WTI Crude Oil

The WTI Crude Oil market initially tried to rally during trading on Tuesday but found enough resistance just below the $55 level roll things over and start pushing lower. By forming a shooting star, this shows just how soft this market is longer term. I believe that the gap underneath will probably get filled, so it’s likely that we could see a little bit of weakness from here. However, I would anticipate that the $50 level could offer some significant support. Breaking through their would open the door to the $45 handle and would of course be very negative. The alternate scenario of course is that we break above the top of the shooting star, clearing the $55 level. That would be an extraordinarily bullish sign and could send this market towards the $57.50 level.

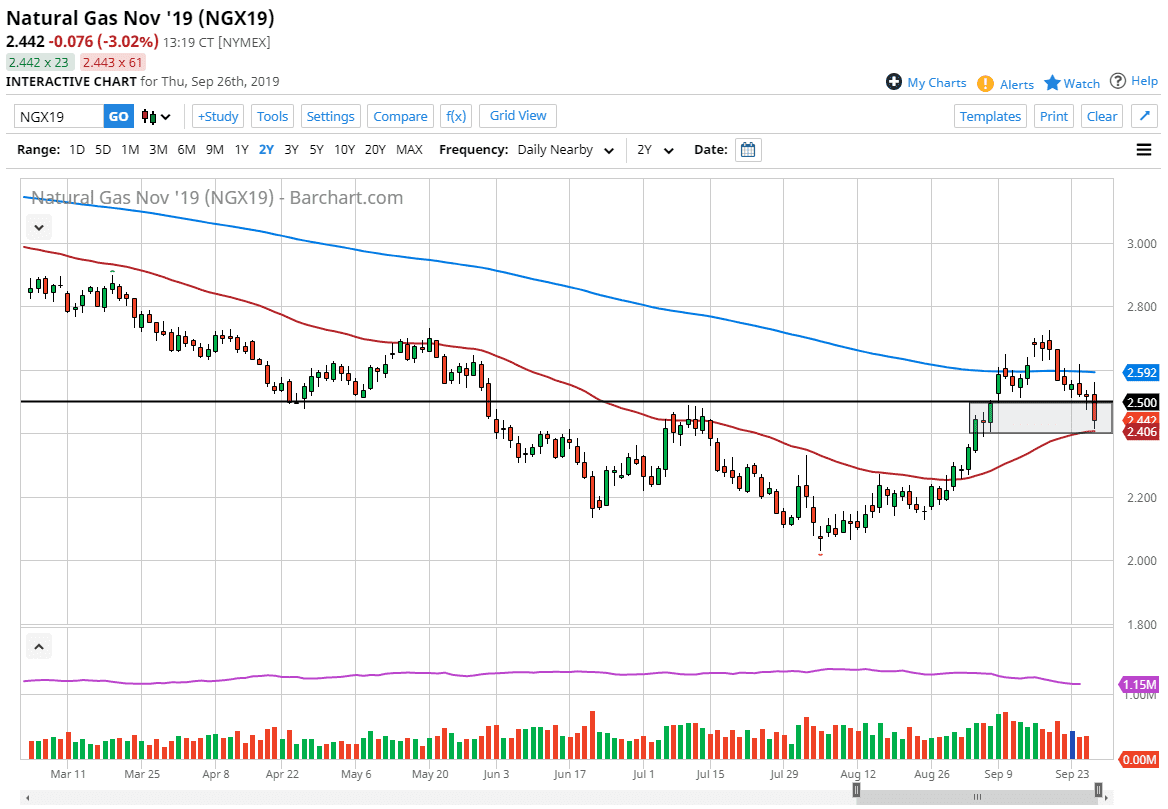

Natural Gas

Natural gas markets rallied a bit during the trading session on Tuesday, but then gave back a lot of the gains above the $4.50 level. I believe at this point we continue to bounce around in the wedge that I have marked on the chart, with a slightly downward tilt overall. After all, we had gotten way ahead of ourselves, and of course the $5.00 level above offers massive resistance in a psychological standpoint. If we were to break above that level, that could send this market much higher, but really at this point I think it’s likely that the market will be contained at that area, and that we will bounce around in the short term, only to break down as we end the trading of cold weather months. The $4.00 level underneath giving way would be massive for the sellers.