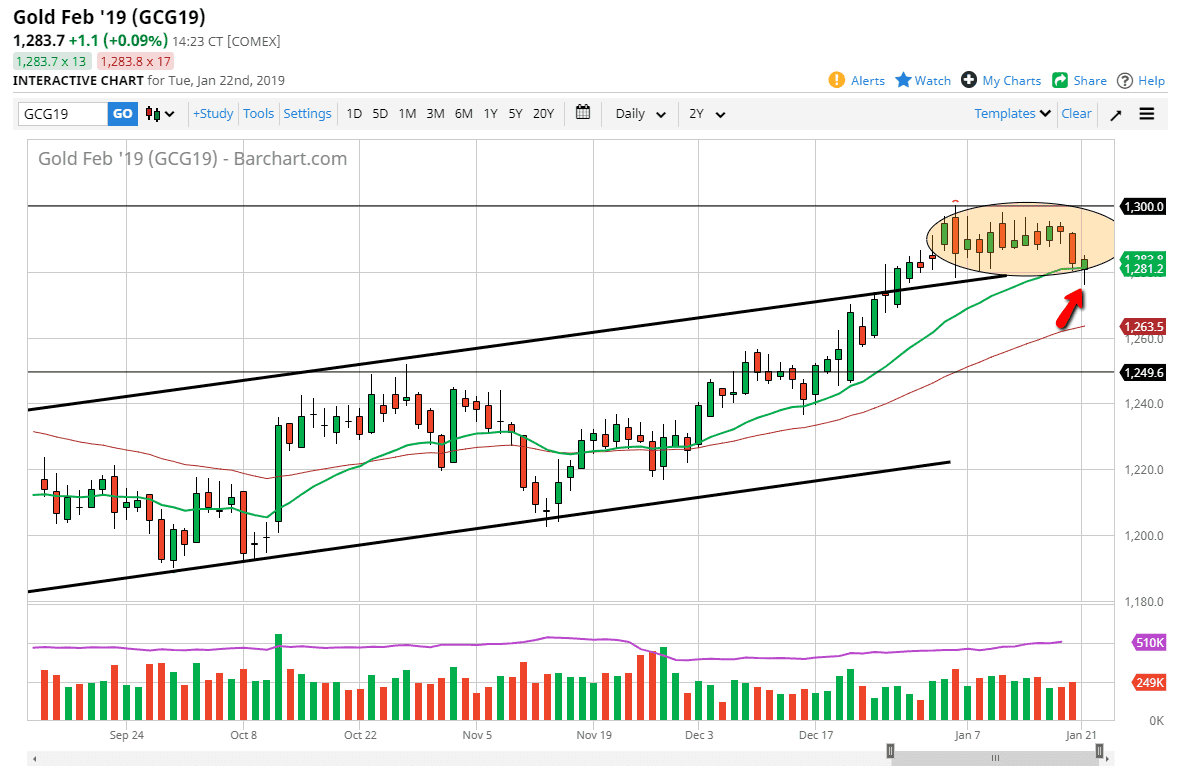

Gold markets fell initially during the day on Tuesday but then turned around to pop back over the $1280 level. This is a very strong sign, and I think at this point it’s likely that the 20 day EMA continues offer support. I believe that the market may go looking towards the top of the very bearish candle on Monday initially, but keep in mind that was a day when the Americans were away at holiday. Because of this, I believe that we are much more likely to continue going higher, especially if we can get some type of dollar negativity during the session. I think the $1300 level is of course massive resistance though, so keep that in mind.

It makes sense that we go back and forth because the market doesn’t really know what to do with the information it has at the moment. We are worried about trade wars, we are worried about the Federal Reserve and whether or whether or not it will continue to tighten monetary policy. It is the balance sheet information that the market is now focused on as it appears that the Federal Reserve is very likely to be a bit more neutral at the very least when it comes to interest rate hikes. That should in theory be negative for the US dollar and by extension should lift gold. If and when we finally break above the $1300 level, then the market could go all the way to the $1400 level, $25 increments at a time. If we break below the candle stick for the session on Tuesday, then I think the 50 day EMA is your next support level.