WTI Crude Oil

The WTI Crude Oil market rallied a bit during the trading session on Tuesday again, using the bottom of the symmetrical triangle that we are in to find support. We rallied nicely but did give back about half the gains yet again. This shows that the market isn’t ready to take up to the upside, but there is plenty of support underneath. If we were to break down below the $50 level, I think the market could go much lower, perhaps reaching down to the $45 level. In general, I believe that the market is going to remain choppy, but if we break down below the downtrend line, I think that could open the door for a longer-term trade to the upside. Ultimately, keep in mind that the production cuts, of course, were bullish, but there are a lot of concerns when it comes to global demand.

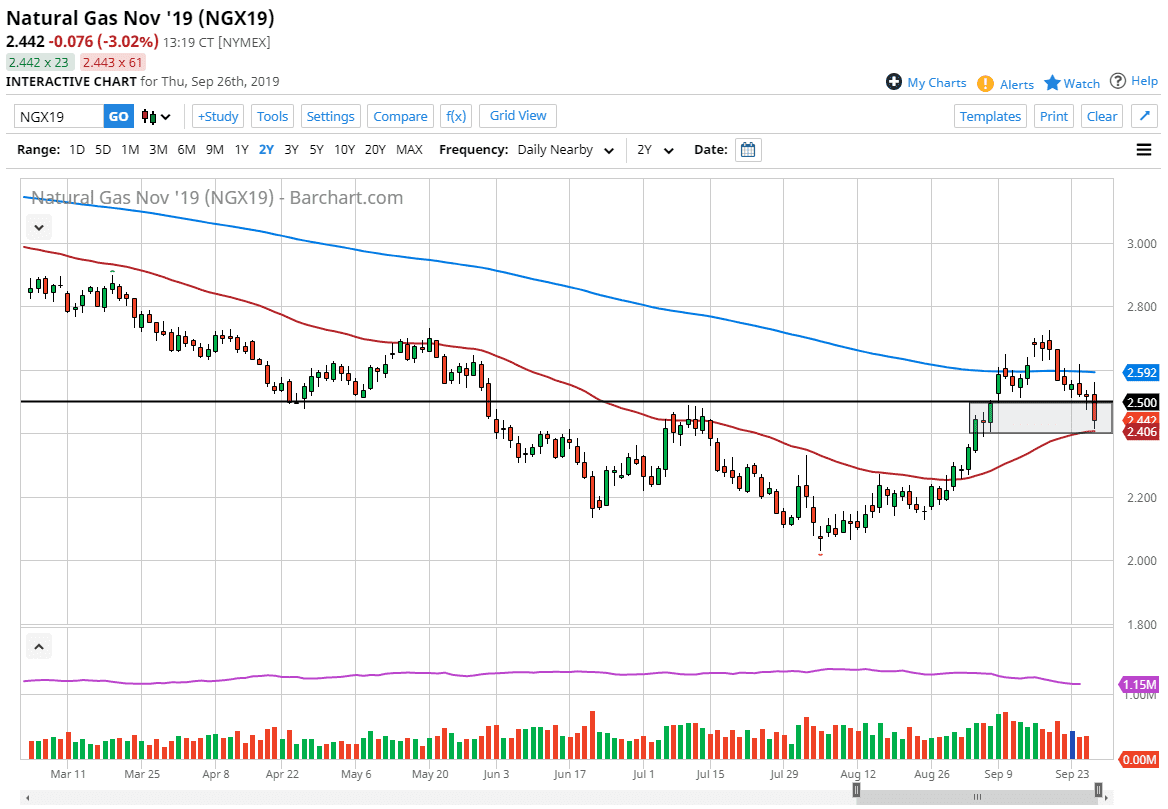

Natural Gas

Natural gas markets rallied a bit during the trading session on Tuesday but turned around to break towards the uptrend line of the symmetrical triangle. I think at this point, the market will probably rally a bit, but only to find sellers above. We are getting close to the end of the year, which is typically close to the end of the seasonal bull market based upon colder temperatures. I don’t think we are ready to break down you, but I do think that rallies will continue to find plenty of Sellers. However, if we were to break above the downtrend line, we could make a move towards the $5.00 level where I would expect to see even more selling pressure again. Eventually, I anticipate that we will go looking towards the $4.00 level.