Gold prices ended a two-sided trading session slightly lower on Wednesday. Anxiety about the pace of global growth weighed on equities, but volatility in the stock market failed to offset pressure on gold from the rising dollar. The dollar was helped by a slump in the euro, following weak manufacturing data from Europe. Although the recent dollar strength put some pressure on gold prices, it may be temporary as investors expect that the Federal Reserve will not raise interest rates as many times as it previously signaled.

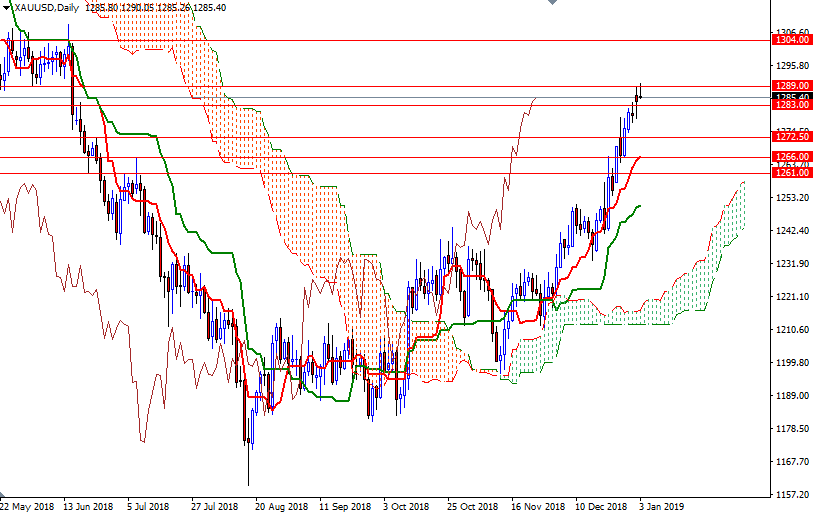

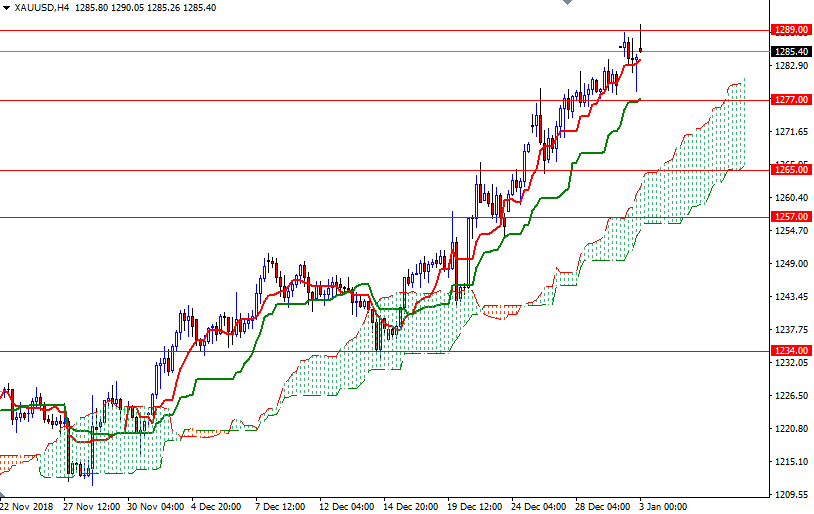

The bulls have the overall technical advantage, with the market trading above the daily and the 4-hourly Ichimoku clouds. The Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) are positively aligned. In addition, the Chikou-span (closing price plotted 26 periods behind, brown line) is above prices.

The bulls need to lift prices back above 1289 if they intend to challenge 1293.50-1292.50. A break through there could trigger a move up to 1296. To the downside, keep an eye on the 1285/3 zone, occupied by the Ichimoku cloud on the M30 chart. If prices fall through, we may visit 1281.50. A break below 1281.50 suggests that XAU/USD will retest the support in 1279/7. The bears have to produce a daily close below 1277 to make an assault on the 1272.50-1270 area.