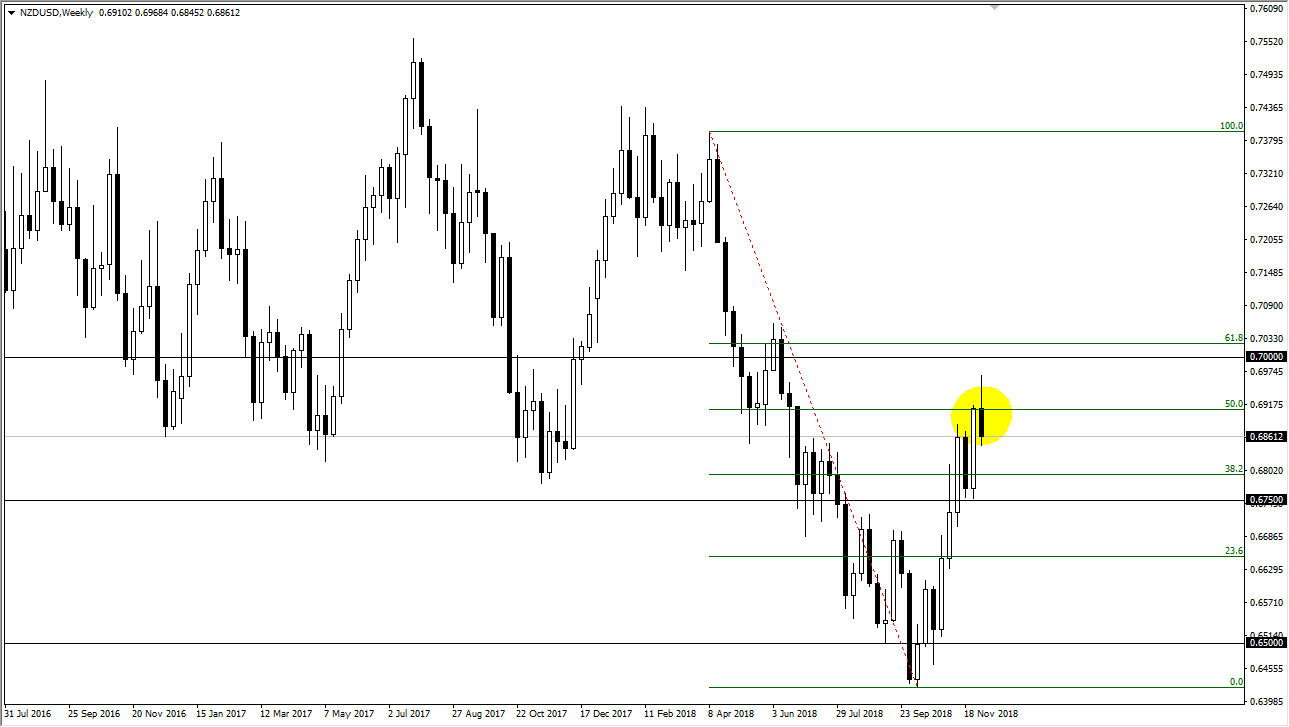

NZD/USD

The New Zealand dollar rallied significantly during the week, but then turned around of form a nasty looking shooting star. The 50% Fibonacci retracement level has offered significant resistance, and I think we could turn around if we get some type of negative headlines coming out of the US/China situation. If that’s the case, I think that we probably drop back down to the 0.6750 level next. If we do break the top of the candle stick, that could be very bullish and send this market looking towards the 0.70 level. However, I think we may get a bit of a “risk off” move here.

