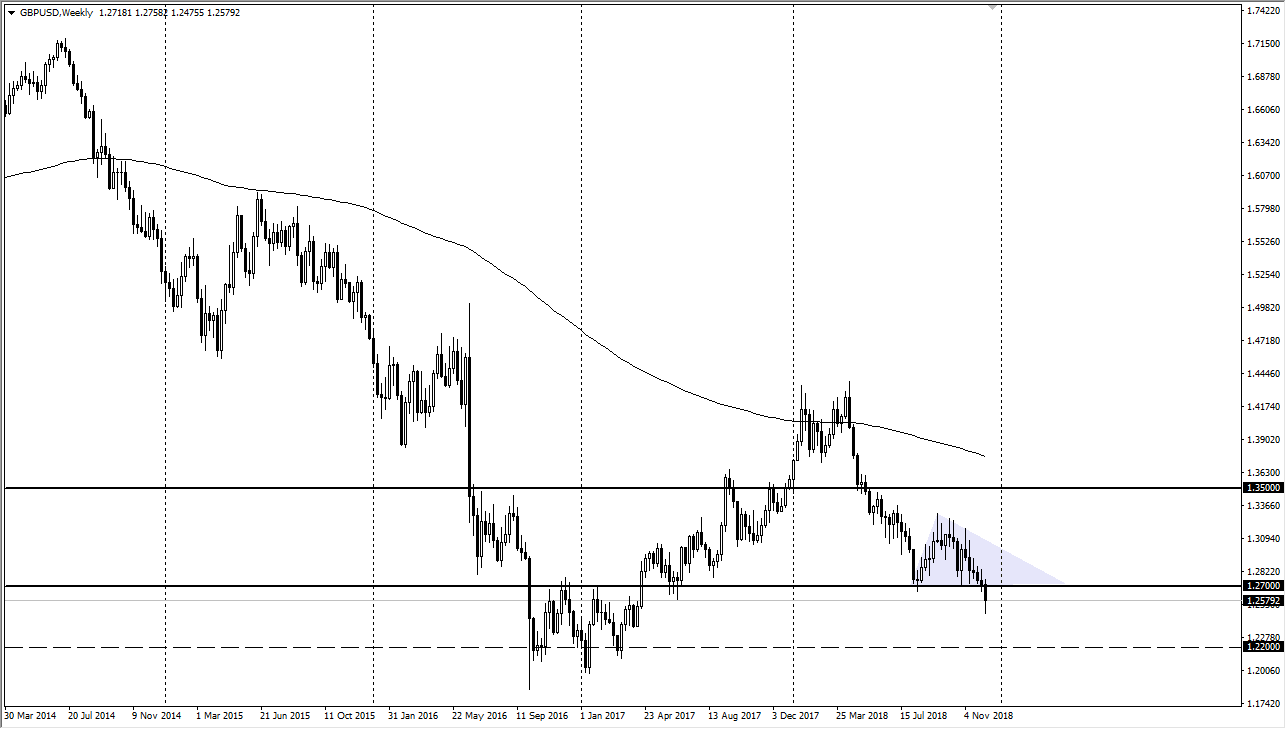

GBP/USD

The British pound broke below significant support in the form of the 1.27 level during the week, before reaching as low as 1.25. However, it’s very likely that we will continue to see negativity overall, as we see the Brexit struggling to be agreed upon between the Parliament and Teresa May. Surviving a no-confidence vote of course helped slightly, but we still most decidedly are negative and I think will be looking for a move towards 1.22 level, based upon the descending triangle that we just broke through.

EUR/USD

The Euro fell during the week, reaching towards 1.13 level. This is a market that I think still has a little bit further to go to the downside, but the 61.8% Fibonacci retracement level is just below, so I think there will be some support their as marked by the yellow ellipse. I don’t know if we go much further than that in the short term, and I would suspect we are probably more likely to see back and forth trading between now and the end of the year.

