Gold prices ended the week up $19.31 at $1255.32 an ounce on the back of a weaker U.S. dollar and a selloff in equities. The Federal Open Market Committee raised the federal funds rate 25 basis points as expected but signaled a milder path of increases over the next year. Although the central bank cut its forecast from three hikes next year to two, Chairman Jerome Powell stressed that policy was not on a preset course and they will act in line with how the economy performs. Global stock markets slumped after the Federal Reserve disappointed investors who were expecting a more dovish policy outlook.

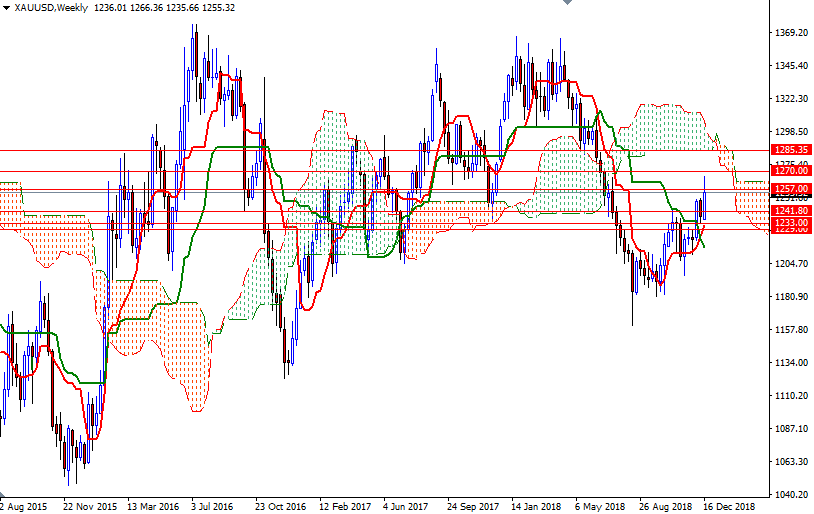

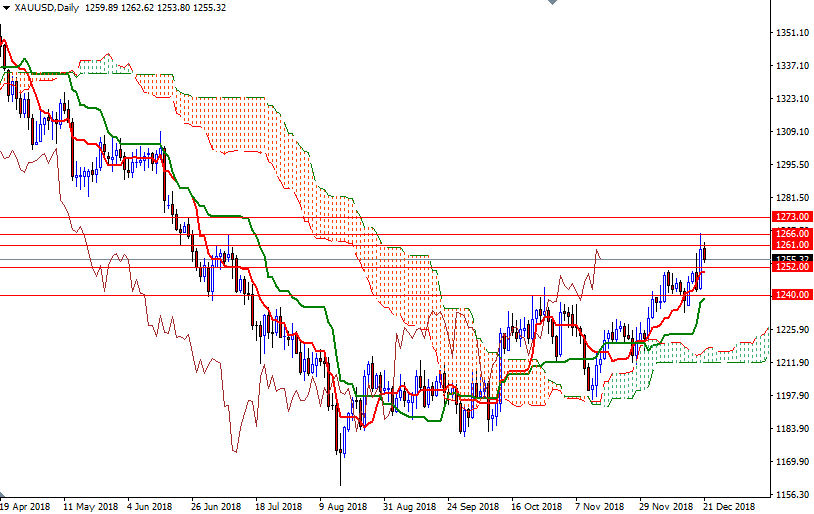

XAU/USD is trading above the Ichimoku clouds on the daily and the 4-hourly charts, suggesting that the bulls have the overall near-term technical advantage. The Chikou-span (closing price plotted 26 periods behind, brown line) is above prices; plus, the Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) are positively aligned on the weekly and the daily charts. While this suggests a move towards the weekly cloud is feasible in the coming weeks, XAU/USD may begin to trend sideways due to New Year holidays.

From a chart perspective the first upside barrier sits in 1262.50-1261. If XAU/USD successfully climbs above 1262.50, the 50% retracement of the bearish run from 1365.10 to 1160.05, the market will be targeting 1273/0. The bulls have to produce a daily close above 1273 to tackle 1277. Beyond that, the 1285/3 area (the bottom of the weekly cloud) stands out as a solid technical resistance. However, if the market continues to trade below 1262.50, we may head lower to test 1252/0 and even 1248/7. The bears have to push prices below 1247 to make an assault on a strategic support in the 1241.80-1240 zone. If this support is broken, look for further downside with 1236 and 1233 as targets.