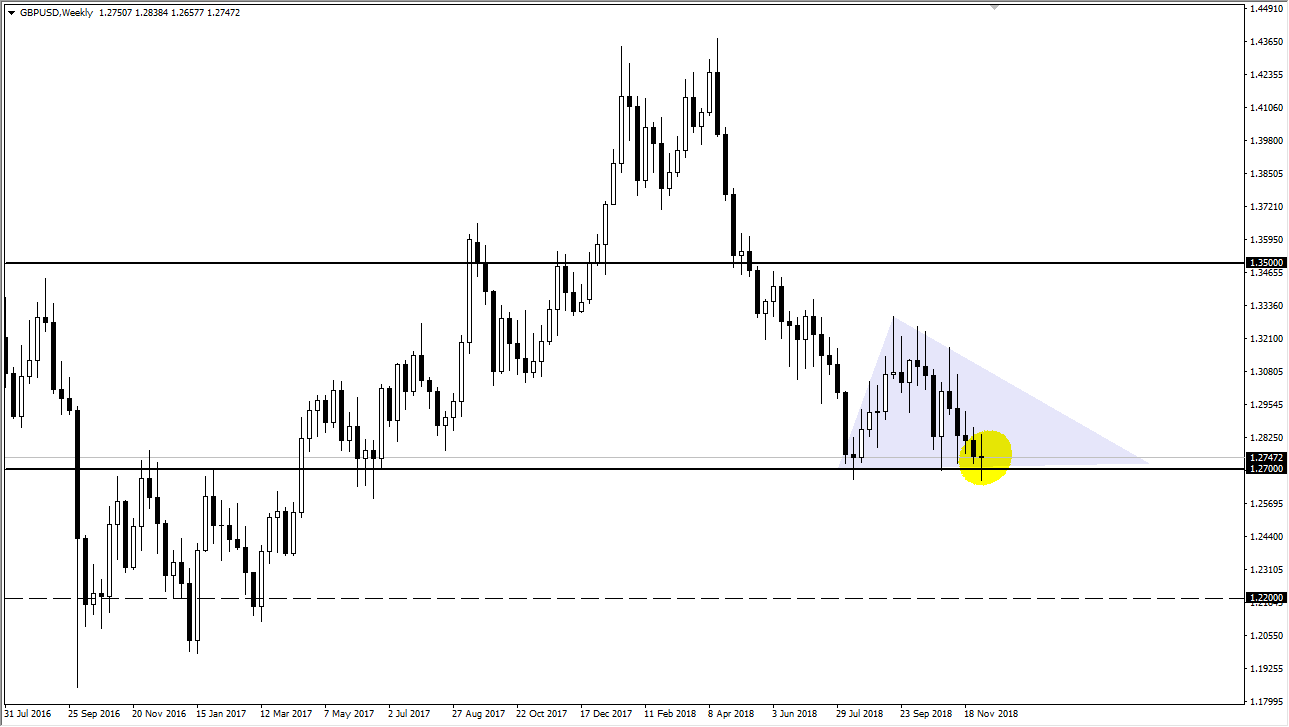

GBP/USD

The British pound, the drama focuses on the British Parliament debating the Brexit deal. We are forming a neutral candle for the week sitting just above the 1.27 handle, so that of course signifies indecision, and at a particularly interesting area. If we break down below the bottom of the candle stick, I think that the market will start to sell off and move rather rapidly to the downside, perhaps 1.22 before it’s all said and done based upon the size of the descending triangle. If we break above the top of the candle stick, then we could go looking towards 1.30 level. Expect volatility and choppiness.

