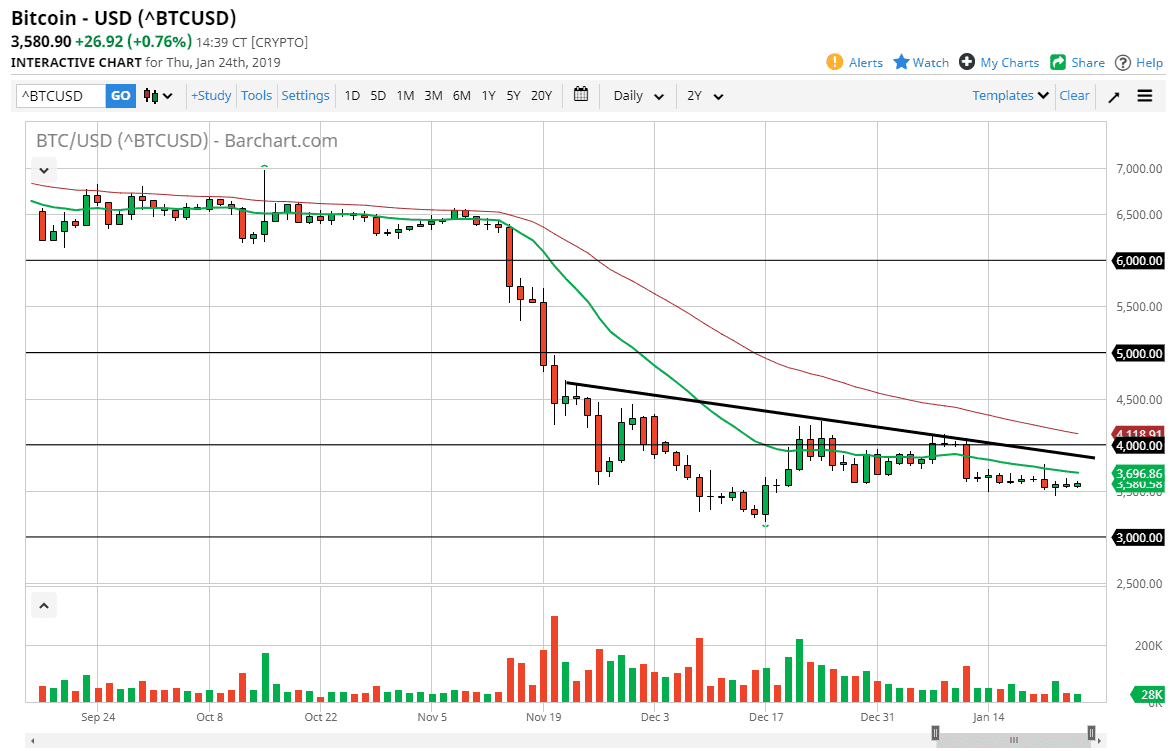

Bitcoin rallied a bit during the trading session on Thursday, but still remains relatively tight in its trading range. The youth $3500 level underneath continues to offer support, as we had seen a nice-looking hammer form during the trading session on Tuesday. It’s a large, round, psychologically significant figure, so of course it attracts a lot of attention. However, we have a lot of negative influence above, in the form of several technical areas. I see the trend line is still very much intact, which of course is negative. However, before we even get there we should have to deal with the 20 day EMA as well.

Ultimately, I think if we break above the 20 day EMA, the trend line will cause a lot of selling pressure, then we have the $4000 level which of course always causes a lot of attention due to the large, round figure. Above there, we now have the 50 day EMA which is about $100 higher, so needless to say there is a lot of technical resistance above. I believe that as we rally there should be selling opportunities based upon exhaustive candles, perhaps on short-term charts. In fact, that’s my favorite way to play this market as selling on rallies continues to work out.

If we do break down below the $3500 level, and more importantly close below there on a daily chart, then I believe that we could continue to go much lower, perhaps down to the $3000 level which was so supportive back in December. I do think we break down through there in continue to go even lower. We have had yet another ETF give up trying to come to market, so that has added more negativity, but the market I think had already priced that in. At this point, I have no interest in buying.