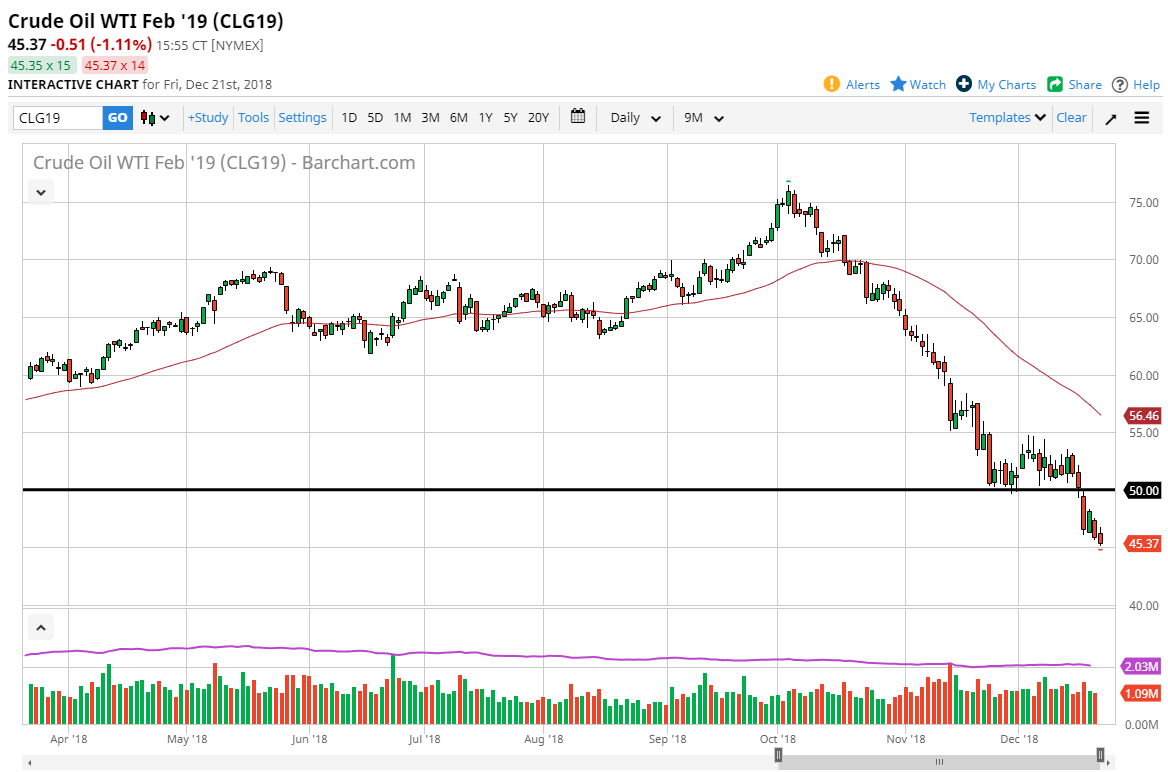

WTI Crude Oil

The WTI Crude Oil market fell again on Friday, testing the $45 level for support. That’s an area that will offer support in theory, but at this point it’s likely that we will continue to see rally sold, and therefore I’m looking for signs of exhaustion between here and the $50 level. I think that this market will continue to struggle, but if we did break above the $55 level, and perhaps the 50 day EMA, that could be a buying opportunity. This is a market that is extraordinarily volatile, but it is most certainly in a downtrend. Keep in mind that supply far outweighs the demand, and there are concerns that global demand is shrinking as well. Ultimately, if we break down below the $45 level, and it does look like we very well could, then I think the market goes to the $40 handle.

Natural Gas

The Natural Gas markets went back and forth during the day, printing an unchanged candlestick. The 50 day EMA is just above and turning lower. The $3.50 level looks to be support, and it looks likely that rallies continues to be sold. I think at this point, it’s very likely that the rallies will be used as opportunities to start shorting. The supply will far outweigh the demand going forward, and it looks as if a warmer than usual winter is going to continue to put pressure on natural gas, not to mention the fact that we are looking at a potential global slowdown. I think at this point selling rallies continues to be the best way to trade this market and I think that the market will eventually target the $3.25 level.