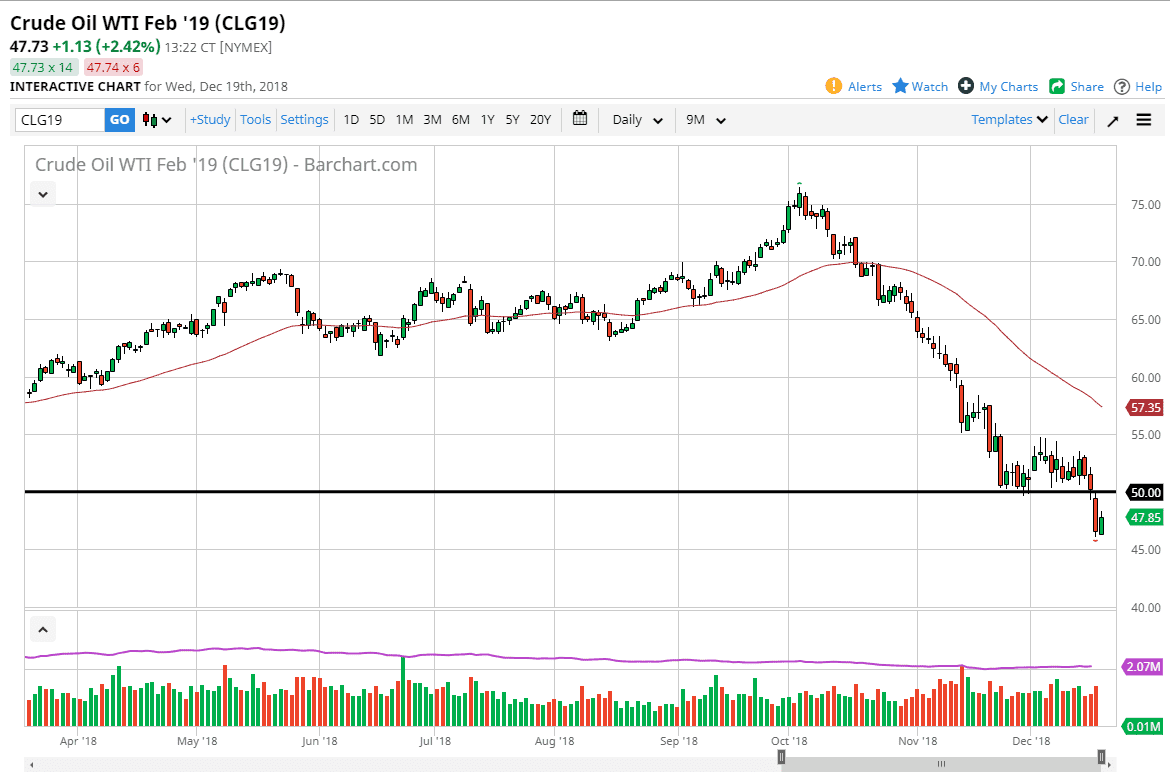

WTI Crude Oil

The WTI Crude Oil market continued to be very noisy during the trading session on Wednesday as the Federal Reserve came out and raised interest rates. However, when we look at the chart, it’s very easy to see that we have broken through a major support level, and that should continue to be a major problem. At this point, it looks as if the $50 level will offer resistance, and I believe that resistance will extend all the way to at least the $55 handle. If that’s going to be the case, I think it’s only a matter time before we get some type of exhaustive candle that we can take advantage of. If we did break above $55, then I might be convinced to start buying. Until then, it’s a “fade the rallies” type of situation we find ourselves in.

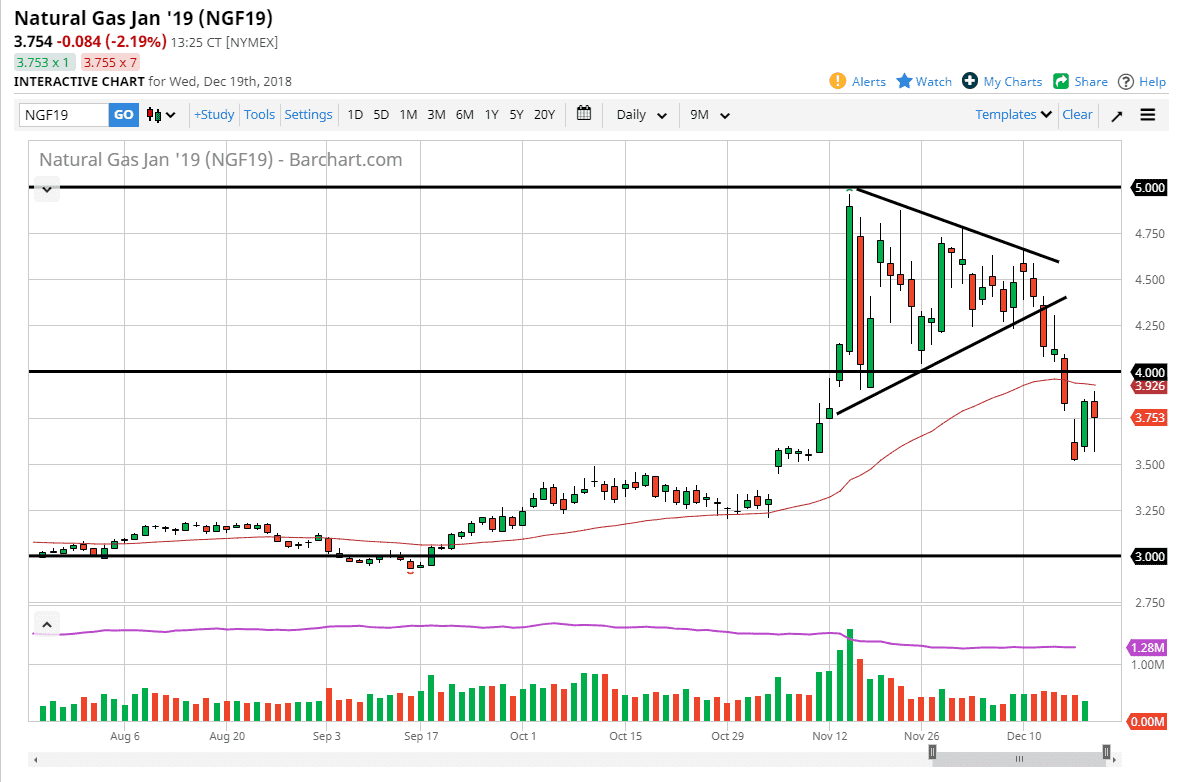

Natural Gas

Natural gas markets have been very noisy during the trading session as per usual, after we have seen such a massive breakdown that of course isn’t much of a surprise. I think we are looking at a scenario that offers the $4.00 level as resistance, and that ultimately fading rallies in this market should also be a viable strategy. The 50 day EMA continues to offer resistance, and therefore I think it’s only a matter of time before we roll over. I look at signs of weakness as something that you should take advantage of, as the market had gotten far ahead of itself. I believe ultimately we will go lower, perhaps reaching towards the $3.00 level over the longer-term. We will of course get the occasional rally, but we will take advantage of that rally and sell it.