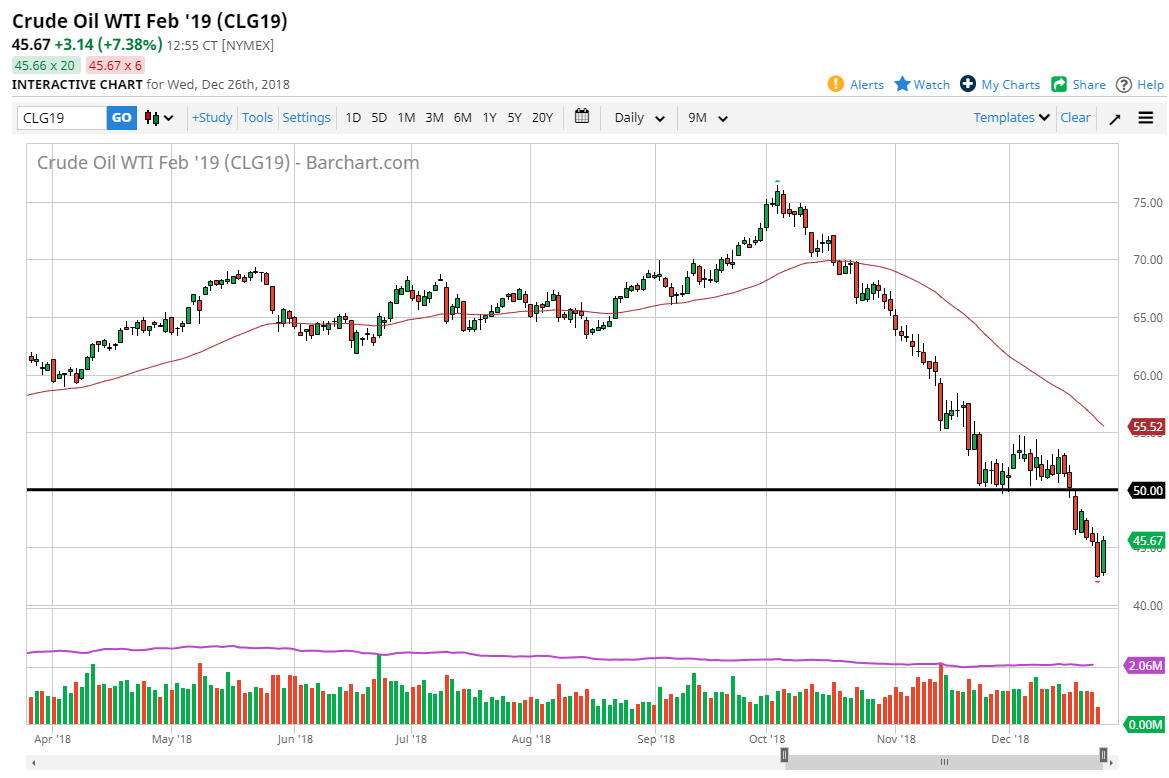

WTI Crude Oil

The WTI Crude Oil market rallied a bit during the trading session on Wednesday as traders came back from Christmas. The market has shown a strong move to the upside but it’s likely that there are plenty of sellers above to push this market lower. The $50 level of course will be a major psychological barrier, and I think that we will more than likely have sellers jump into this market near that level. We are in a massive downtrend, so it’s very likely that the rally that we see now will probably be a bit of a “relief rally” overall. The 50 day EMA has also turned down decidedly, so I think at this point it’s very likely that the trend following will continue to the downside. However, if we break above the $55 level, that should send this market much higher because it would be a major breach of resistance.

Natural Gas

Natural gas markets went back and forth again during the day on Wednesday, as we are bouncing around in what would be a very thin market. We have fallen rather drastically, so I think we could get a bounce from here, and the 50 day EMA will more than likely offer resistance, just as the $4.00 level above could be resistance as well. I’m looking to fade rallies, but I’m not interested in buying what I think will be a bounce. In general, I believe that this market is one that if you are patient enough, you should find plenty of reason to get short yet again. We have filled the gap at the $3.25 level, so it would be technically a complete wipeout of the mass of bullish pressure that we had seen, which of course has a lot of the buyers cleaned out. I think that we will continue to see negative pressure in this market but wait for the rally to take advantage of it.