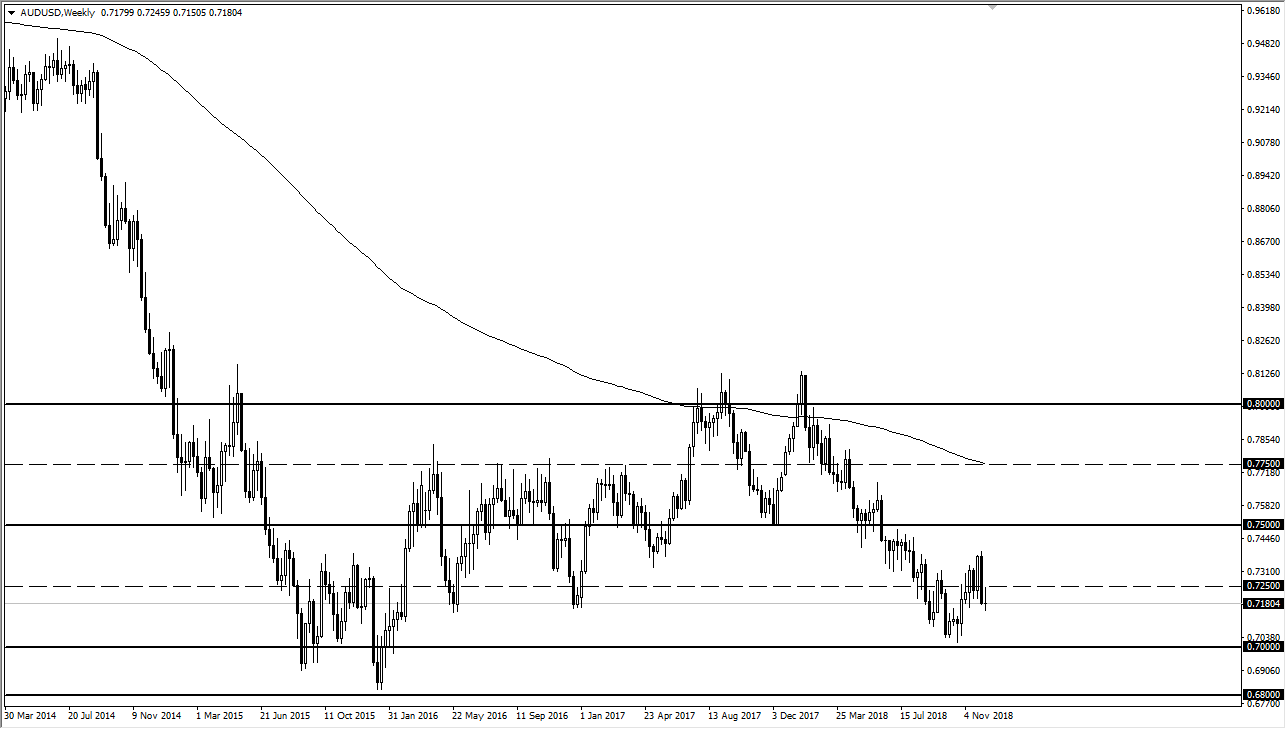

AUD/USD

The Australian dollar spent most of the week trying to rally but gave back those gains to form a very negative looking candle stick. At this point, I think we will go looking towards the 0.70 level underneath which has been support. Remember, this market is highly sensitive to things going on in China, and with horrible economic numbers coming out of that country, it’s going to be difficult to see Aussie strength anytime soon.

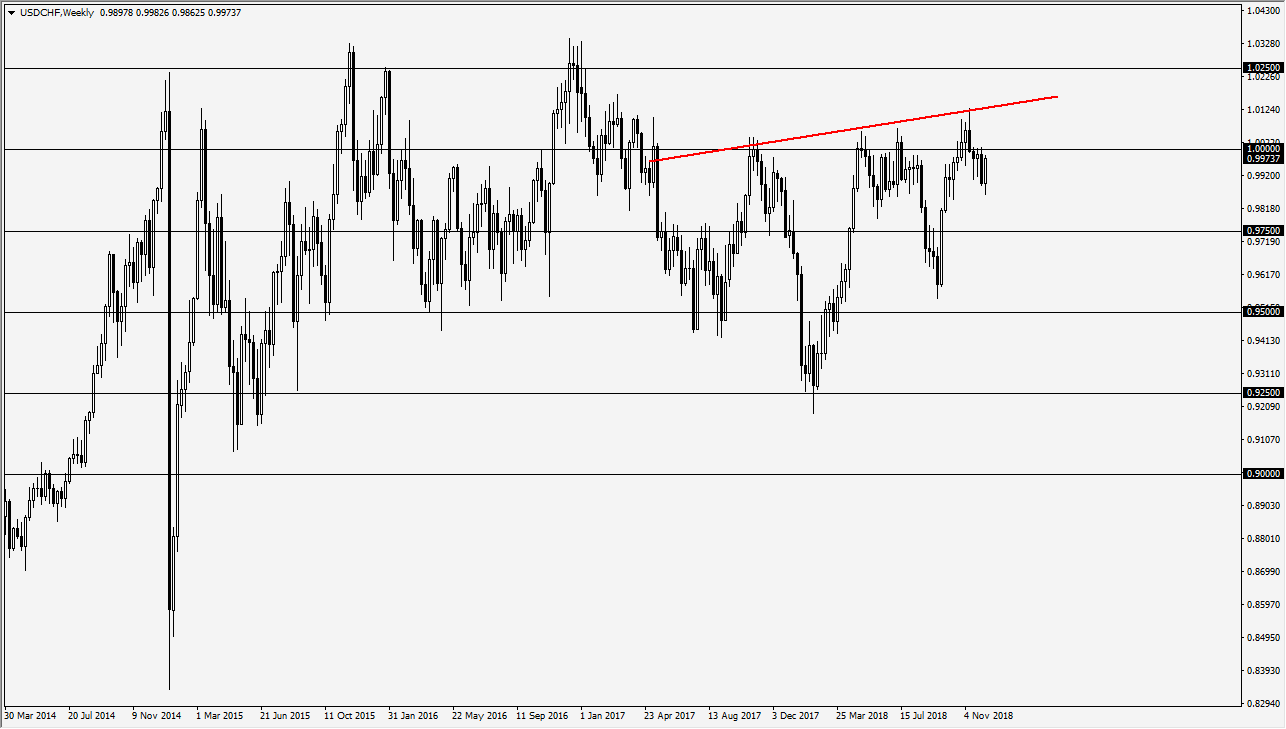

USD/CHF

Out of all of the chart that I’m falling right now, this is one of the more interesting ones. As you can see I have a trend line drawn above recent highs, which I think makes a neck line for an inverted head and shoulders. That doesn’t mean that we start buying right now, it just means that if we were to break the neck line, we could see a massive move higher. We could be talking about a move of roughly 1000 pips. I’m not prepared place a trade in the short term, but this is most certainly on my radar right now.