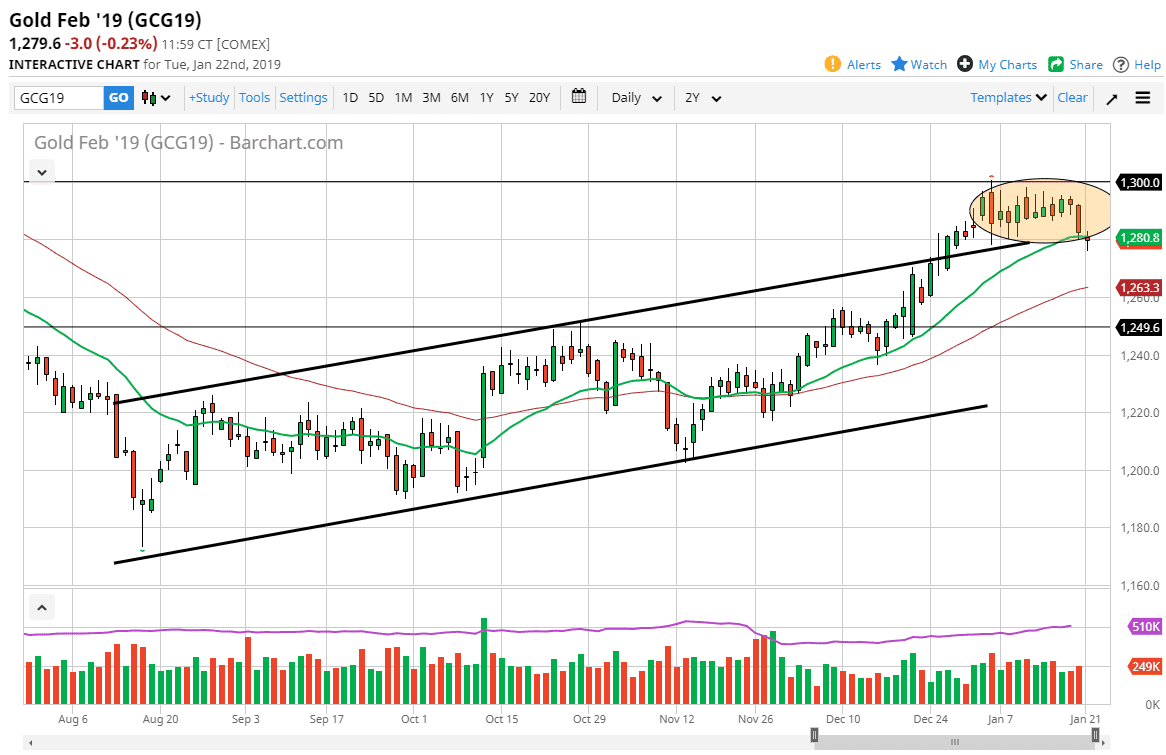

Gold futures dropped to kick off the week, piercing the $1280 level, but keeping things in perspective we need to appreciate the fact that it was Martin Luther King Jr. day in the United States, dropping liquidity drastically. Unlike currencies, the true session that matters is in the United States and not in Europe, so the European selling gold really isn’t much to think about. The fact that we formed a hammer shows just how much support is underneath, and I think that we will probably turn around to see buyers come back in. However, if we break down below the bottom of the hammer candle stick for the trading session, we will probably go down to the 50 day EMA on the market, which is closer to the $1265 level.

Looking at this chart, we can break above the top of the candle stick for the day it shows just how much support is underneath and we will probably go back towards the top of the consolidation area, and perhaps even trying to test the $1300 level. The US dollar has been strengthening a bit over the last couple of days so that has weighed upon gold but I think longer term we are still going to see a lot of softness in the greenback given enough time, as the Federal Reserve looks likely to stay on the sidelines, if not possibly even cut. Regardless, that is bullish for gold but I think a pullback makes sense as the $1300 level offers a lot of resistance. If we break down below the 50 day EMA though, that could send the market down to $1250 level, perhaps even lower than that. Ultimately, we have seen a lot of bullish pressure so I think it makes sense that given enough time we will go higher based upon momentum if nothing else.