Gold

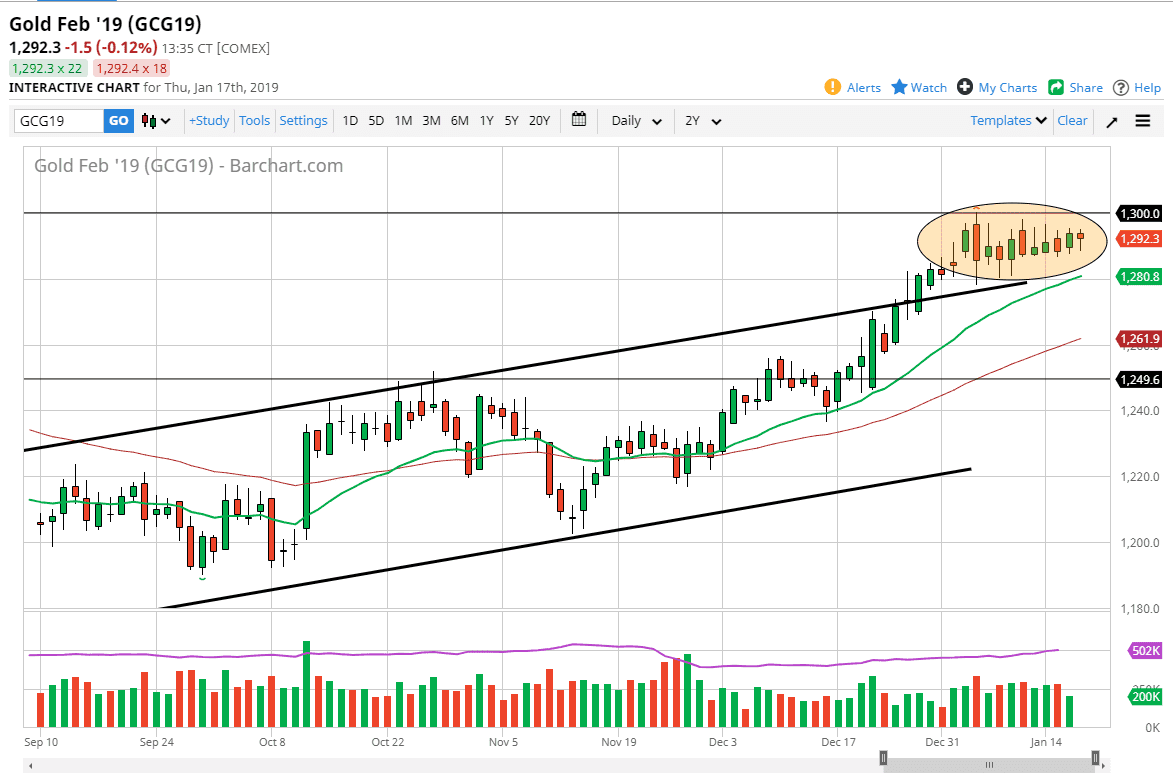

Gold markets were contained within the trading range that we have been in for some time during the day on Thursday, as we see the markets look for some type of direction, mainly from the US dollar if history is any indication. That being the case, we got word out of Washington DC that perhaps the Americans are looking to strike a deal between the Americans and the Chinese, which had the dollar selling off suddenly. However, we are still stuck in the range that we have been in so I don’t think that this is a major catalyst to send the market higher yet. However, I also recognize that there is massive amounts of support underneath so I still believe that buying dips continues to work.

The 20 day EMA is just below, and that of course offers a lot of support from a technical standpoint, just as the top of the uptrend channel has been. Because of this, I think that short-term traders continue to pick up gold when it offers value and will be looking to try to break above the $1300 level. If we can break that level, then the market will continue to reach towards the $1325 level, possibly even the $1400 level after that. I do not think that this market is particularly vulnerable at this point, because not only do we have the trend line and the 20 day EMA, we also have the 50 day EMA after that. Even a break down at this point will probably just be looked at as an opportunity to pick up even more value.

On a daily close above the $1300 level, I think you will see a flood of fresh new money coming into the market, as the US dollar will shrink. That being said, short-term traders will pick up little dips, longer-term traders will wait for the daily close.