Gold prices ended Friday’s session down $3.84 an ounce as the dollar strengthened following upbeat data on U.S. retail sales and industrial output. U.S. retail-sales figures showed consumer spending remains healthy while industrial production rose sharply last month and further cemented expectations the Federal Reserve will lift interest rates at its December 18-19 meeting. The dollar was also helped by a slump in the euro, which came under pressure after German data showed private-sector expansion slowed in December. However, the dollar’s gains were limited by bets the Federal Reserve might go slow on interest rate hikes next year.

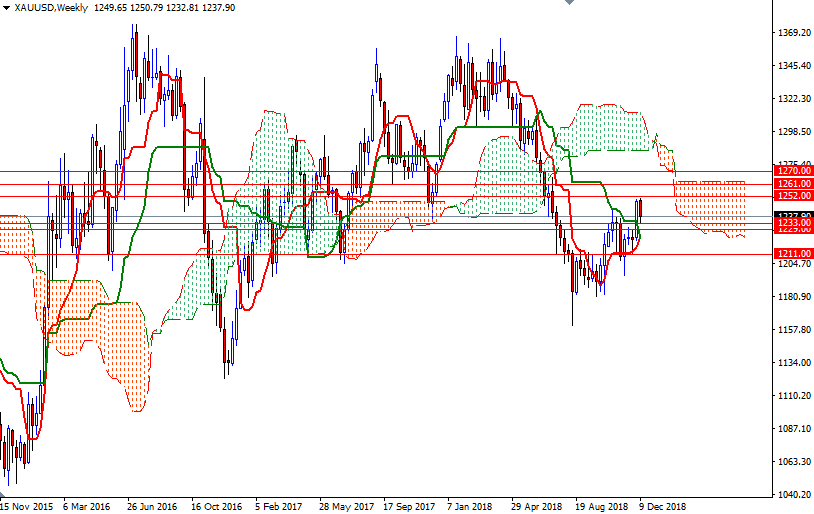

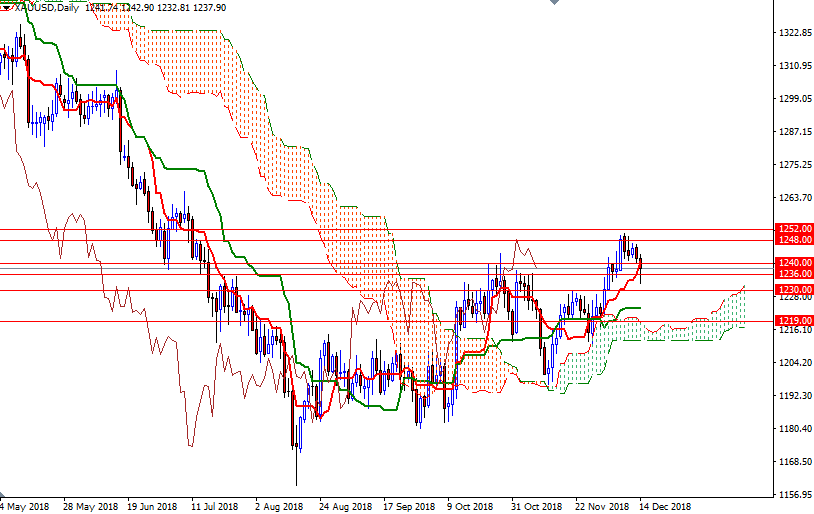

Technical selling was also behind the market’s 0.94% decline last week. XAU/USD failed to penetrate the solid resistance in the 1252/48 zone and as a result, prices pulled back to 1236/3 as expected. The Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) are positively aligned on the weekly and the daily charts. Prices are above the daily Ichimoku cloud, however, the market is still residing below the weekly cloud.

To the downside, keep an eye on the support in the 1230/29 area. A break below 1229 paves the way for a test of 1227/6. If this support gives way, then the market will be targeting 1222/19. The bears have to produce a daily close below 1219 to challenge 1213/1, where the bottom of the daily cloud sits. To the upside, the initial resistance stands in 1241/0, followed by 1245.50, the top of the 4-hourly cloud. If XAU/USD climbs back above 1245.50, we may retest the key resistance in 1252/48. Closing above 1252 on a daily basis could offer enough inspiration for the bulls to send prices higher towards 1261/0. A break through there would open the door for a move to 1266-1265.50 or even 1273/0.