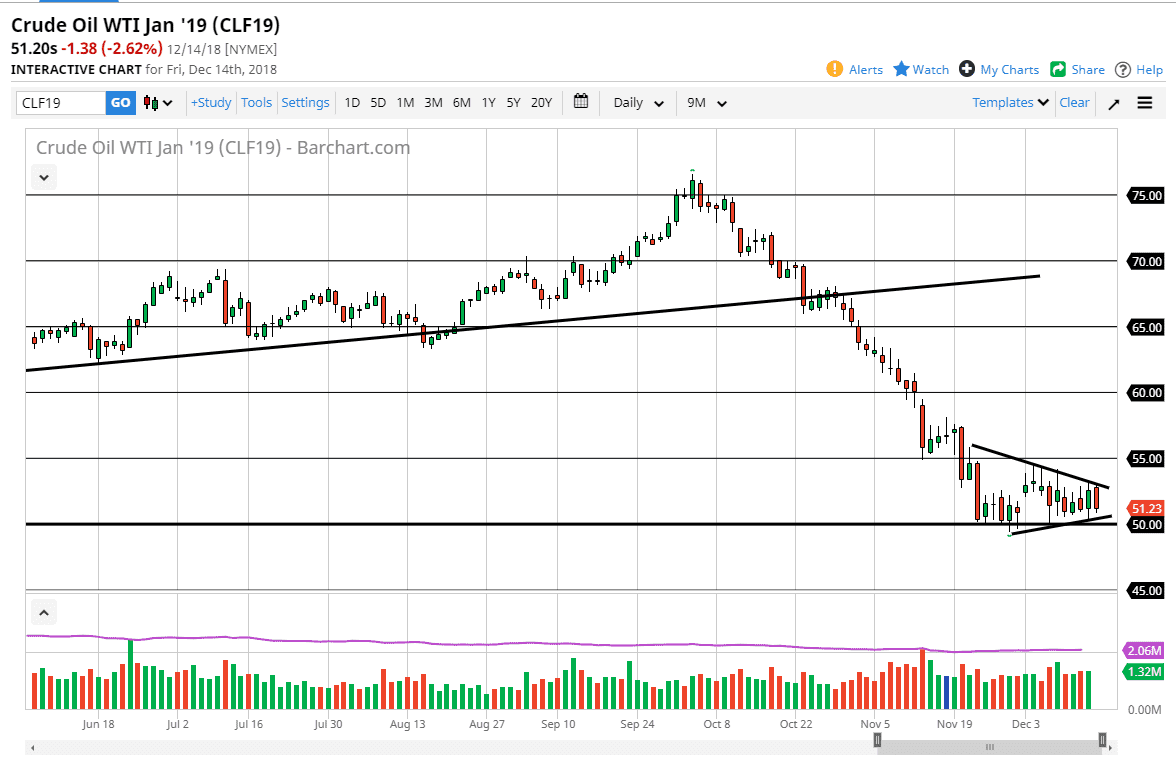

WTI Crude Oil

The WTI Crude Oil market fell a bit during the trading session on Friday, as we continue to bounce around in a symmetric shaped triangle. At this point, I think it’s obvious that the $50 level is crucial, and if we break down below there I think we go much lower. At the very least, I would be aiming for $45 at that point. Alternately, if we can break above the downtrend line, then $55, followed by $57.50 will be targeted. I believe overall the biggest concern we have now isn’t so much supply, it’s on the demand side as we are starting to see global growth slow down. If that continues to be the case, I think oil will in fact continue lower. I suspect in the next couple of weeks though, we will probably get choppy sideways action more than anything else.

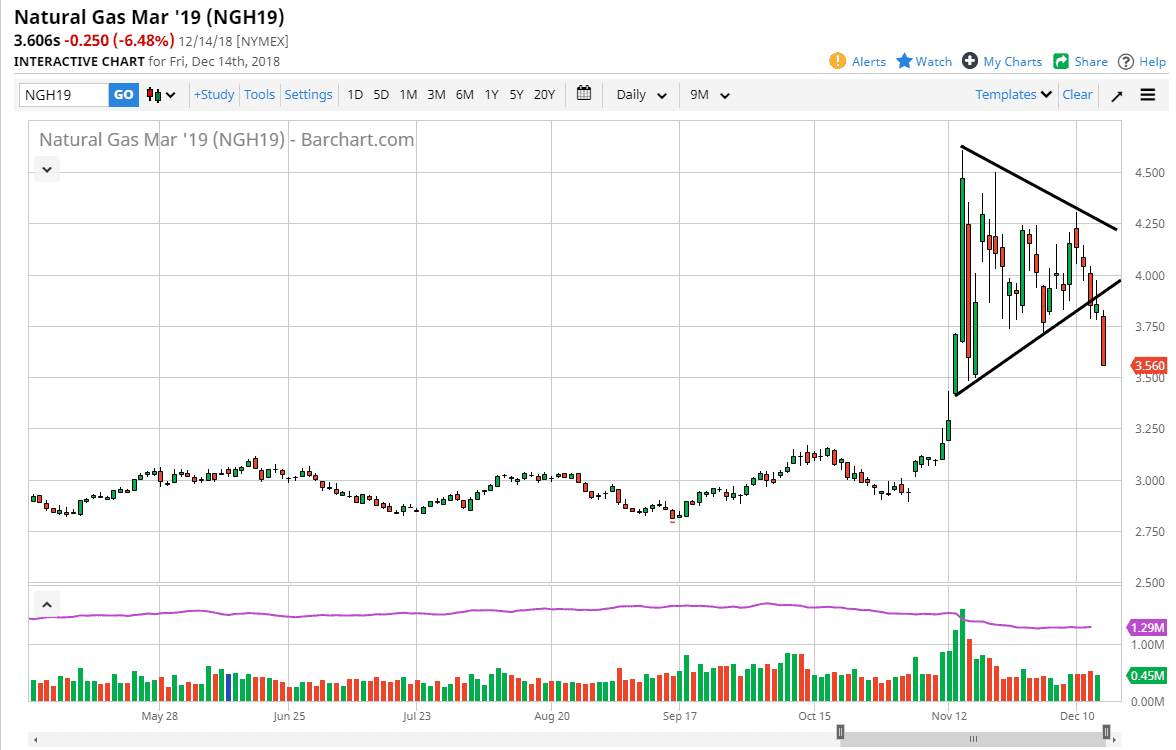

Natural Gas

The natural gas markets collapsed during trading on Friday, dropping over 7% and now looks to test the $3.50 level. We switched over to the March contract, and that of course is a spring contract, meaning that demand should continue to drive. Beyond that, temperatures in the northeastern part of the United States have been very mild, so demand is falling through the floor. I do believe that rallies at this point continue to get sold, and we, as I’ve been saying for weeks now, have already seen the highs for the year. That doesn’t mean we will get the occasional rally, but every time you see a sudden move higher, you should be looking for signs of exhaustion to short this market. I believe at this point we have much lower to go as supply of natural gas is enormous.