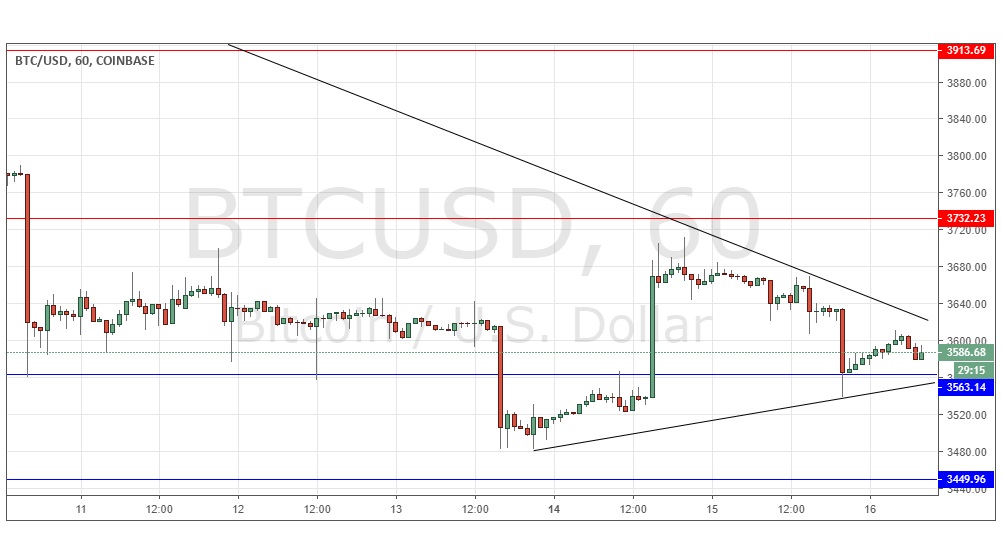

Yesterday’s signals were not triggered, as the bullish price action took place just a little below the support level identified at $3,568.

Today’s BTC/USD Signals

Risk 0.75% per trade.

Trades may only be taken until 5pm Tokyo time today only.

Long Trades

Long entry after a bullish price action reversal on the H1 time frame following the next touch of $3,563 or $3,450.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is $200 in profit by price.

Take off 50% of the position as profit when the trade is $200 in profit by price and leave the remainder of the position to run.

Short Trades

Short entry after a bearish price action reversal on the H1 time frame following the next touch of $3,732 or $3,914.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is $200 in profit by price.

Take off 50% of the position as profit when the trade is $200 in profit by price and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

BTC/USD Analysis

I wrote yesterday we could now expect the level just below $3,570 to probably be supportive.

I had no bias, but I thought that if $3,568 held as support then we may be seeing the final leg of a bullish “over and under” pattern begin to form.

I was broadly correct about the support, which was a few dollars lower than I expected but still held. However, the bulls look relatively weak, so I have little confidence in an upwards move from here. For bulls, holding the support at $3,563 will be crucial, but a sustained break below that level and the lower triangle trend line would be a more convincing bearish sign. I would take a bearish bias down to $3,450 if get this bearish break. There is nothing due today regarding the USD.

There is nothing due today regarding the USD.