Gold prices are in a bearish correction for 4 days in a row, reaching to $1279 an ounce, with the return of trader’s optimism towards the possibility of a trade agreement between the USA and China. Until this moment, the gold price was able to move towards the psychological peak at $1300 an ounce.

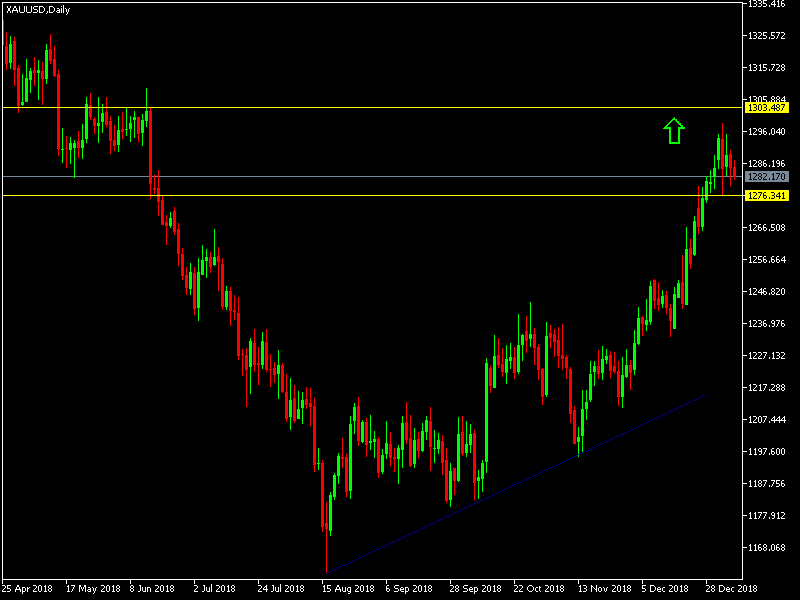

Last Friday, prices collapsed from the resistance level at $1298, the highest price in 6 months, all the way to the support level at $1276, with the mix of American jobs’ numbers and the continuation of Government Shutdown for the third consecutive week.

Gold recent gains came in the risk aversion sentiment and seeking safe heavens, despite the breakthrough between the USA and Chine regarding their trade conflicts. The ongoing political worries in the USA and the ongoing government shutdown contributed to gold gains, which could support our expectations of the gold moving towards the psychologically important peak at 1300. What also contributed to the gold’s strong gains recently was Trump’s strongest attack towards the Fed’s policy, and his threats to remove the governor, Jeromy Bawl, in response to sticking to the rate raises plan, which Trump sees as a hurdle to his economic plans. The golds general direction will continue to be upwards as long as it is above the resistance at 1250.

The weaker US dollar and investors fleeing towards safe heavens contributed to the recent gold gains

The final minutes of the Federal Reserve meeting and the comments of Governor Jerome Powell confirm their confidence in the performance of the US economy, but there will be some risks that will affect its strength - debt increases and tariff rises amid Trump's fierce trade war against US trading partners. Some of Powell's previous remarks and similar remarks from other Fed officials have raised hopes in financial markets that the central bank may be about to slow its interest rate increases.

Technically: Gold prices today reached all levels of resistance we had previously anticipated and the continuation of the bullish momentum may reach the psychological peak of $1300, and then 1315 and 1325, respectively. On the downside, the nearest support levels for gold are currently 1285, 1275 and 1260 respectively. We still prefer to buy gold from every bearish bounce.

Economic data: Gold’s focus will be on the level of the US dollar and reaction from the announcement of the contents of the Federal Reserve minutes. Gold will also be affected by investors’ appetite for risk as it's one of the most important safe havens. Gold will see monitor global geopolitical concerns about North Korea, Britain's exit from the EU or Trump's economic policy.