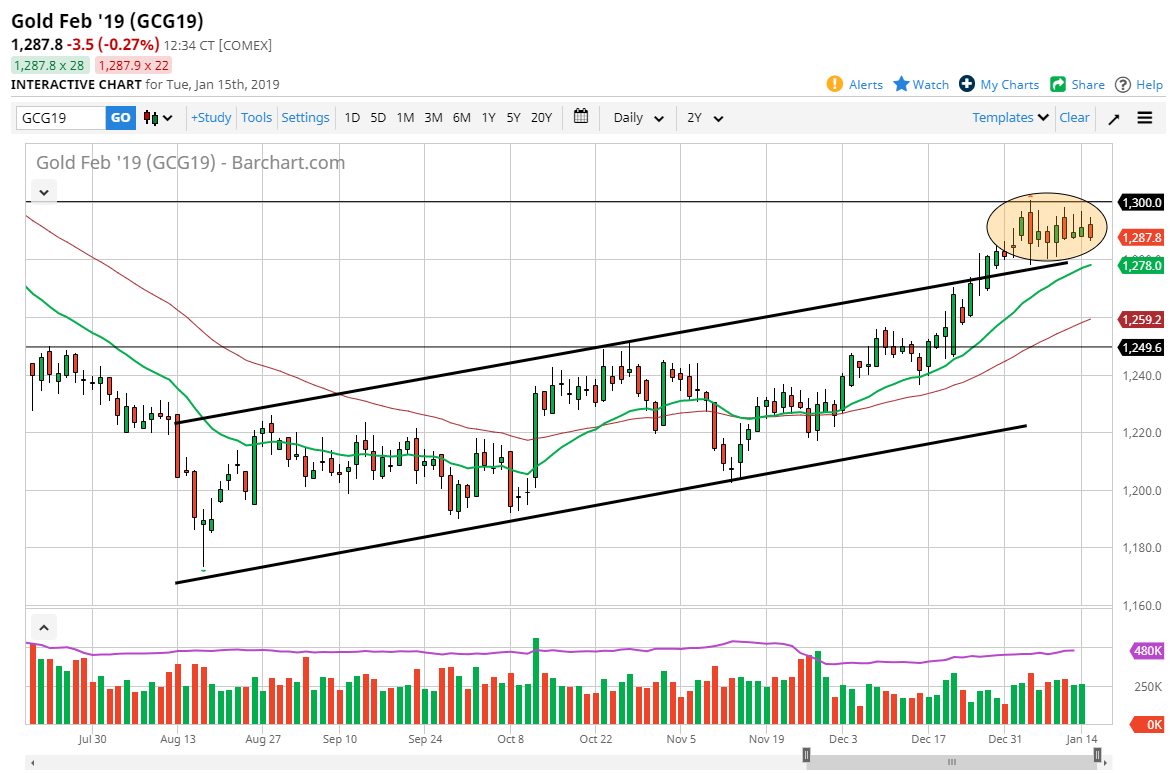

Gold markets have gone back and forth during the trading session again on Tuesday, as we are stuck between a couple of major areas. The resistance above at the $1300 level could be very difficult to get above, but once we do break above that level, it would be a major boon to the buyers as we should go much higher. I would consider a daily close above that level as another buy signal, but I also recognize that short-term pullbacks towards the 20 day EMA and by extension the top of the up trending channel could be a buying opportunity.

I think we are simply treading water right now trying to figure out what’s going to go on with the Federal Reserve and what they are likely to do as far as interest rates are concerned going into 2019. There is a school of thought now that the government shutdown will have enough of a negative effect to keep the Federal Reserve on the sidelines, as they await to see what the effect of that will be longer term. If that’s the case, then of course the US dollar will soften and gold should rise as a result.

Ultimately though, I think gold will continue the overall consolidation that we have been in for a long time, meaning that we should probably go looking towards the $1400 level which has been so resistive in the past. I am a buyer of a pullback at this point, unless of course we were to break down below the $1250 level, which for me is the “floor” at the moment. I don’t have any interest in shorting this market anytime soon, because I do believe that the US dollar is starting to run out of steam.