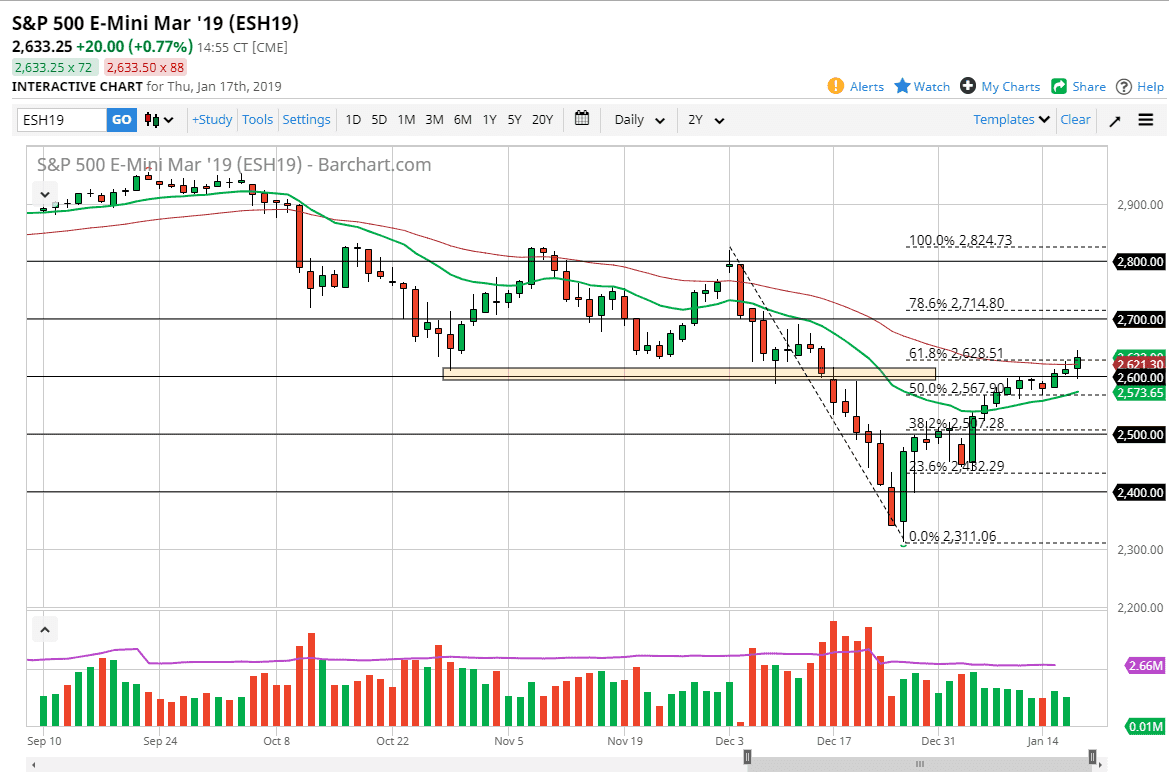

S&P 500

The S&P 500 went back and forth during trading on Thursday, initially pulling back to test the 2600 level. However, we jumped higher and broke above the 50 day EMA. We even closed above the 50 day EMA, which of course is a very bullish sign. The 61.8% Fibonacci retracement level is in the neighborhood as well, so expect a significant fight. That being said, if we can break above the top of the range for the trading session on Thursday, then I think we could go much higher. The alternate scenario of course is that we break down below the 2600 level, which could send the market right back down. Expect a lot of volatility, because this is earnings season and there are a lot of moving pieces out there. There are rumblings of the US trying to move forward with the Chinese stocks, so that might help.

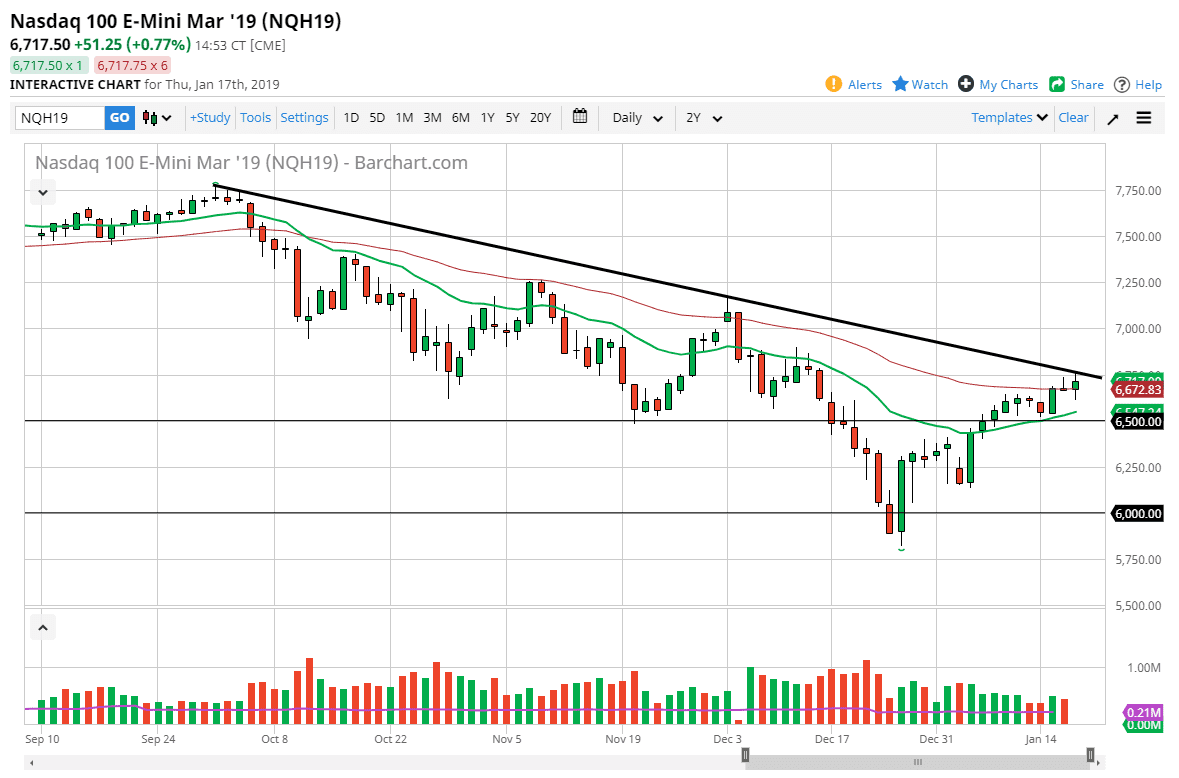

NASDAQ 100

The NASDAQ 100 had a bullish session during the day but is currently struggling with a downtrend line that I have drawn on the chart. If we can break above the highs of the day for Thursday, I think that the NASDAQ will lead the way for both stock market indices, heading towards the 7000 handle. Pullbacks at this point probably have support at 6500. If we were to turn around and break down below that level, then things could change and markets could roll over somewhat negatively. I think you can expect more volatility but it certainly looks as if the buyers are trying to make a statement, and that they would more than likely get their way given enough time.