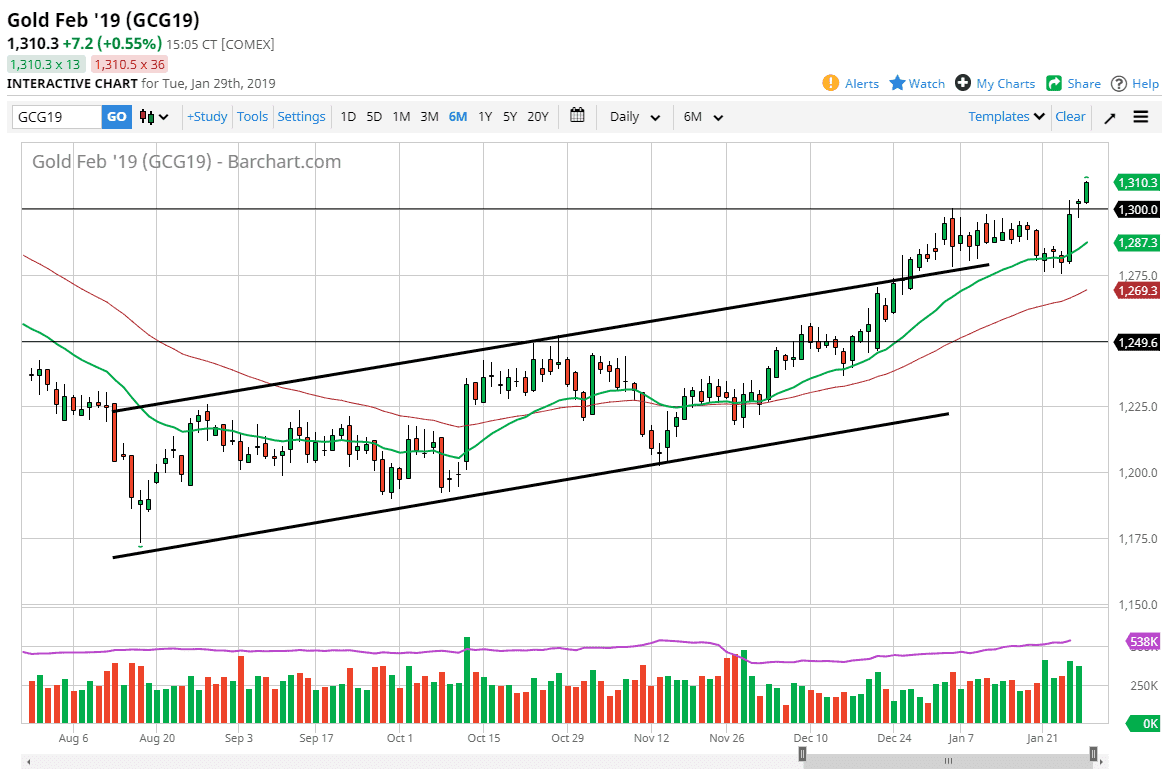

Gold markets rallied again during the trading session on Tuesday as we await the FOMC press conference on Wednesday. The US dollar has taken it on the chin as of late, as the trading world is coming to grips with the idea that perhaps the Federal Reserve is getting ready to loosen its stance on monetary policy. If that’s the case, then we could see gold really take off to the upside. However, there are other reasons to think that gold may be going higher, not the least of which would be geopolitical concerns around the world.

With both of these things moving in tandem, it has been a bit of a “perfect storm” for the yellow metal, and we have recently broken out of consolidation that measures for a move towards the $1325 level. It seems as if there is a lot of interest in the gold market every $25, so that lines up pretty nicely with historical charts as well. At this point, I believe that pullbacks will be looked at as buying opportunities, especially near the $1300 level, an area that was a bit stubborn when it comes to allowing the market to break above it. In fact, unless Chairman Powell suggests on Wednesday that the Federal Reserve is going to become aggressively tighten, or at least on “automatic pilot” as he has previously stated, then I believe that the US dollar will continue to fall.

I believe that the hammer that formed on Wednesday is trying to signal that there is a bit of a “floor” in the neighborhood, and I also believe that given enough time we will probably go looking towards the $1400 level, based upon the longer-term consolidation that we are in the middle of.