Gold prices ended Wednesday’s session up $7.93 an ounce as the U.S. dollar extended losses following the release of the minutes from the Federal Reserve’s December meeting. The minutes indicated officials are unlikely to hike rates for at least a few months while they assess the impact of recent developments on the economy. “Participants expressed that recent developments, including the volatility in financial markets and the increased concerns about global growth, made the appropriate extent and timing of future policy firming less clear than earlier,” according to the minutes.

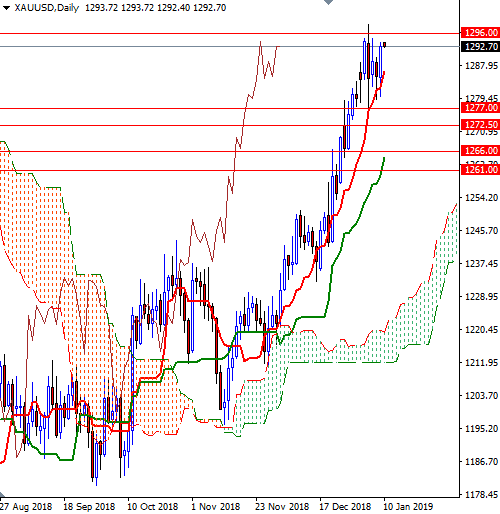

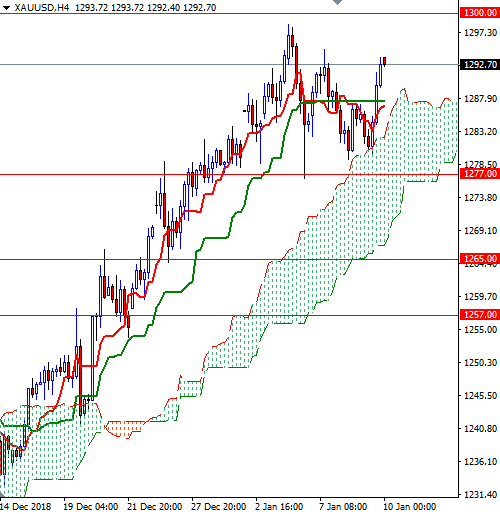

The market continues to trade above the daily and the 4-hourly Ichimoku clouds. The Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) are positively aligned on the weekly and the daily charts. However, note that XAU/USD has effectively been trapped within a $20 trading range for the past seven sessions.

The first upside barrier comes in around 1296 near the top of the weekly cloud. That is followed by the psychologically important 1300 level. A successful break above 1300 implies that the market is heading towards 1307/4. To the downside, keep an eye on the 1287.30-1286 zone where the Tenkan-sen and the Kijun-sen converge on the H4 chart. The bears have to pull prices below 1286 to test 1284/3 and 1280/79. The bottom of the 4-hourly cloud sits in the 1277/6 zone so if prices drop below 1276, look for further downside with 1274 and 1272.50-1270 as targets.