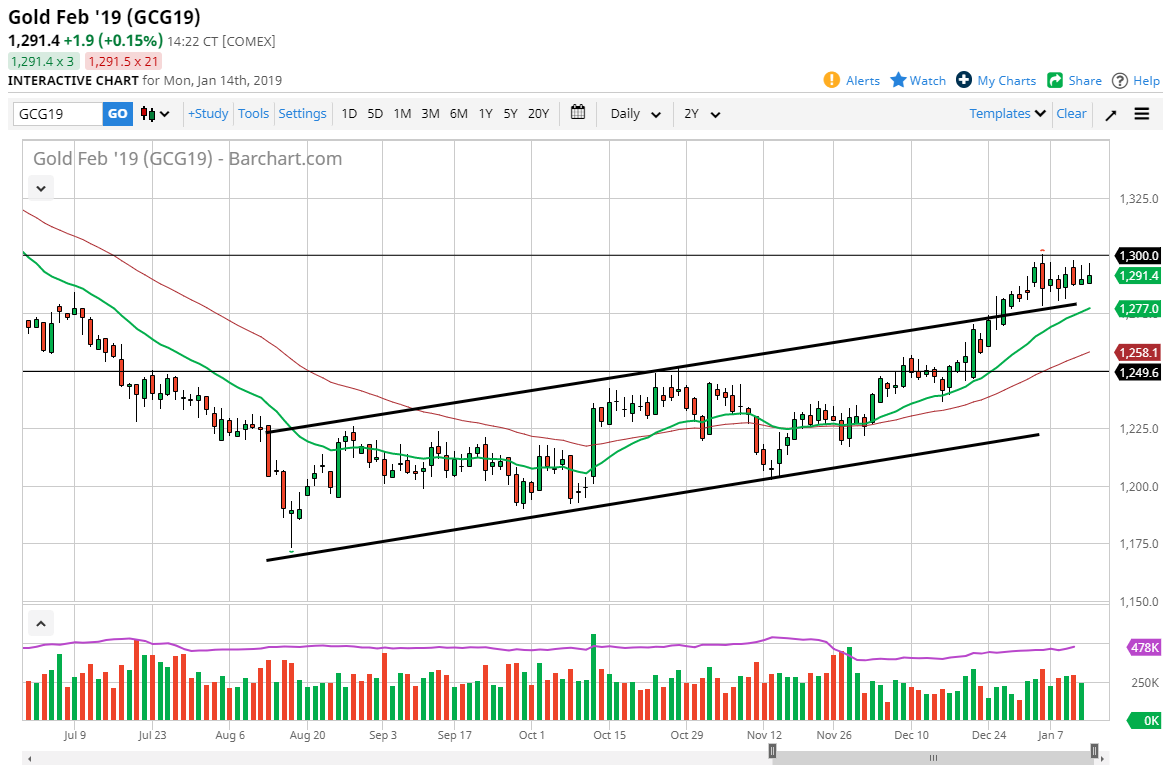

Gold markets tried to rally again to kick off the week on Monday, but as you can see, we have given back a bit of the gains. Gold markets will continue to be very choppy in this area, because we have recently broken out of an uptrend line, but we also have the psychologically important $1300 level above. Because of this, I think that it will remain incredibly tight and choppy, and that shouldn’t be much of a surprise considering how much confusion the Federal Reserve has thrown into the marketplace. Initially thought to be overly hawkish, now traders are starting to figure out whether or not the Federal Reserve is willing to raise rates at all in 2019. If they continue to look a bit dovish, then I think that gold will finally break out. In fact, it’s my best case currently.

Looking at the chart, you can see that the 20 day EMA, pictured in green on the chart is just below current trading. Obviously, the $1300 level above should continue to offer a bit of psychological importance and resistance, but I think once we finally break above that area, then the market could probably continue to go towards the $1325 level initially, on its way to the $1400 level above which is the top of a larger consolidation area.

Even though I acknowledge that we are struggling to continue to go higher, I believe that we will eventually take off to the upside. Even if we do break down from here, I believe that the 50 day EMA underneath, pictured in red and hanging about the $1258 level should offer buying as well. Overall, I believe that we continue to see a “buy on the dips mentality.”