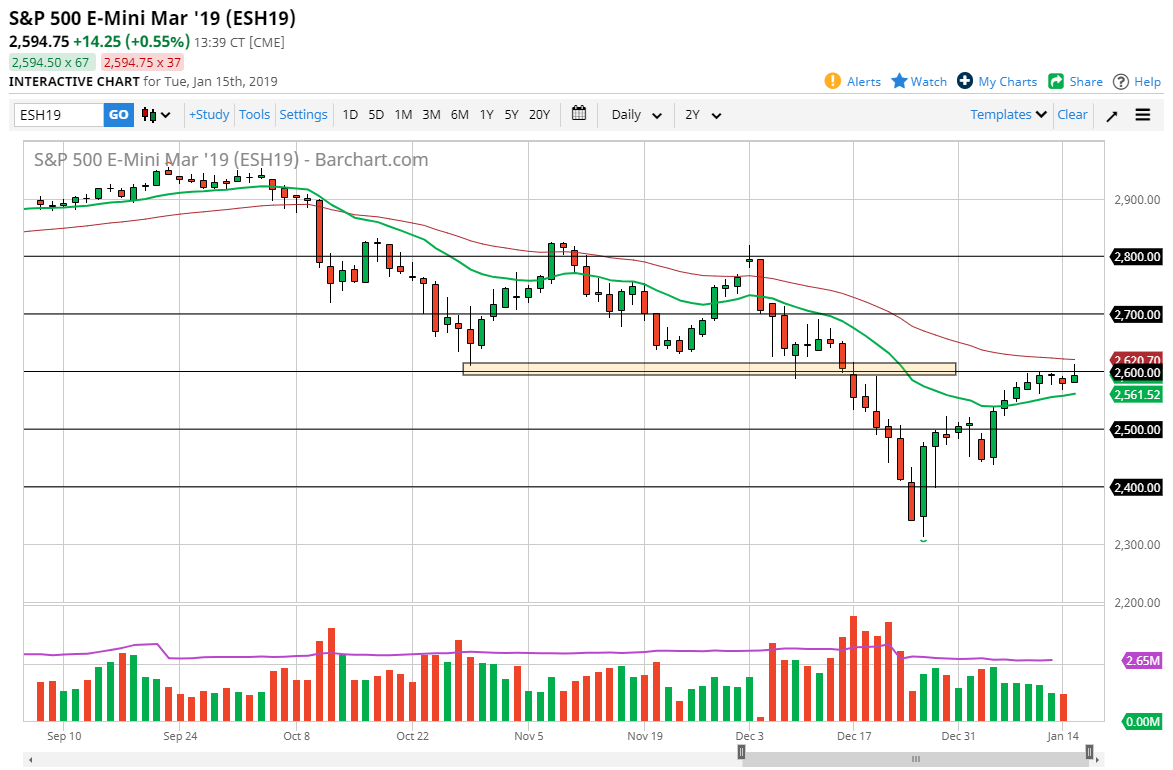

S&P 500

The S&P 500 tried to rally during the majority of the session on Tuesday, as we reached towards the 2600 level. There is the 50 day EMA just above, and that of course will cause a significant amount of resistance as well. I think at this point it’s likely that we will roll over slightly, but we are currently stuck between two major moving averages, so I think there isn’t much to do until we get a daily close either above or below the range that we are in. This scenario more than likely continues to be very difficult to work with, but this will only be exacerbated by the fact that we are right in the middle of earnings, which of course causes its own set of headaches. Wait until we get a daily close above the 50 or below the 20 before putting money to work.

NASDAQ 100

The NASDAQ 100 rallied a bit during the trading session, and looks as if it is trying to lead the way for US equities. The 20 day EMA underneath offer support at the 6500 level, just as the 6750 level above and the 50 day EMA both are going to offer resistance. I think at this point it’s likely that we continue to see a lot of volatility, but it looks as if the NASDAQ 100 is trying to go higher. Ultimately, I think there is a lot of concern out there when it comes to the US/China trade relations which of course have gone nowhere as well. Even though we could rally from here, I think that the market will have more risk to the downside than anything else but I need to see a daily close outside of the range of the two moving averages here to put money to work as well.