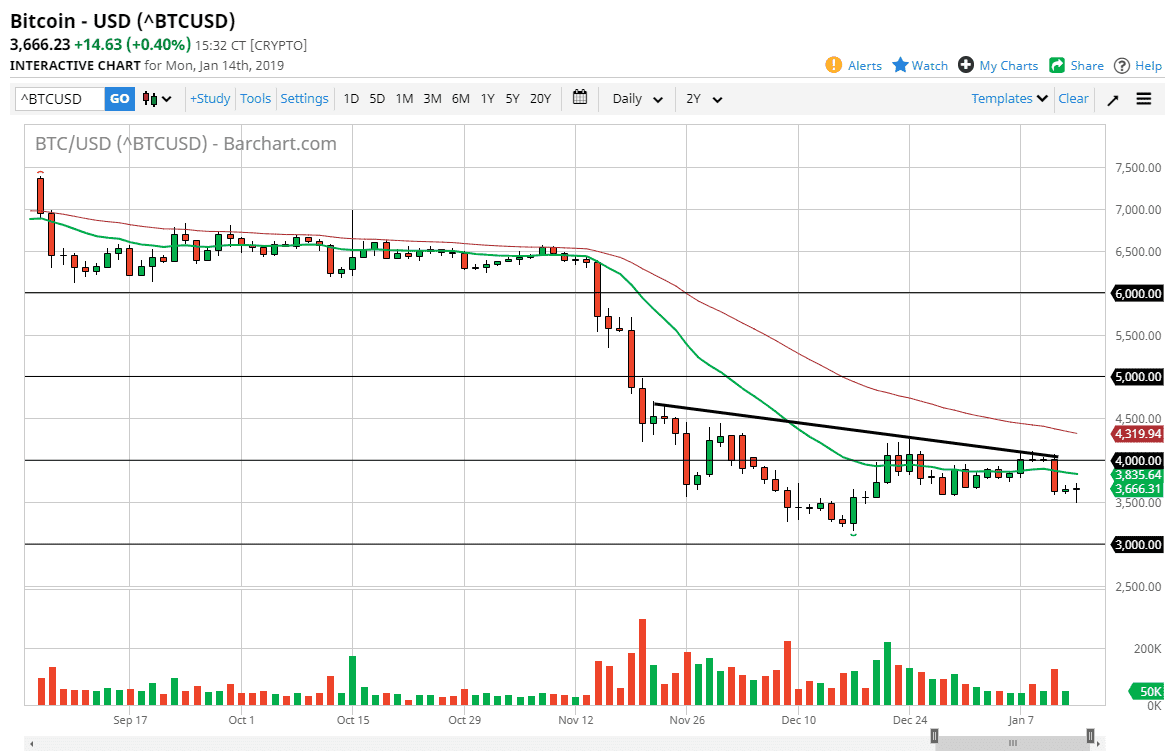

Bitcoin went back and forth during the trading session on Monday, as we continue to see a lot of choppiness. That being the case, what I would pay attention to more than anything else is the fact that we had a very explosive bearish candle that had strong volume behind it, as we had found a lot of resistance at the downtrend line, and of course the $4000 level. By doing so, and the fact that the Monday candle stick, although a bit of a hammer, shows very little in the way of an attempt to break out to the upside, I think that sellers will continue to jump back into this market place.

The 20 day EMA is just above, and it is starting to turn lower. Ultimately, I think that the market will continue to see a lot of negative pressure, because not only do we have the 20 day EMA, but we have the $4000 level again, and of course the downtrend line. If we break above there, then the 50 day EMA is also going lower. Ultimately, I think that the market breaking down below the $3500 level opens the door back down to the $3000 level.

I have no interest in buying bitcoin, because there are far too many reasons to think that the downtrend should continue. Granted, we have sold off quite drastically over the last couple of months, and therefore a bounce could be coming, but that should show a nice opportunity to start shorting yet again. The $5000 level above is going to of course be massive resistance as well, but at this point I would be quite surprised to see us even come close to that level without some type of major catalyst to get things going.