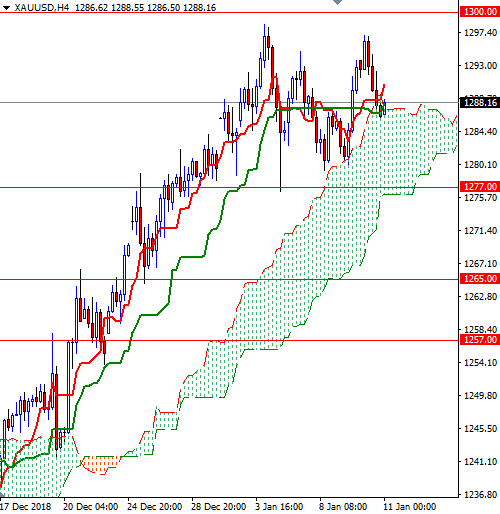

Gold prices fell $7.39 an ounce on Thursday as rising stock prices dented the appeal of the safe-haven metal. A rebound in the U.S. dollar index, following selling pressure this week, also worked against the precious metals markets. XAU/USD tested the anticipated support in the $1287.30-$1286 zone as expected after prices failed to hold above the $1296 level.

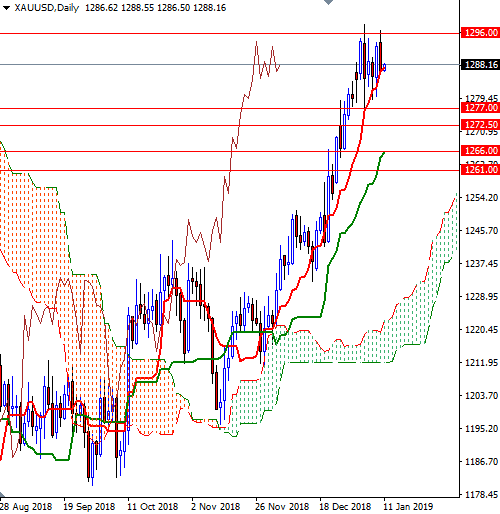

The bulls still have the overall near-term technical advantage. The Ichimoku cloud on the 4-hourly chart continues to act as support, and the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) are positively aligned. If the bulls can defend their ground, we may revisit the 1293-1291.50 area, where the Tenkan-sen sits on the H4 chart. The bulls need to overcome the aforementioned strategic barrier at around 1296 to gain momentum for a test of 1300. A break through there could foreshadow a move to 1307/4.

On the other hand, if XAU/USD drops below 1286, then the next stop will be 1284/3. The bulls have to drag the market below 1283 to make a move for 1280/79. Below there, the 1277/6 zone (the bottom of the 4-hourly cloud) stands out as a key technical support. A break down below 1276 would open up the risk of a drop to 1272.50-1270.