Gold prices rose $3.43 an ounce on Monday as investors bet that the Federal Reserve will not raise interest rates this year if economic growth slows further. In economic news, the Institute for Supply Management said its index of non-manufacturing activity fell to 57.6 in December from 60.7 in November. Global stock markets were mixed while U.S. stocks rose on optimism about the outcome of trade talks between the U.S. and China.

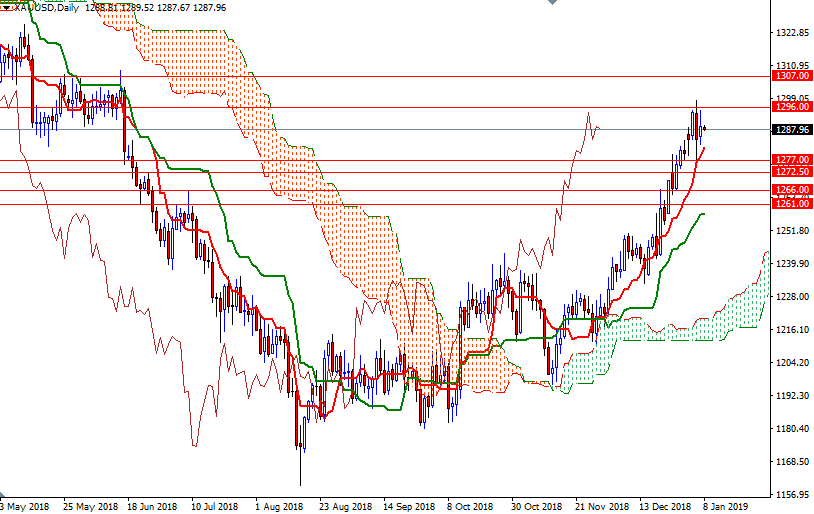

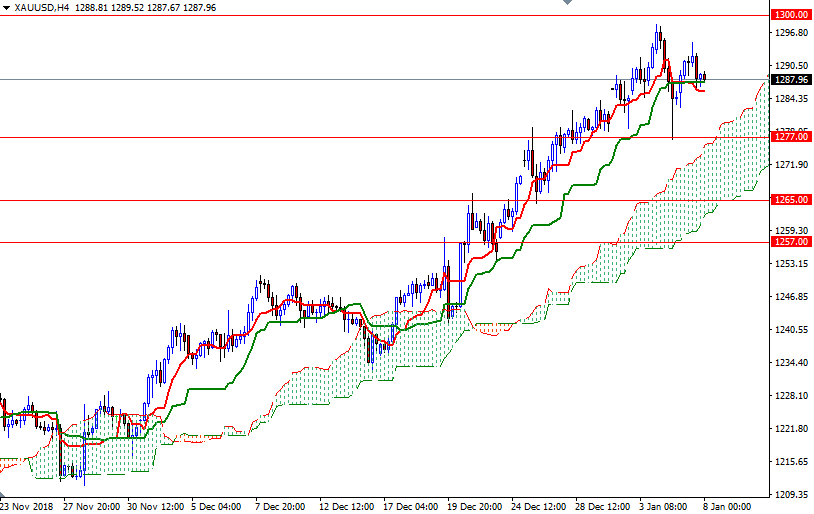

XAU/USD is trading above the Ichimoku clouds on the daily and the 4-hourly charts, suggesting that the bulls have the overall technical advantage. However, we have negative Tenkan-Sen (nine-period moving average, red line) - Kijun-Sen (twenty six-period moving average, green line) crosses on the H1 and M30 charts. It looks as if the market will test an intra-day support in the 1285.60-1284 zone. The 4-hourly Tenkan-Sen and the bottom of the hourly cloud converge in this area so the bears need to drag prices below 1284 to challenge 1282. If prices dive below 1282, the next stop will be 1279/7.

To the upside, the initial resistance sits in 1293/2. If the market gets back above 1293, we may revisit the 1296/5 zone. The bulls have to convincingly push the market above 1296 to make a run 1300. Closing above 1300 on a daily basis paves the way for a test of 1307/4, which is the next solid technical resistance on the charts.