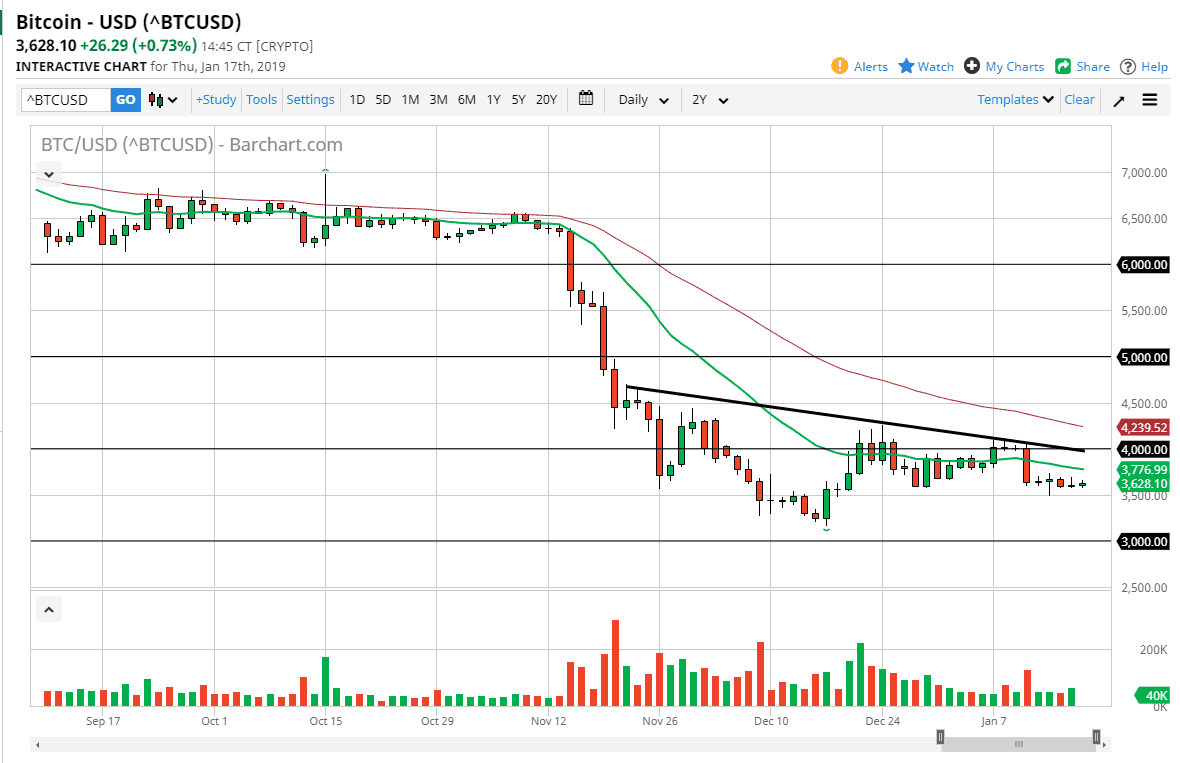

Bitcoin continues to do almost nothing during the day, as Thursday was very quiet. We continue to hover around the $3600 level, which I think is simply an extension of the support at the psychologically important $3500 level. The 20 day EMA is starting to drift lower again and is acting as dynamic resistance. If that’s going to be the case, I think that the market is going to make a break below the $3500 level rather soon. I also recognize that the $4000 level above and the downtrend line both offer significant resistance, so I think that rallies are to be sold as the market has yet to prove itself to be willing and able to hold rallies. I think that will probably continue to be the issue going forward, as we almost certainly will eventually go looking towards the $3000 level.

If we were to break above the $4000 level, after we bust through all of that resistance we then need to deal with the 50 day EMA which is about $250 above the big figure. Overall, I believe that we will see signs of exhaustion that we can get involved with, and that we would have to be a rather aggressive going forward with what has been an extraordinarily bearish run. There is no sign of Bitcoin picking up again, at least not on this chart.

From a fundamental standpoint, there doesn’t seem to be much use for Bitcoin, and although the diehards will stress the amount of transactions, in the big scheme of things it is but a fraction of a fraction of overall liquidity flows in the marketplace when it comes to currencies. I have no interest in buying this market until something changes it a very drastic manner.