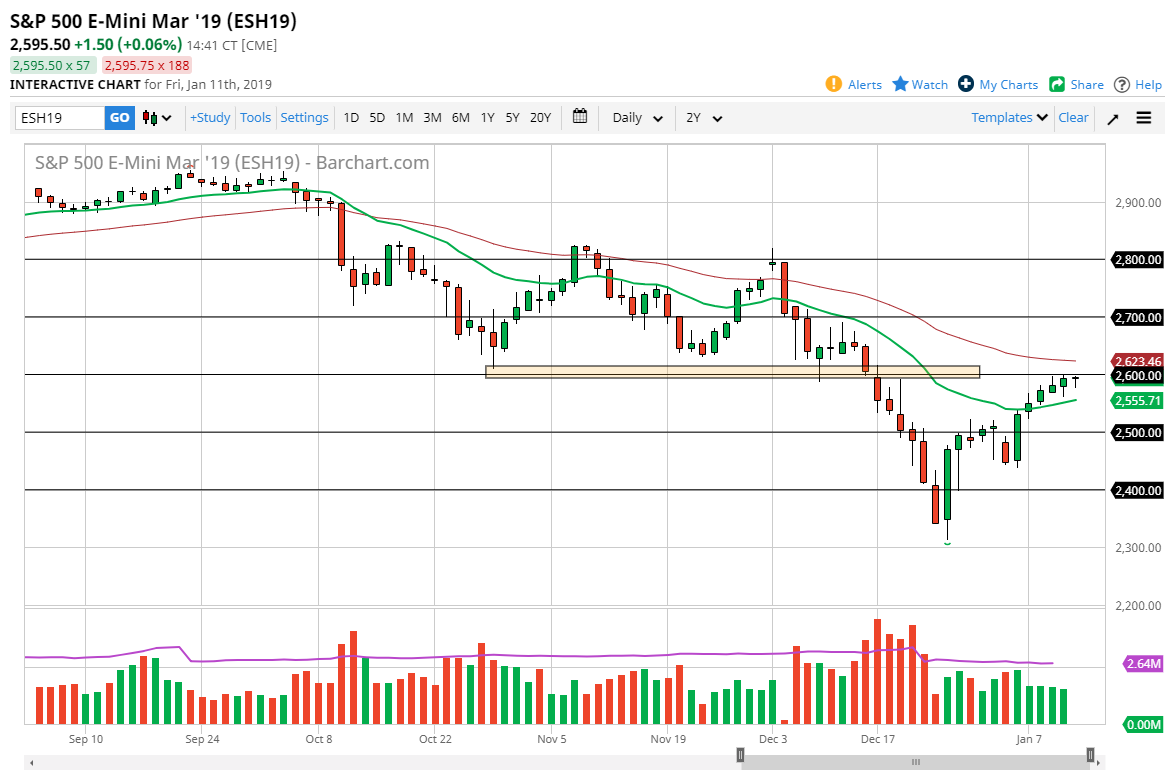

S&P 500

The S&P 500 initially pulled back a bit during the trading session on Friday, but then turned around to plow towards the 2600 level. This is a market that is on the precipice of making a major move, and we are closing out the week right where we need to be in order to have the next leg higher or break down. We are right between the 20 day EMA and the 50 day EMA, meaning that we are going to continue to see a lot of volatility. Beyond that, the 2600 level is the previous support level which should now be resistance. Ultimately, I think that you need to see a daily close either above the 50 day EMA to start buying, or below the 20 day EMA to start selling. With earnings season coming, this is about to get very noisy.

NASDAQ 100

The NASDAQ 100 went back and forth during the trading session on Friday as well, and just as the S&P 500 is, the NASDAQ 100 is stuck between the 20 day EMA and the 50 day EMA. I believe that the same rules apply here: buying on a daily close above the 50 day EMA pictured in red or selling below the 20 day EMA pictured in green. I think that this market is especially interesting right now, because it also has quite a bit of sensitivity to the US/China trade situation, which of course is going to continue to be a major headline. I believe at this point, the market will make a significant decision soon, but waiting to get the daily close to put money to work, as false breakout potential is very high in this region.