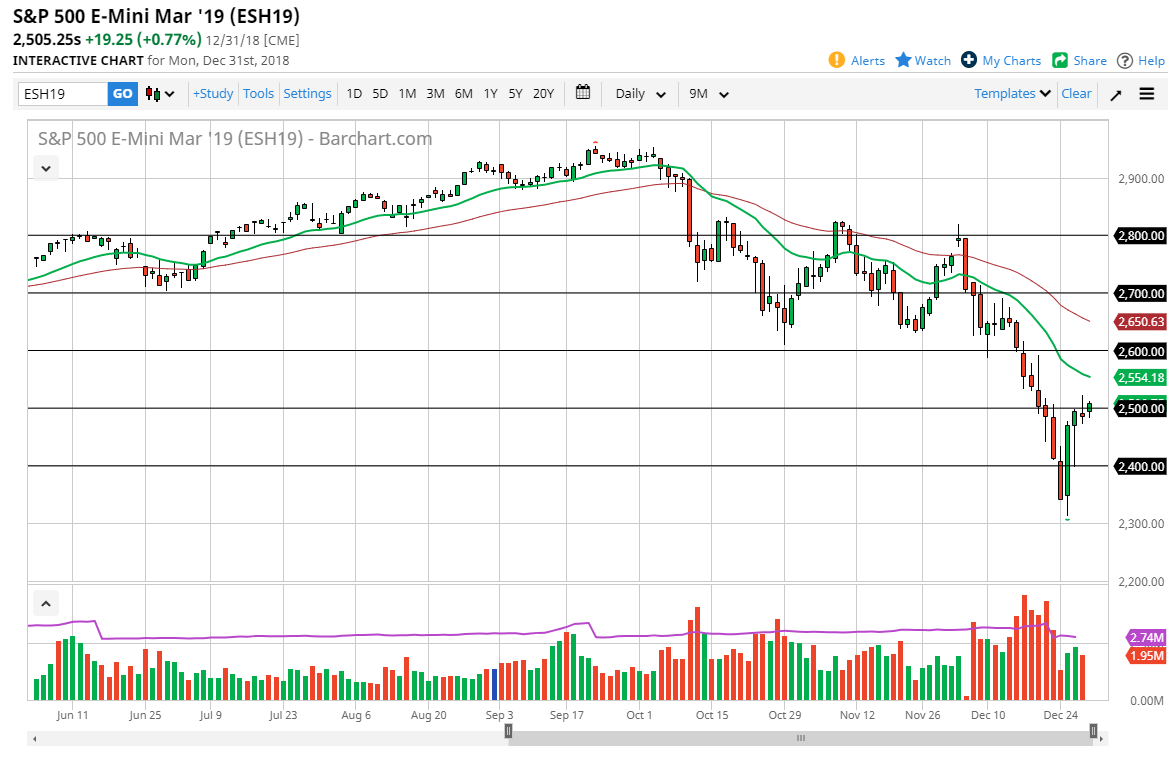

S&P 500

The S&P 500 did pull back initially during the trading session on Monday, but then broke above the 2500 level. The market looks very likely to try to continue to go higher, but I think that there is a significant amount of resistance above, so at this point I think that dating this market closer to the 20 day EMA makes sense. I believe that the overall attitude of the markets might be a bit of relief in the short term, but after managers put a lot of money to work at the beginning of the year, I think we will start seeing selling again. 2600 is crucial, and if we can break above there then we may have an opportunity to continue to rally. Earnings season starts on January 17, so this is another reason why we may have a short-term bounce, but I suspect the sellers are still out there.

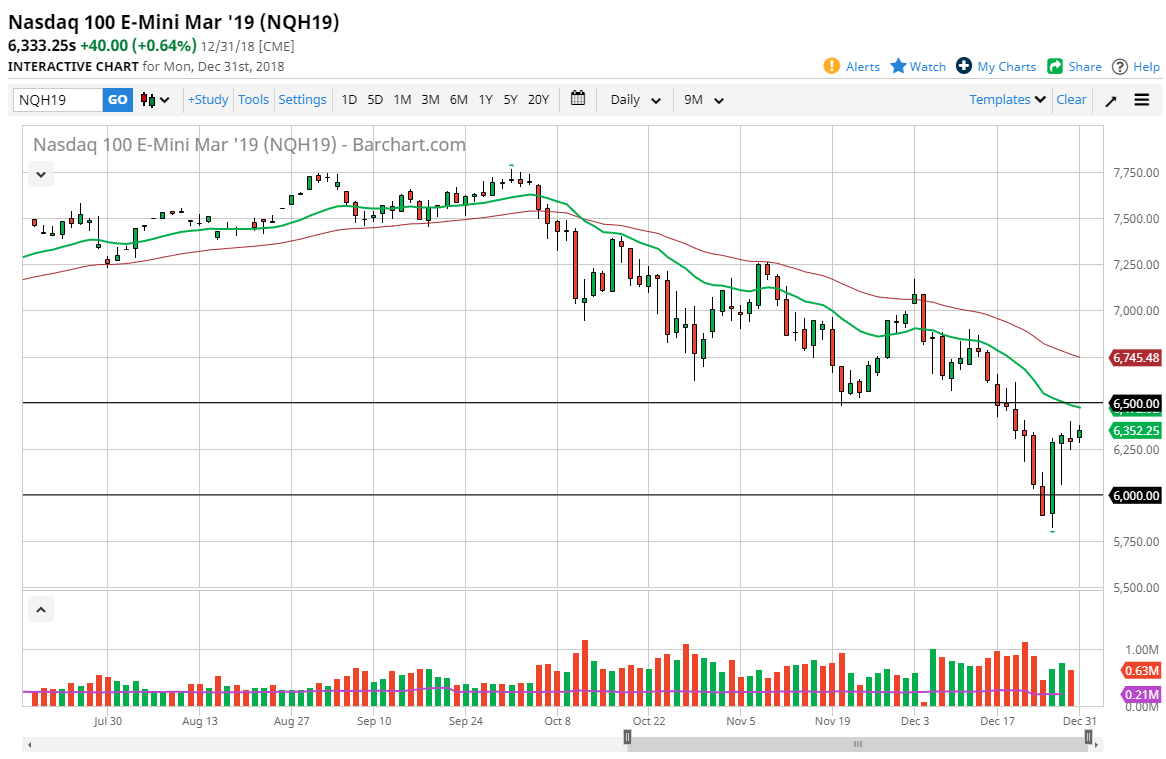

NASDAQ 100

The NASDAQ 100 rallied slightly during the trading session on Monday, but it was the end of the year so it’s difficult to imagine we can read much out of the daily candle. The 6500 level above is massive resistance, so it’s likely that we will see some selling pressure after a short pop. If we do break above the 6500 level, then the 6750 level would be the next major resistance barrier. Ultimately, I think a short-term rally makes sense, but it’s only a matter of time before we reach towards the lows again as the market has been in an extreme bear market, and I think at this point there is still plenty of momentum to the downside. Selling rallies continues to work from what I can see.