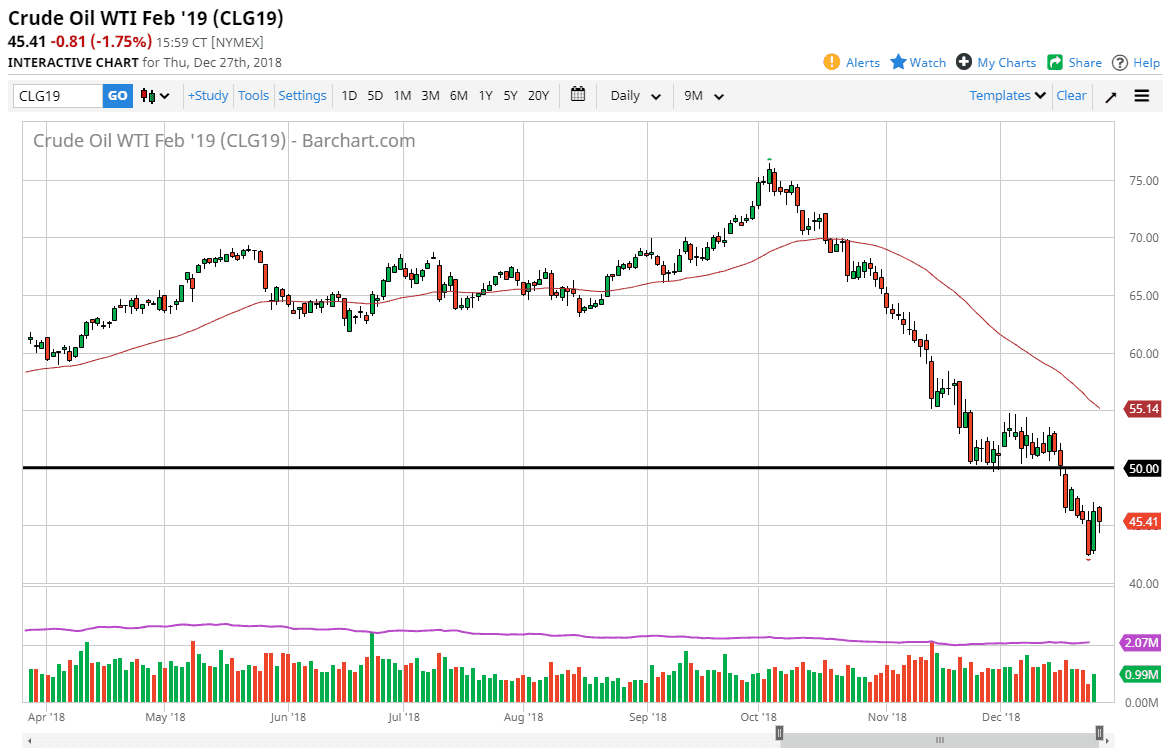

WTI Crude Oil

The WTI Crude Oil market fell significantly during the trading session on Thursday but did find buyers at roughly $45. That’s a good sign, and I think at this point it’s likely that we will continue to see the market try to find its way higher, and of interest would be the S&P 500 correlating quite nicely with this market. Otherwise, we could make a move towards the $50 level but I would expect a lot of resistance there based upon the fact that it was significant support previously. Beyond that, it is a large, round, psychologically significant figure and of course an area where a lot of technical traders will be interested. The 50 day EMA is just above, and I think that the moving average will of course offer resistance as well. In the short term though, we may get a little bit of a bounce.

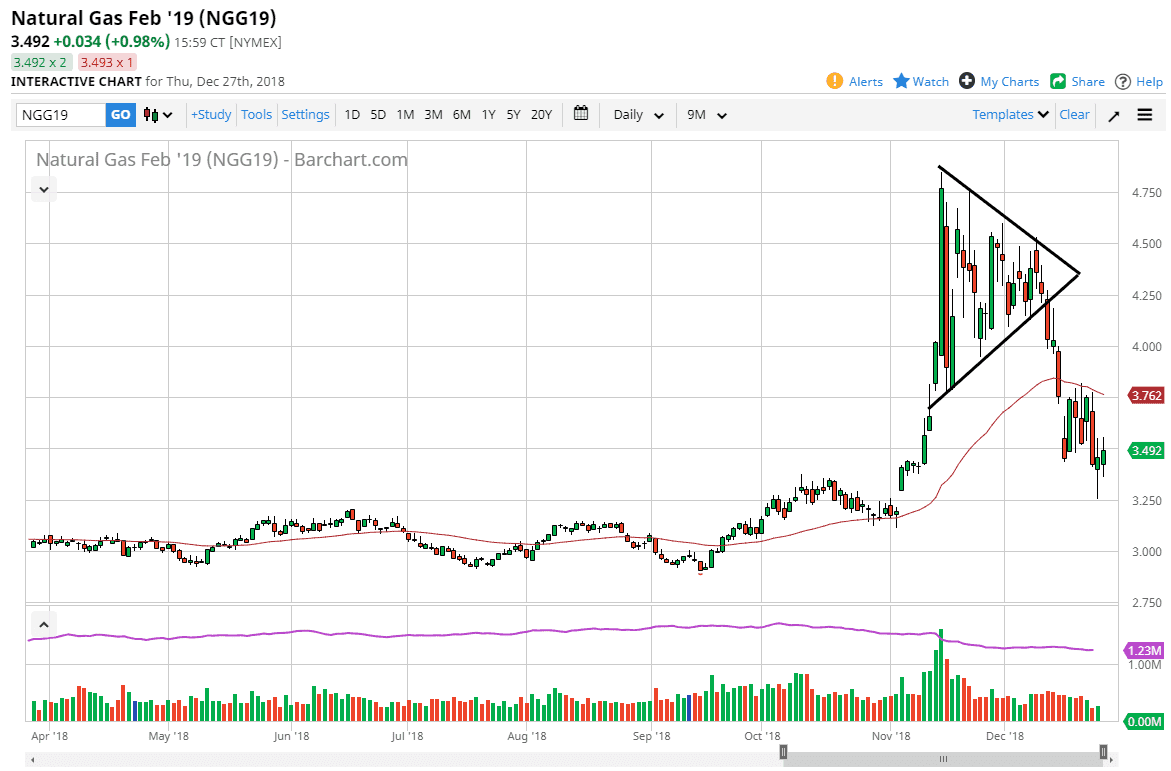

Natural Gas

Natural gas markets went back and forth during the day, showing slight positivity but I think that the 50 day EMA is starting to roll over a bit, and that could offer resistance. I think that the market is certainly broken, and of course the warmer temperatures in the United States will continue to be a problem for natural gas buyers. I think that the $4.00 level above is massive resistance, so therefore I would be very surprised to see us break above there. I believe that the $3.25 level underneath is supportive as well but will get broken given enough time. I prefer to let this market rally a bit, and then start selling at the first signs of exhaustion as I have been doing for some time now.