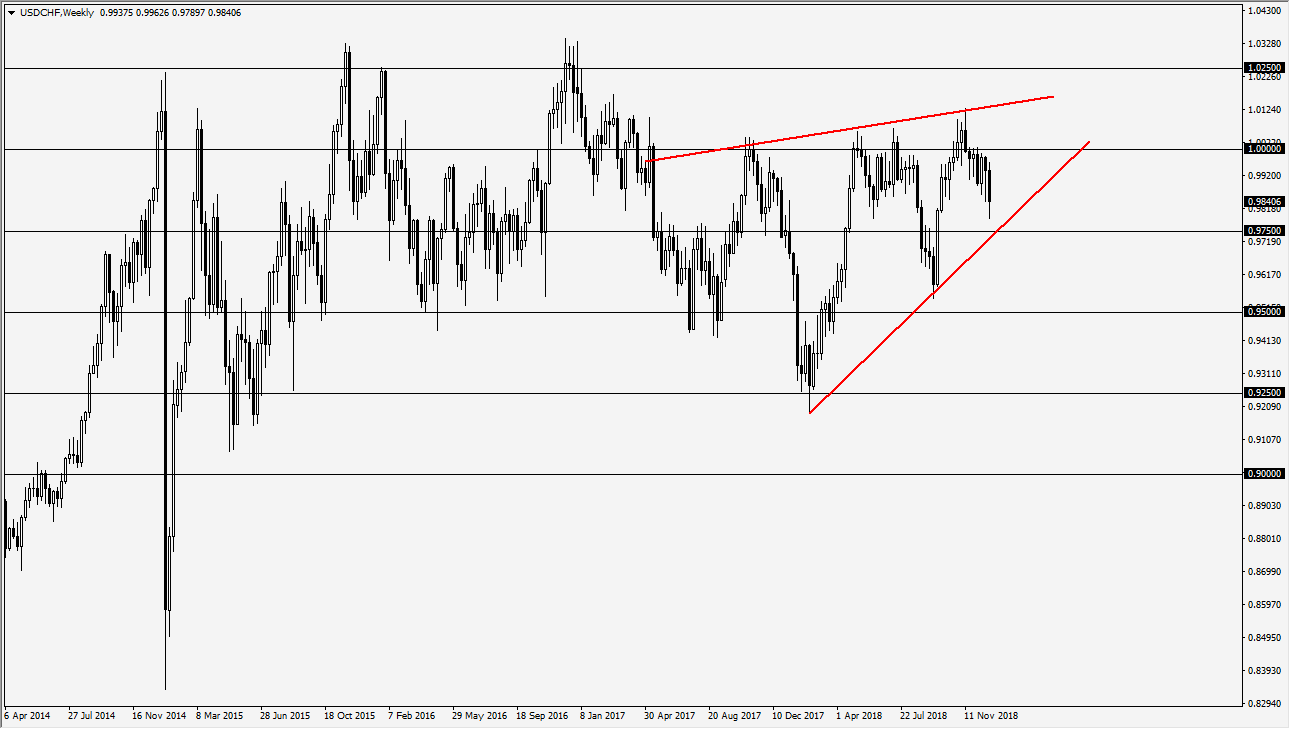

USD/CHF

The US dollar fell against the Swiss franc most of the week but did find a little bit of support just above the 0.9750 level, showing signs of life again. As you can see on the chart, I have a couple of trendlines drawn, so I think that buyers could come back into the markets, but if we were to break down below the uptrend line, that opens the door down to the 0.95 handle next which should be rather supportive as well.

