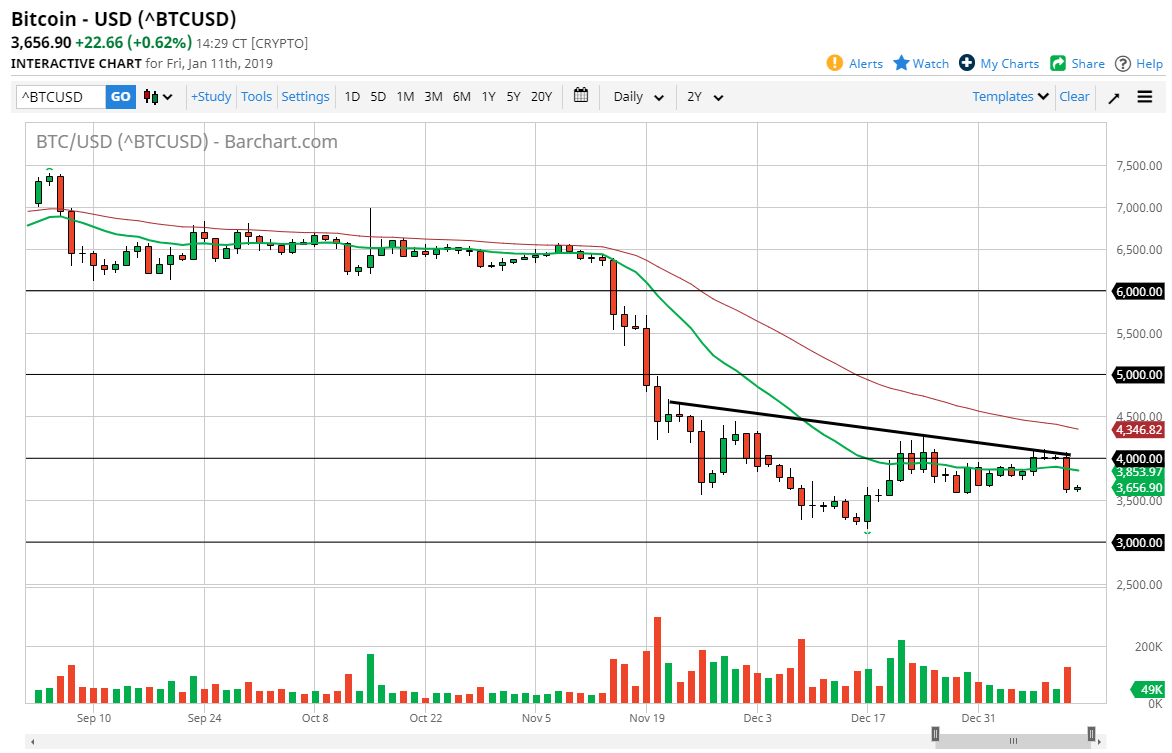

BTC/USD

The bitcoin markets fell apart on Thursday, and on Friday wasn’t exactly confidence inspiring. Looking at this chart, I do think that we have lower prices ahead of us, as the $3500 level will be supportive, but I think it also gets broken. Ultimately, I believe that we are going to test the $3000 level and I think that rallies at this point are opportunity to start selling. The $4000 level lines up quite nicely with the downtrend line that doesn’t seem to be able to get wiped out, so I think at this point it’s only a matter of time before we continue to see sellers jump into this market place and punish Bitcoin for its lack of functionality.

I do think that eventually the $3000 level will be targeted, but it may take a couple of attempts. If we break down below the $3000 level, then the market could go down to the $2500 level next. Rallies are to be faded, but if we do break above the $4000 level, we may be looking at the 50 day EMA being tested again. If that’s the case, then I think that the $4500 level becomes the next battlefield. I believe that the potential inverted head and shoulders now looks completely blown out, and I think at this point if we continue to go lower, this will be but a distant memory and the talk of a head and shoulders will disappear.

We been extraordinarily bearish times over the last year or so, and I don’t see anything that’s going to change this of significance. Overall, I think that the market is one that continues offer plenty of opportunities to short if you are patient enough, as seen during the Thursday candle stick.