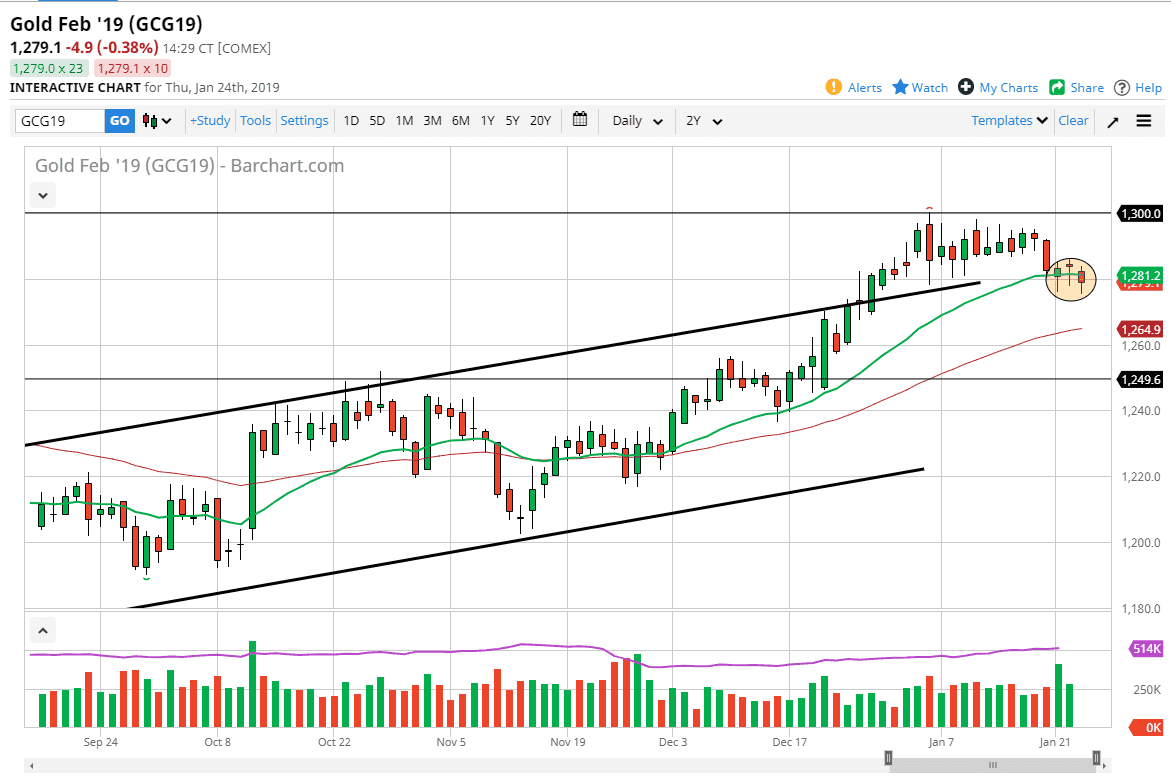

Gold markets initially dipped during the trading session on Thursday, slicing through the $1280 level before bouncing again. In fact, we have formed the third hammer in a row, right at an area that should offer support anyways. Because of this, I believe that the market is getting ready to rally and we will eventually take off to the upside. If we can break above the candle stick for the Wednesday session, then it opens the door to the $1290 level, followed by the $1300 level which is a significant resistance barrier. This of course is the most obvious trade and the fact that the 20 day EMA is hanging about in the same area and acting as support makes sense as well.

However, there is also the alternate theory that we could break down below the low of the trading session on Thursday, and that would put Gold into a seriously bad attitude. We would go looking towards the 50 day EMA at the very least, as we would be breaking the back of three hammers, something that off the top of my head I don’t know that I’ve ever seen before, or if I have it’s only been a few times. It is because of this that I am still bullish of this market even if we haven’t been able to do much.

All things being equal, I think that we will probably go looking towards the $1290 level but we need the US dollar to roll over a bit. It does look a bit soft against the Japanese yen, but the Euro has given it a bit of a lifeline during the trading session on Thursday, so it is a bit of a mixed signal coming from the greenback.