The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 6th January 2018

In my previous piece last week, I was long Gold/USD and Silver/USD whilst also being long of the USD/CAD currency pair. Gold rose by 0.33%, Silver rose by 1.97%, but the USD/CAD currency pair fell by 1.96%, so the forecast produced an averaged win of only 0.11%.

Last week saw the strongest rise in the relative value of the Canadian Dollar, and the strongest fall in the relative value of the U.S. Dollar.

Last week’s Forex market was quite active and was dominated by a strong recovery in Crude Oil, a lesser recovery in the stock market, and a Forex “flash crash” which sent the Japanese Yen sharply higher and affected other currencies too. This may have produced long-term lows in the Australian Dollar and the British Pound, and the market seems as if it is on the brink of some major changes. This state of flux can be a dangerous market condition, and few trends look set to survive or resume.

This week is likely to be dominated by what happens to the U.S. stock market, which may recover further if the FOMC Minutes are dovish and new U.S. inflation data is low. Brexit will also return to view so there could be more activity in the British Pound.

Fundamental Analysis & Market Sentiment

Fundamental analysis seems very unclear on the U.S. Dollar. The U.S. printed a very high new jobs number at the end of last week, and the stock market continued to recover from its lows. However, there are still major fears over the seeming high sensitivity of the economy to any further rate hikes, plus the ongoing trade dispute with China and the current government shutdown which is beginning due a struggle over financing between the President and Congress. JPMorgan currently suggest that the market is pricing in a 60% chance of an economic recession in the U.S. occurring at some point during 2019.

Brexit remains an unknown, and the situation is unlikely to be clarified until Parliament starts to prepare for a new vote on a possible deal by approximately 14th January. This may happen this week.

The Australian Dollar is especially vulnerable to developments in the trade war between China and the U.S.A.

Technical Analysis

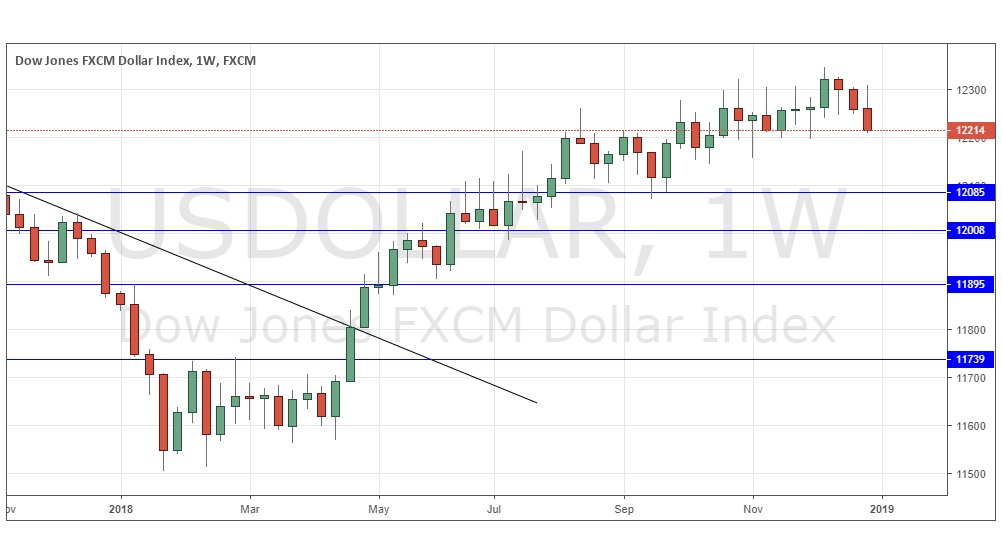

U.S. Dollar Index

The weekly price chart below shows that last week the USD Index fell again, printing a bearish candlestick that was not large but did close very near its low. This is a bearish development, and the long-term bullish trend is coming into question as we now have the price lower than it was 3 months ago, which is a bearish sign. However, the price is still up over 6 months, which is conversely a fairly bullish sign. There is downwards momentum in the Dollar, but the technical picture is a little mixed and essentially uncertain on the greenback.

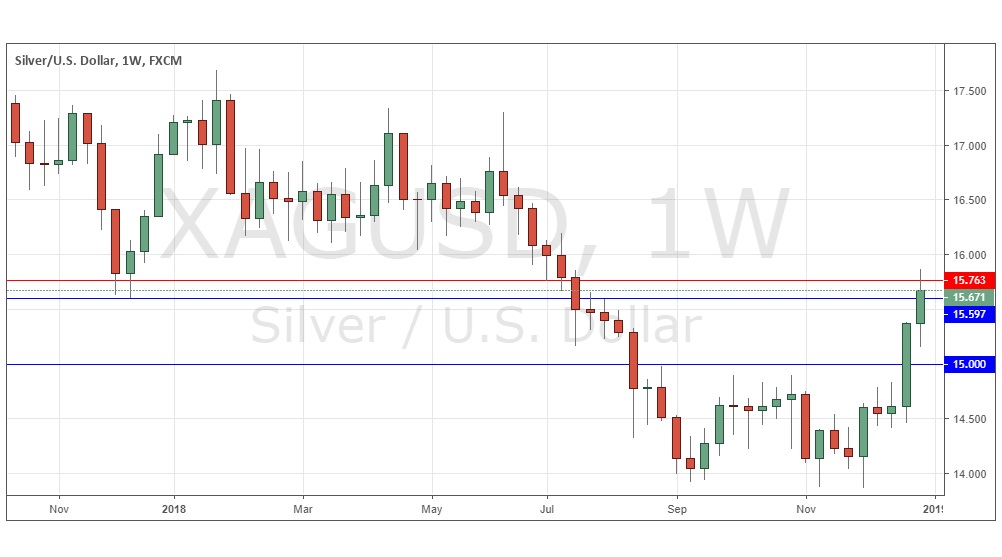

Silver

The weekly chart below shows last week produced a reasonably large bullish candlestick. The price again closed above the psychologically important $15 level and made the highest close and highest high seen in over five months. These are significant bullish signs, but there are some signs signaling caution for bulls, with a bearish reversal occurring at the end of last week. Additionally, there is an obvious resistance level at $15.76 which the price was only briefly able to exceed, and the weekly close was below that resistance level. Additionally, if the recovery in stock markets continues, there will be less money flowing into Silver as a safe-haven. However, I remain bullish overall, and this is the strongest trend in the market at present. It is also worth noting that Silver looks considerably more bullish than Gold.

Conclusion

Bullish on Silver, bearish on the U.S. Dollar.