BTC/USD

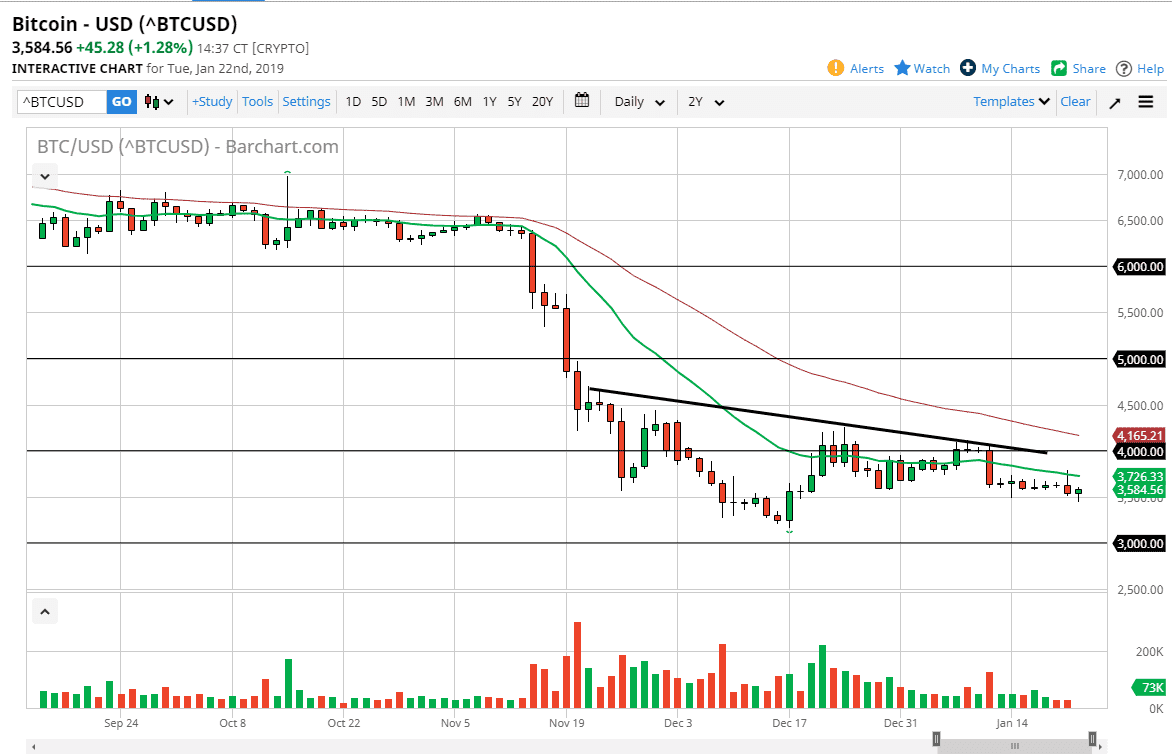

The bitcoin market pulled back initially during trading on Tuesday but has found support underneath the psychologically figure of $3500. By turning around and forming a bit of a hammer, this is a somewhat solid sign of buying pressure underneath, but we still have the shooting star from the Monday session, and of course the 20 day EMA just above sloping lower. At this point, I suspect that we are going to go lower eventually but we may get a short-term bounce in order to bring in more sellers. That being said, I believe that the $4000 level above will also offer a significant amount of resistance, so I think that we are looking at a situation where we will continue to sell the rallies.

I don’t necessarily believe that bitcoin is going to collapse at this point, but I do think lower pricing makes sense. Adoption continues to be a major issue, and the volume is all but dried up. With the lack of volume, it shows a lack of interest in this market. Ultimately, I believe that the market will continue to be very choppy, but it has a downward bias to it that hasn’t gone away. At this point, I don’t have any interest in buying this market until it breaks above the 50 day EMA, as it would be a significant break out and would catch a lot of short sellers on the wrong side of the trade. Ultimately, I believe that the market will continue to struggle to lift, and that the crypto currencies continue to suffer going into 2019 on the whole. If and when we break below the $3000 level, it would signal the next leg lower in this market.