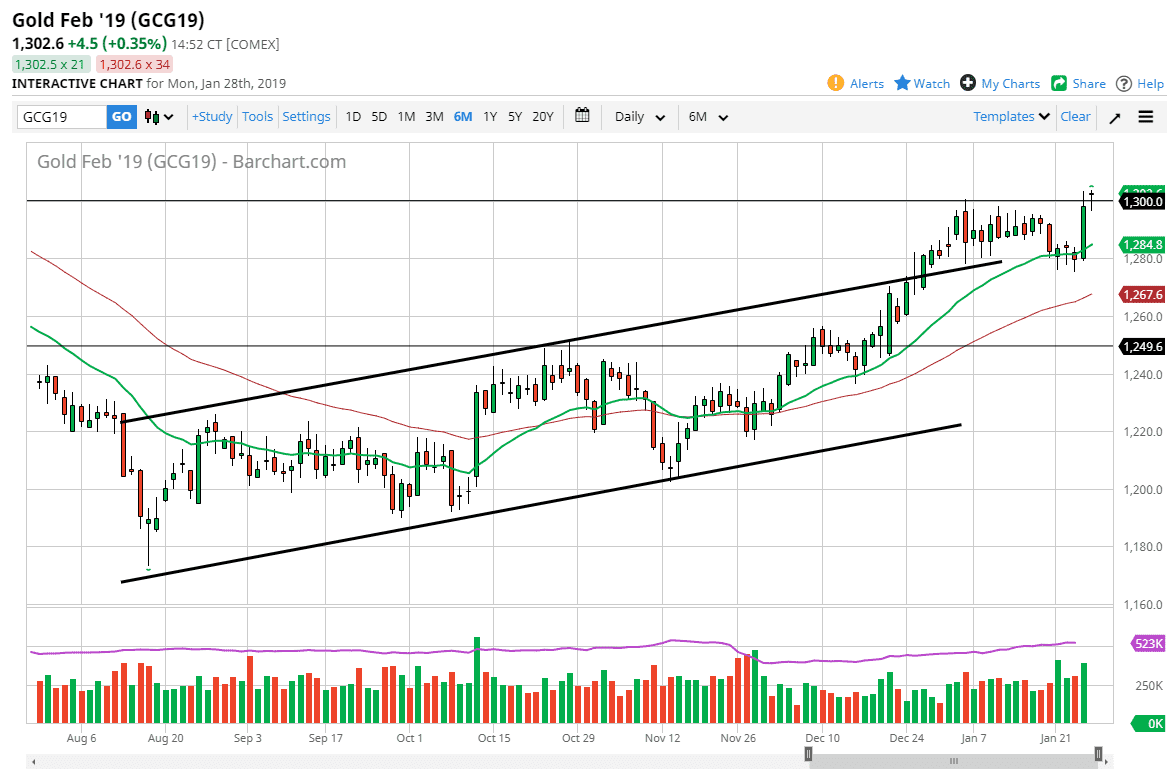

Gold markets have pulled back slightly after gapping higher on Monday, showing signs of underlined pressure to the upside. The $1300 level being broken to the upside of course is a very bullish sign, and now that we are closing out the candle stick and what looks very much like a hammer, I think that we could see some continuation going forward. Expect short-term pullbacks but they should be opportunities to pick up a bit of value close to the $1300 level. If we were to break down below the bottom of the candle stick though, that would have the market resetting, perhaps going as low as the 20 day EMA which is pictured in green on the chart. That being said, I suspect that the easiest path of least resistance will be to the upside, as we have seen so much in the way of bullish pressure as of Friday.

The Federal Reserve of course will come into focus this week, as the FOMC statement on Wednesday could give us some hints as to whether or not the Federal Reserve is looking to slow things down again. If they are, that should continue to put upward pressure on gold. Beyond that, we have a lot of global concern out there that will perhaps make gold a bit attractive as well. With the combination of a US dollar that is losing strength, and a lot of concern around the world, is very possible that we will continue to see traders try to pick up gold for a bit of a safety play. I think ultimately that the market will continue to reach towards the $1320 level initially, based upon the previous consolidation area that started at the $1280 level. Pullbacks should continue to offer plenty of value.