WTI Crude Oil

The WTI Crude Oil market rallied again during the trading session on Wednesday but continues to struggle as we get close to the $55 level. That’s an area that of course offers a lot of resistance due to the previous support and of course a lot of institutional flow in that region. If we were to break above the $55 level, then we could go much higher, perhaps reaching towards the $57.50 level. I believe that a pullback is very likely, but the $50 level should continue to offer a bit of a “floor” in the oil market. We are definitely in and oversold condition but I also recognize that you can probably get a better buying opportunity at lower levels. If we do break down below the recent lows, then the market will unwind down to the $45 handle.

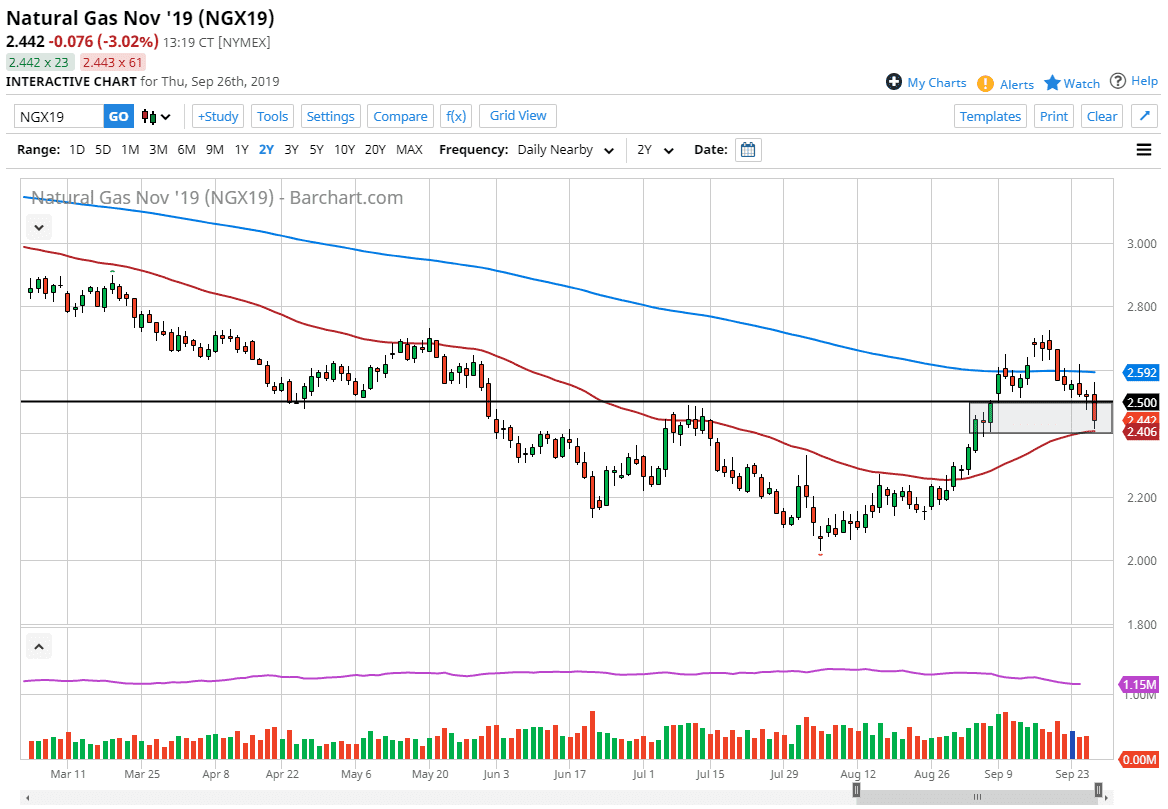

Natural Gas

Natural gas markets initially tried to rally during trading on Wednesday but continues to see sellers every time we get close to the top of the wedge in the market. We are getting close to the time of the year that traders come back in and start selling, especially once we roll out of the January contract in the futures pits. In the short term, I think we will continue to see a lot of noise, bouncing around for both sides of the wedge. I do prefer to sell rallies as they occur, and I step on the sidelines when it comes to buying. I think that the $5.00 level above continues to be the absolute ceiling in the market, and I believe that we are much more likely to see $4.00 rather than that level again.