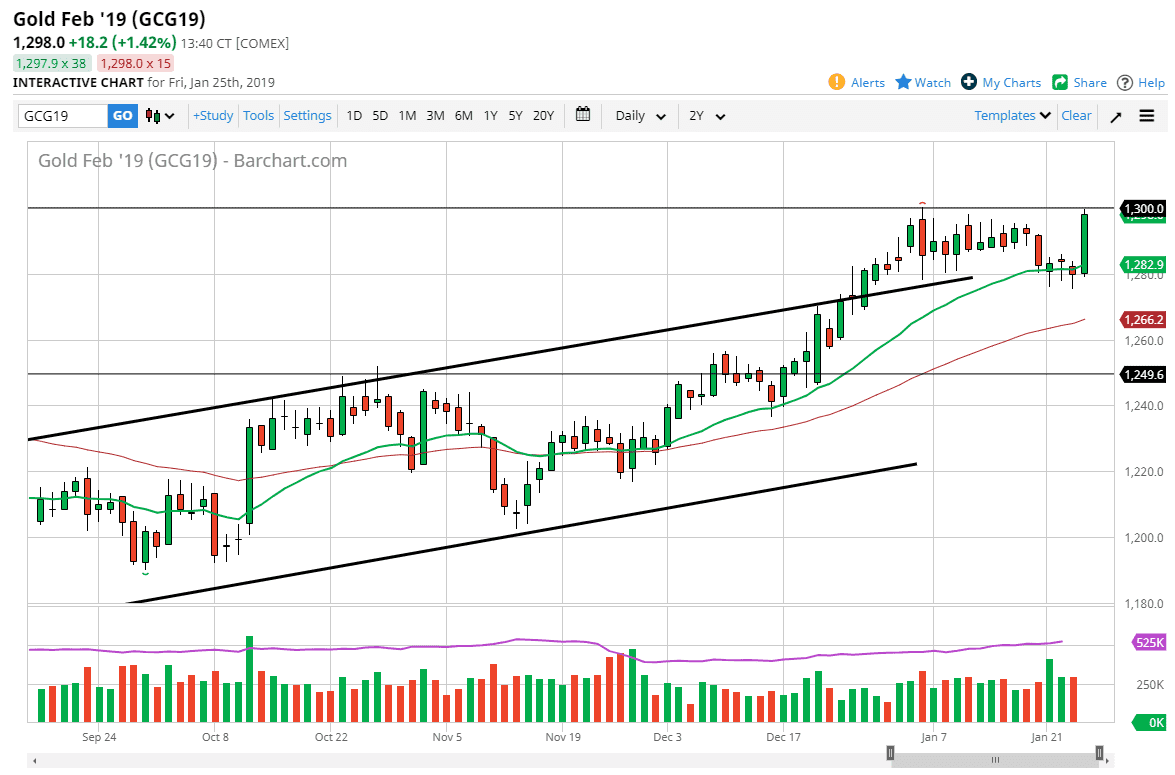

Gold markets exploded to the upside during the trading session on Friday, after forming three hammers in a row on the daily chart. I had suggested on Thursday that we could get a strong move to the upside, but this kind of surprised me. We slammed into the $1300 level where we found resistance, as would be expected. I figured that this was going to take a couple of days to complete, not a couple of hours. Nonetheless, we are at a major resistance barrier so if we get a daily close above the $1300 level, that would be the signal that we are going to go much higher. Otherwise, I think a pullback is very likely and we will probably find buyers near the $1295 level, or perhaps the $1290 level.

I believe that the $1280 level is still the “floor” in the gold market currently, but after the action on Friday, I’d be surprised if we fell that low. If we did, that would be a very negative sign to say the least. This is an extraordinarily strong candle, and we are closing towards the very top of it. It does not surprise me that we could break out though, because it was ahead of the weekend and most people would not want to be that overly exposed in a risk as set with the geopolitical situation being as it is. Speaking of geopolitical problems, I believe that is one of the main drivers of gold. Beyond that, we have the Federal Reserve suddenly looking a bit more dovish these days, and that of course will help goal going forward as interest rates look likely to continue to drop. I like buying pullbacks in this market that offer value.