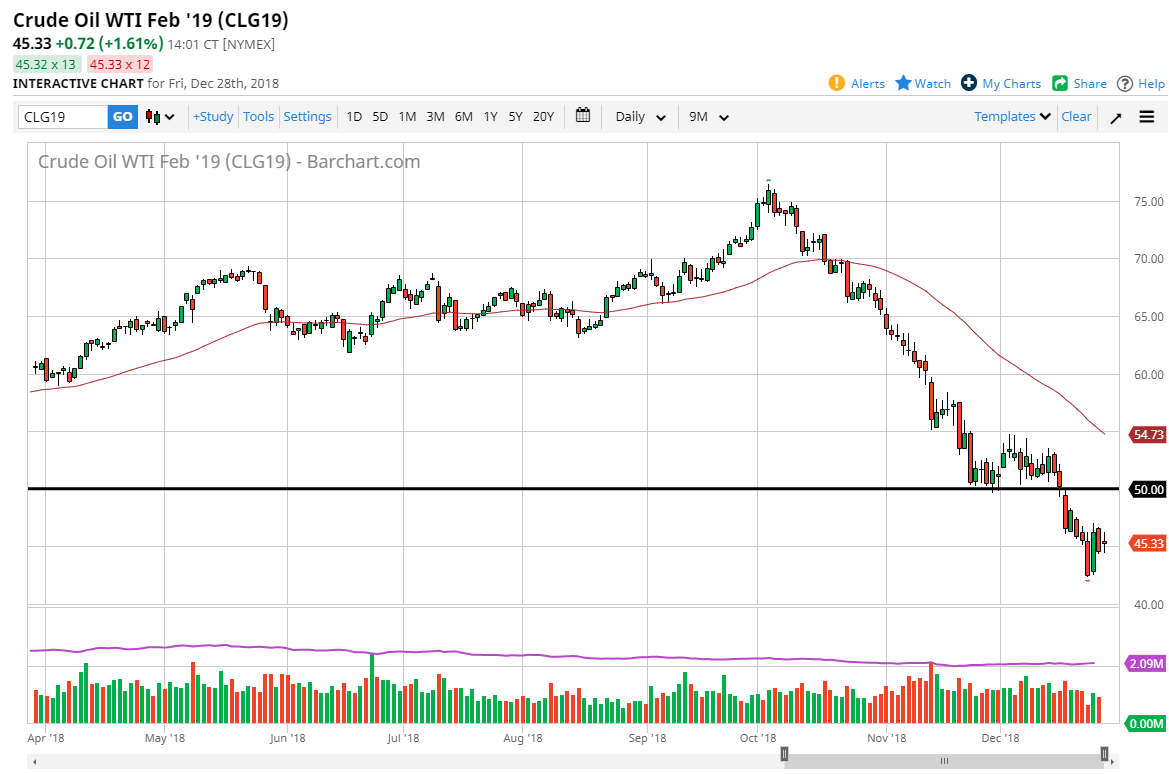

WTI Crude Oil

The WTI Crude Oil markets gapped higher to kick off the session on Friday, then chopped around of form a relatively neutral candlestick. However, when I look at the weekly charts I see that we are forming a perfect hammer, and I think that we may be trying to put in the bottom at this point. I believe that there is massive resistance above at the $50 handle though, and I think that between the $50 level in the $55 level is a significant amount of resistance. If we can break above that level, and even the 50 day EMA, then I think we can have a longer-term move. In the short term, I fully anticipate that we could get a bit of a bounce, and I think that we can start to see value hunters coming into the market as it has been so oversold.

Natural Gas

The natural gas market broke down a bit during the course of the session on Friday, reaching down towards the $3.30 level. I think the $3.25 level continues to be massive support, as it was the scene of a major gap. Ultimately though, I think that we will get the occasional bounce and you should be looking for signs of exhaustion to start selling. However, if we break down below the $3.25 level, then we could go down to the $3.00 level which is my longer-term target. In the short term though, I prefer to see rallies that show signs of exhaustion near the 50 day EMA and continue to punish natural gas which is well oversupplied. Beyond that, if global growth slowing down there is going to be less need for energy.