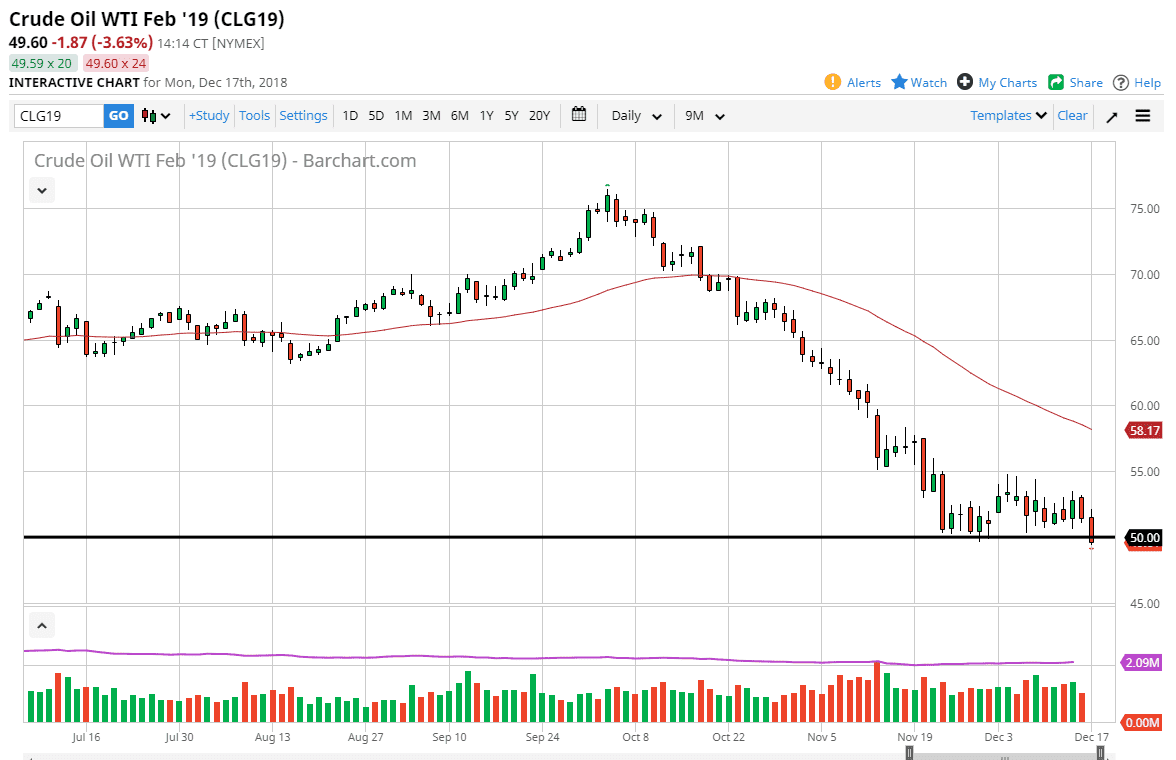

WTI Crude Oil

The WTI Crude Oil market initially tried to rally during trading on Monday, but then broke down rather hard. The fact that we sliced through the $50 level suggests to me that there is more pain to come for crude oil traders. I am a bit surprise that we broke through here, but clearly we are starting to see a lot of negativity come into the global marketplace, and that is starting to weigh upon the idea of global growth. If global growth is hampered, that will of course bring down demand for energy. Looking at this marketplace, it looks as if we could break down to the $45 level based upon the five dollar range we had just been trading in. If the US dollar continues to strengthen, that could also weigh upon crude oil as well.

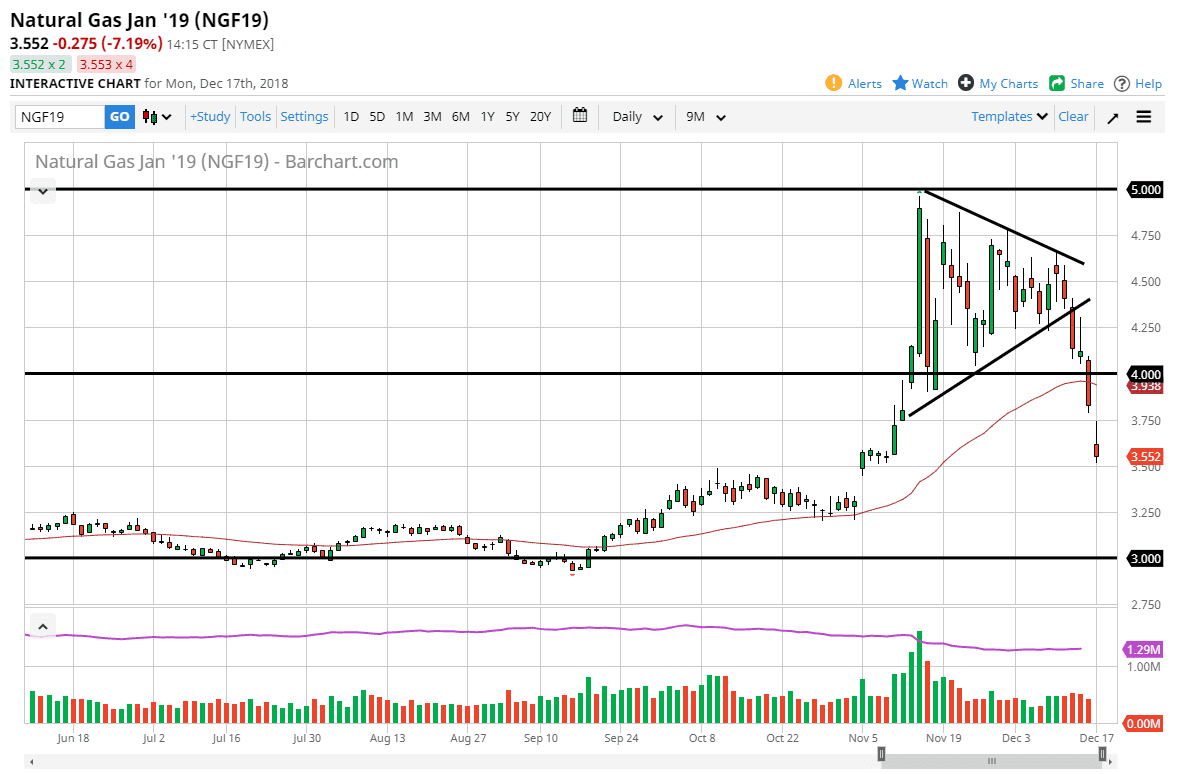

Natural Gas

Natural gas markets gapped lower to kick off the session on Monday, but then turned around to fill the gap and roll over again. This is a market that looks horrible right now, and I have no interest in trying to short this market at these extraordinarily low levels. I think at this point, you need look at natural gas markets as an opportunity to short every time we rally and show signs of exhaustion. The $4.00 level above should continue to be a bit of a “ceiling” in the market, just as the 50 day EMA is starting to turn lower right underneath that level. I think it’s going to be difficult to gain any real traction to the upside in this market, so I’m going to wait for signs of exhaustion to take advantage of.