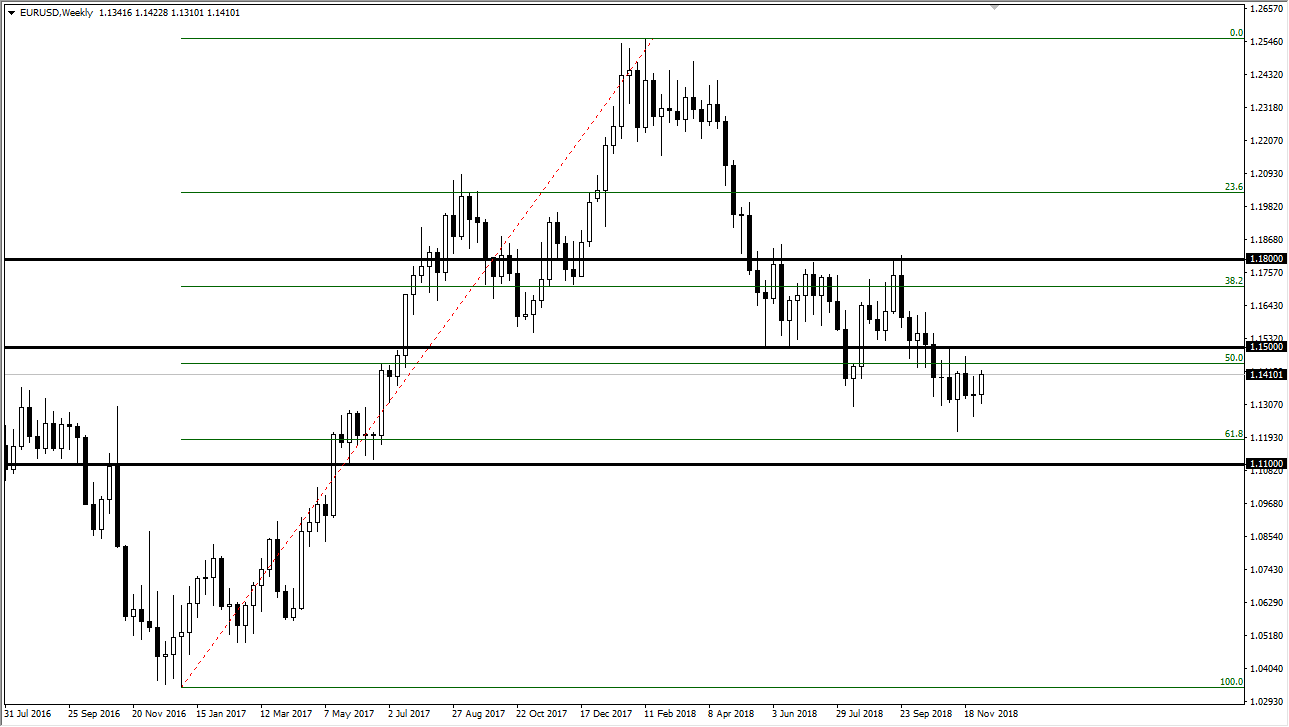

EUR/USD

The Euro initially fell during the week but then turned around to show signs of life again. We closed out at 1.14 roughly, which is a victory, but we need to get above the 1.15 level to continue going higher. If and when we do, then I think the Euro will go looking towards 1.18 level. Ultimately, I can’t help but wonder whether or not we aren’t bottoming out in this long and complicated process. The 1.12 level continues to offer massive support.

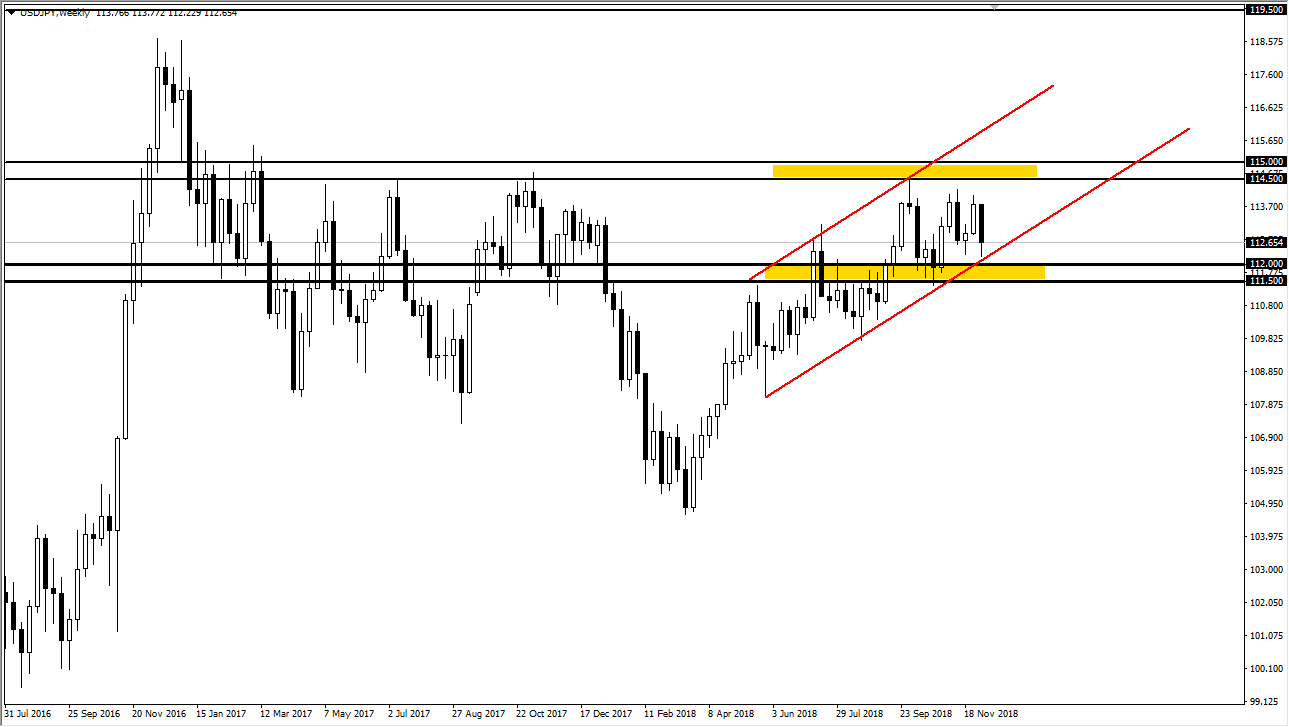

USD/JPY

The US dollar fell during most of the week against the Japanese yen but found enough support at the uptrend line to turn things around and show life again. I think at this point, it’s likely that the uptrend line should hold, but if it doesn’t then if we break down below the 100 level ¥0.50 level, we probably unwind rather drastically. Ultimately though, I do think that the support underneath should continue to be important and relevant.