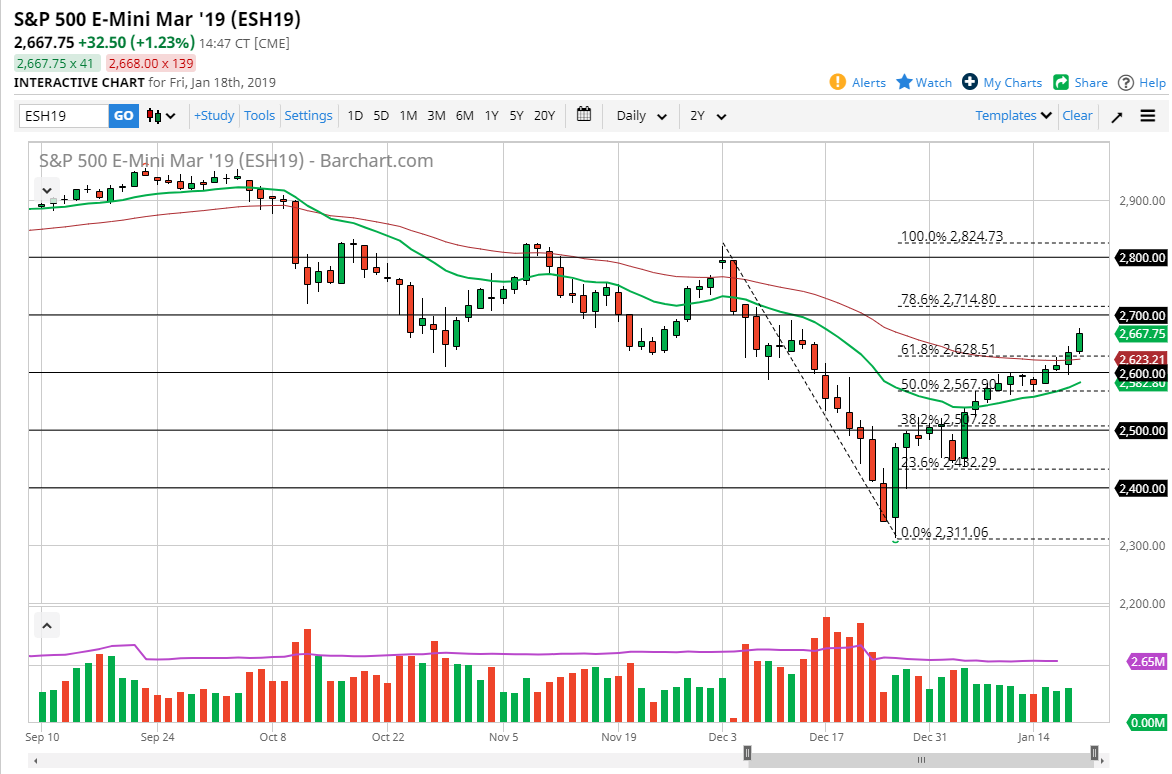

S&P 500

The S&P 500 rallied again on Friday as we continue to see a lot of strength in the US stock markets. At this point, volume is finally starting to pick up and now we are well above the 61.8% Fibonacci retracement level. That is a very good sign, because quite frankly I have found over the years that if we can break the 61.8% Fibonacci retracement level, quite often we will wipe out the entirety of the move. The 2700 level of course is resistance, so it wouldn’t surprise me at all to see a little bit of a pullback. However, if we can break above the 2700 level, then the market will then go looking towards the 2800 level after that. As long as we can stay above the 2600 level, I think this market is still very bullish. If we were to turn around and break down below there, then things get a bit dicier.

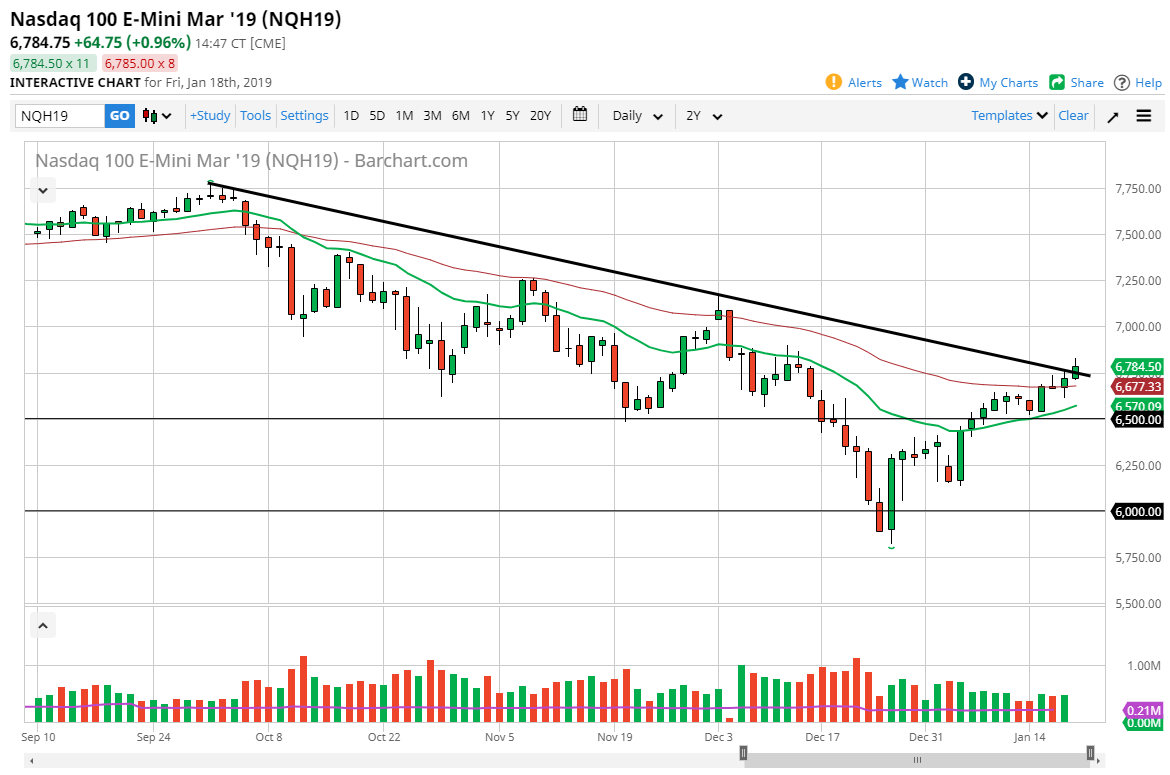

NASDAQ 100

The NASDAQ 100 has continued to rally on Friday as well, piercing a downtrend line and closing just above it. That’s a very bullish sign, and I think that the NASDAQ 100 is going to go looking towards the 7000 handle after that. That is of course is a massive resistance barrier, and I think that level will be more than resistant but I think we have already seen so much in the way of bullish pressure as of late I think that the buyers have firm control. That’s not to say that this will be easy, just that they certainly have taken control. If we do pull back from here, as long as we can stay above the 50 day EMA, pictured in red, then I think buying is the only thing you can do.