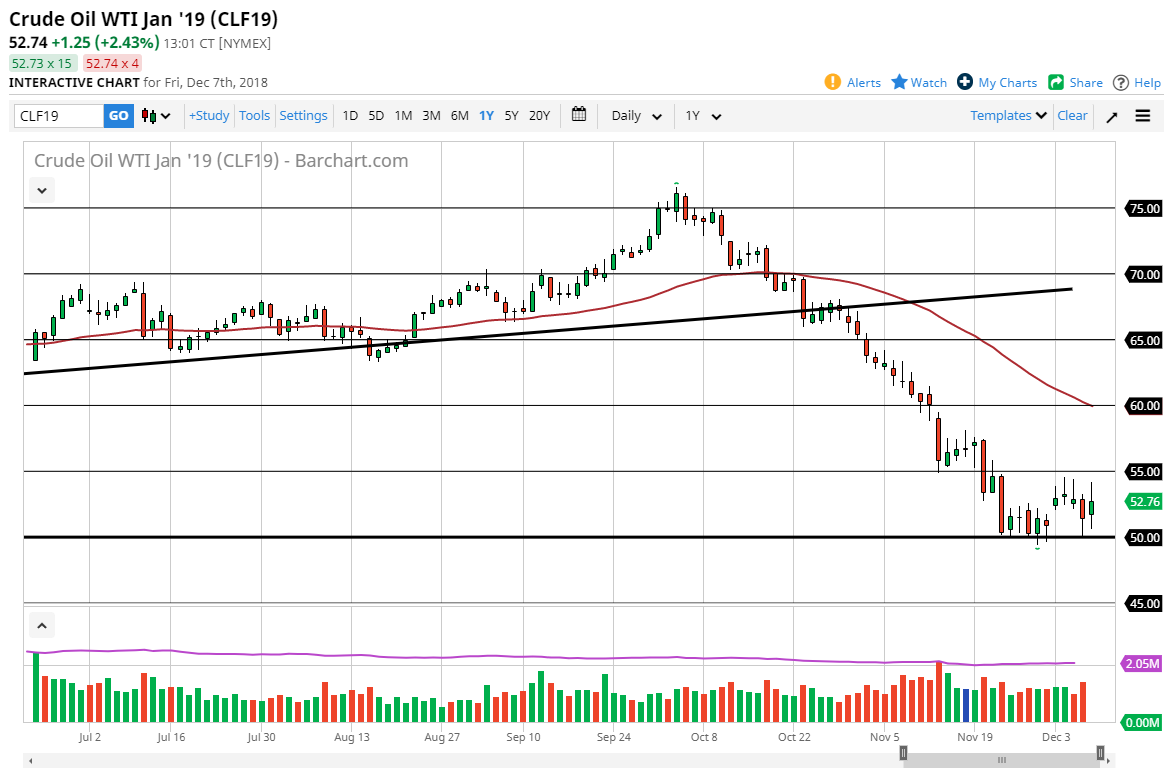

WTI Crude Oil

The WTI Crude Oil market went back and forth during trading on Friday, as OPEC then announced a production cut. By saying so, it looks as if we could get a little bit of a bounce from here, and I think at this point it’s likely that the $50 level should offer a significant amount of support. If we can break above the $55 level, then I think the market could have some follow-through, perhaps reaching towards the $57.50 level, and then eventually the $60 level. I do think that a whale is oversold anyway, but there are concerns about global growth and the like. Ultimately, if we break down for a fresh, new low, then we probably go down to the $45 level after that, which will wipe out the entire move to the upside from the beginning of the rally we just killed.

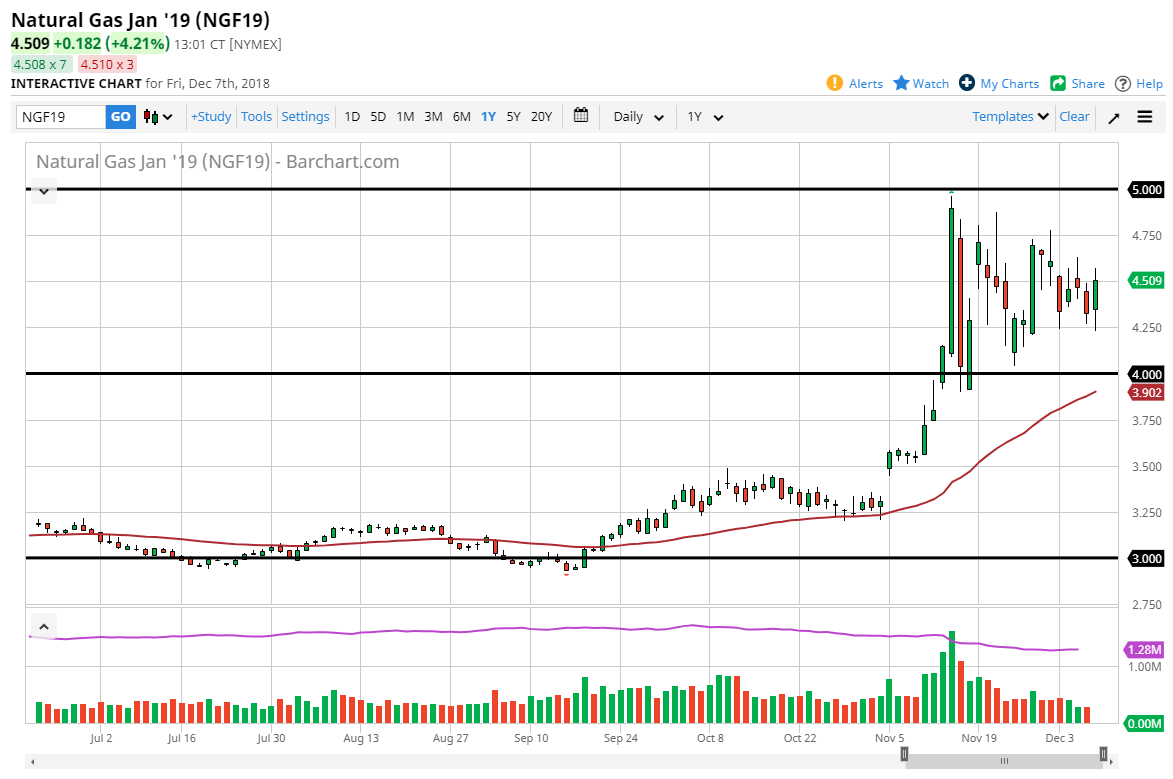

Natural Gas

Natural gas markets went back and forth during the trading session on Friday, as we continue to see a lot of volatility. I think that it’s only a matter time before the markets are selling off, due to the fact that we are getting late in the cycle when it comes to seasonal bullish pressure, as we will be trading Spring contracts in a few weeks. Ultimately, I think that the five dollars level above will continue to offer resistance as suppliers will be more than willing to jump into the market and sell contracts at those high levels. The $4.00 level underneath is massive support, and if we can break down below there we could go much lower. Ultimately, I think that short-term rallies are going to be nice opportunities to start shorting this market.