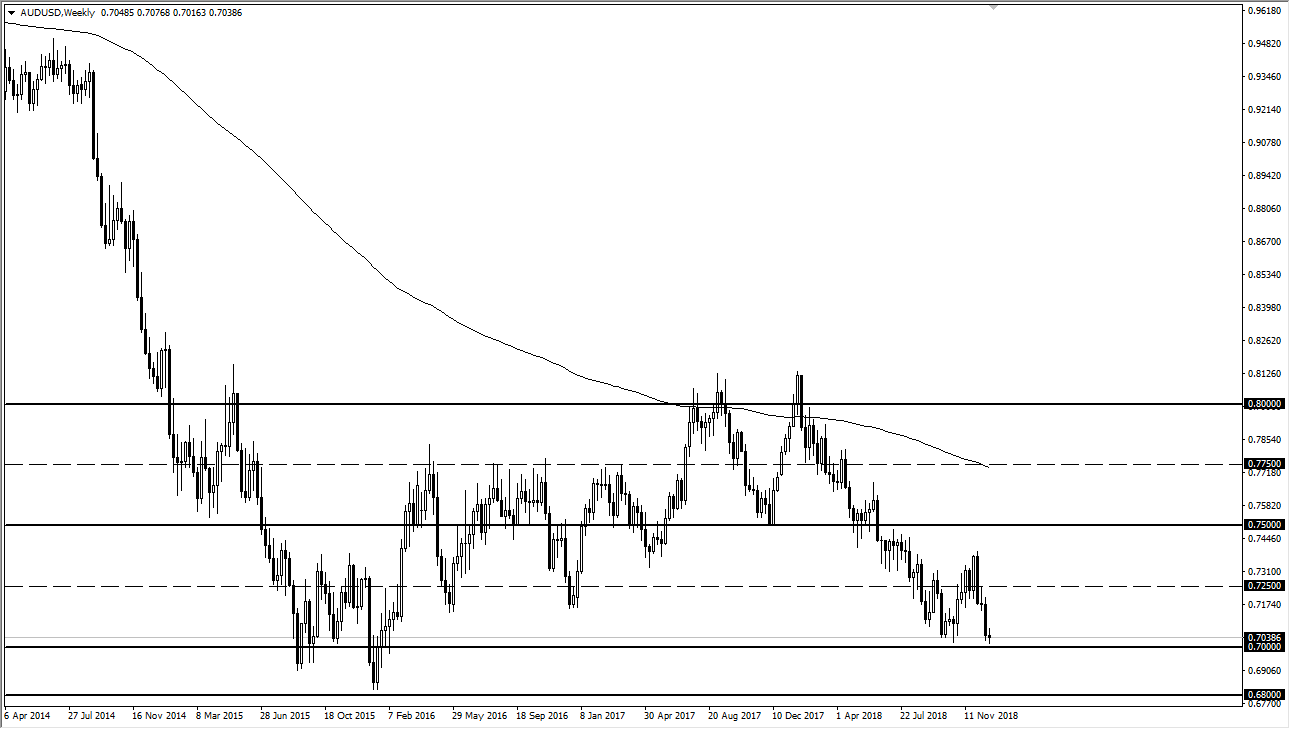

AUD/USD

The Australian dollar went back and forth during the week, showing signs of indecision, which is in a huge surprise considering that it’s the end of the week, and I think at this point it’s probably going to be a scenario where the market could bounce a bit from here, but ultimately find reasons to rollover based upon the US/Chinese problem, and I think the dashed line at the 0.7250 level is also an area where we could see sellers return. What this market bounce and then short again. However, if we close below the 0.70 level, we will probably go to the 0.68 level rather quickly.

GBP/USD

The British pound rallied a bit during the week, testing the 1.27 level by the time the market ended the week. I think we are at a major resistance barrier though, so I’m looking for some type of exhaustion to start selling again. The descending triangle above should continue to push this market lower, and the measure of the move is the 1.22 handle as I have marked on the chart. With the Brexit issue still out there, I think it’s only a matter time before the pound rolls over again.

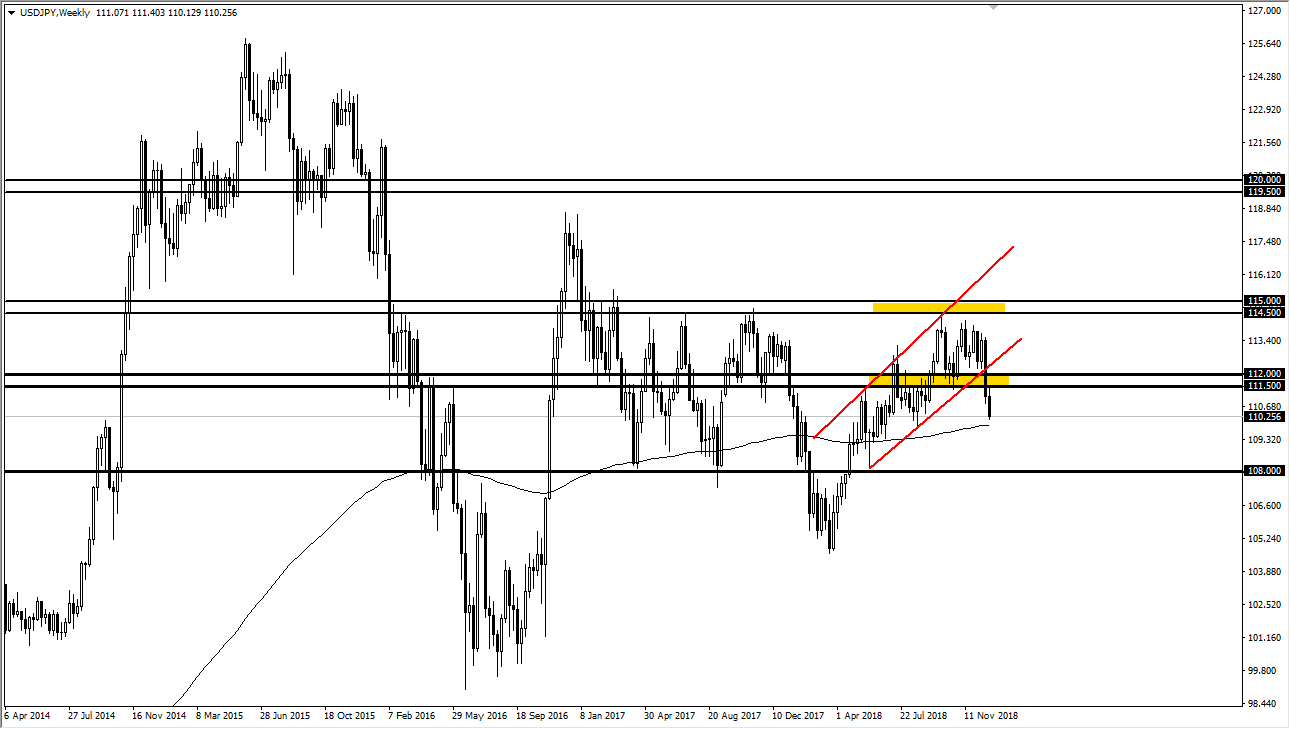

USD/JPY

The US dollar rallied initially against the Japanese yen during the week, testing the ¥111.50 level. We fell significantly from there, reaching down towards the ¥110 level by the time the markets closed this past week. I think that rallies at this point should offer selling opportunities, or a daily close below the ¥110 level will as well, perhaps opening the door to the ¥108 level.