WTI Crude Oil

The WTI Crude Oil market initially dipped during the trading session on Thursday but then turned around to show signs of life again. We are still in the same consolidation area that we have been in, bouncing around in a triangle of sorts. The $50 level underneath continues offer massive support, so if we can continue to find buyers underneath, it’s likely that we could go towards the $55 level, just as if we break down below the $50 level, we could go down to the $45 level. Ultimately, I think we continue to see a lot of volatility, and ultimately I think that it’s only a matter of time before we make a decision, but right now it looks as if we are still trying to figure out where we are going next. I would not be surprised at all to see this market to simply go sideways though, because we are at the end of the year and liquidity will start to trade.

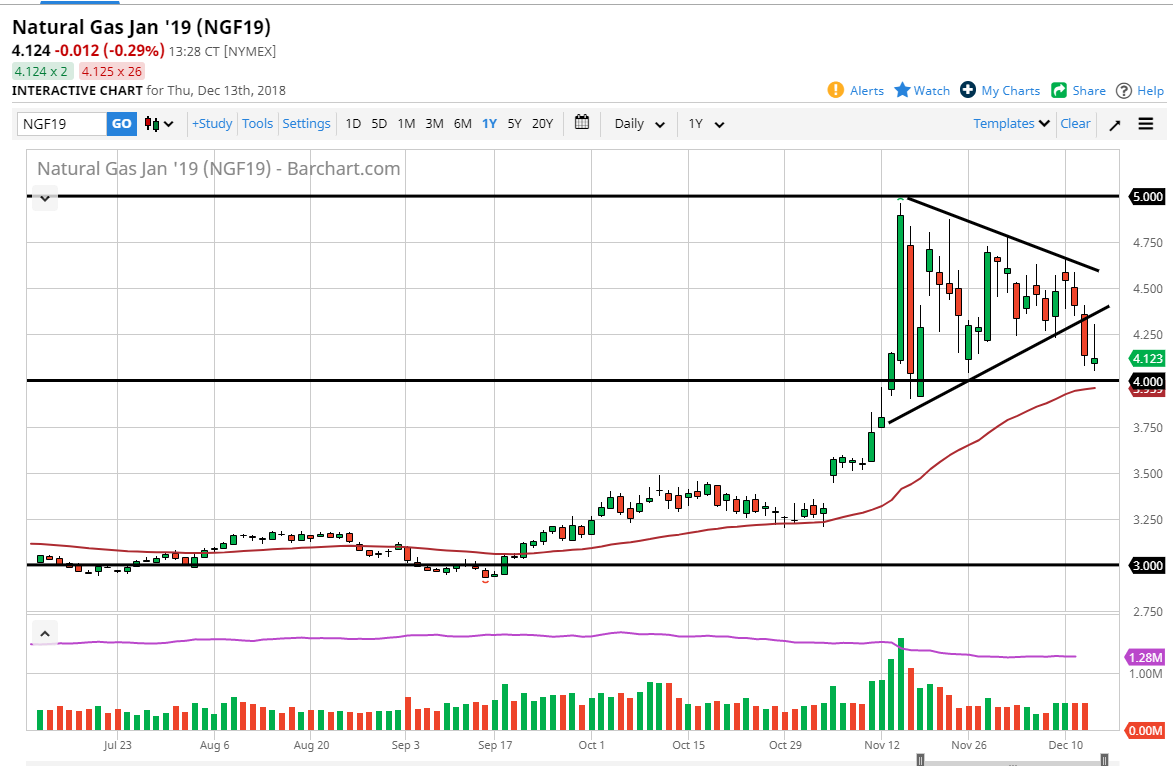

Natural Gas

Natural gas markets initially rallied rather significantly to bounce back towards the bottom of the triangle that we had been in. However, we fell from there and it looks very likely that the shooting star for the day signifies just how ugly things are, and if we can break down below the $4.00 level and the 50 EMA, we could go much lower. Rallies at this point continue to be sold on signs of exhaustion, because we had been so overbought. There is far too much in the way of supply longer-term to keep the value of natural gas at these lofty levels. I simply look for signs of exhaustion to start selling yet again.