Gold prices ended Friday’s session up $11.09 an ounce as the dollar slid in the wake of weaker-than-expected U.S. jobs data. The Labor Department reported that the economy added 155000 jobs in November, well below consensus estimates of 198000. The jobless rate held at 3.7% and average hourly wages rose 0.2%, but revisions cut a total of 12000 jobs from payrolls in the previous two months. Although employers slowed their pace of hiring, the U.S. job market remained healthy overall in November. The U.S. central bank is still widely expected to raise interest rates at their December 18-19 meeting. However, dovish comments from Fed officials Kashkari and Bullard led markets to question how many times the central bank will hike rates in 2019.

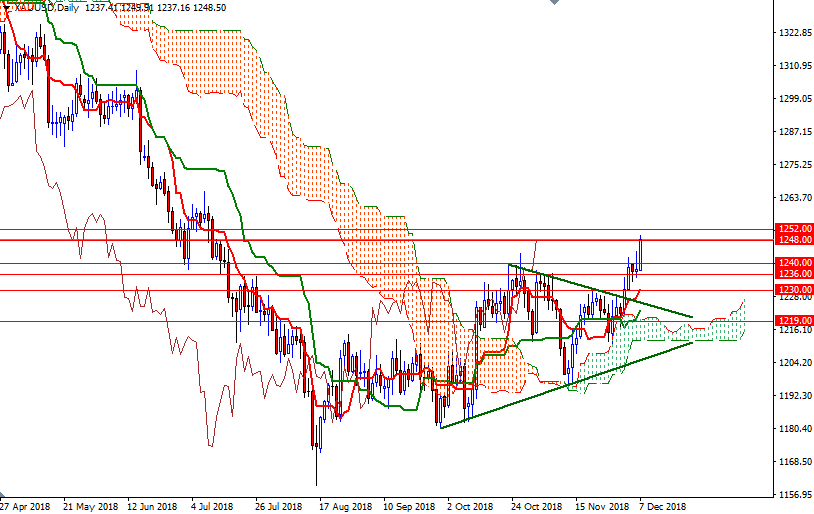

The gold market also benefited from an improved technical outlook. XAU/USD was able to break through the 1230/29 zone after prices moved above the 4-hourly Ichimoku cloud. The resistance in 1241/0 initially held but finally was broken. This triggered a push up to the 1252/48 as anticipated. The market is trading above the Ichimoku clouds on the daily and the 4-hourly charts. The daily Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) are positively aligned and the Chikou-span (closing price plotted 26 periods behind, brown line) is above prices (and also the daily cloud), indicating the bulls have momentum on their side.

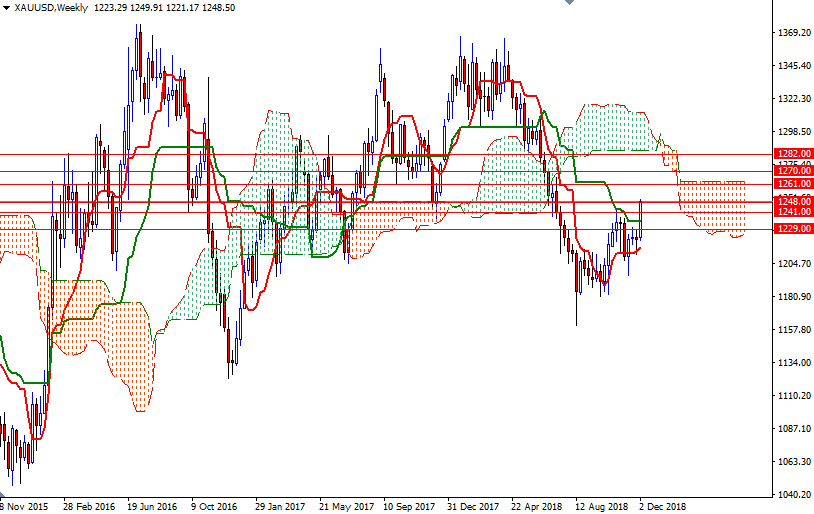

If XAU/USD successfully penetrates the strategic resistance in the 1252/48 area, we may see a move up to 1261/0. A break through there brings is 1273/0. The bulls have to produce a daily close above there to march towards 1282-1280.50. On the other hand, if the market fails to breach 1252, prices will probably head lower to revisit 1240 and 1236/4. A break below 1234 implies that XAU/USD is getting ready to test the support in 1230/29. The bears have to capture this camp to make an assault on 1226/4. Once below there, the market will be targeting 1220/19.