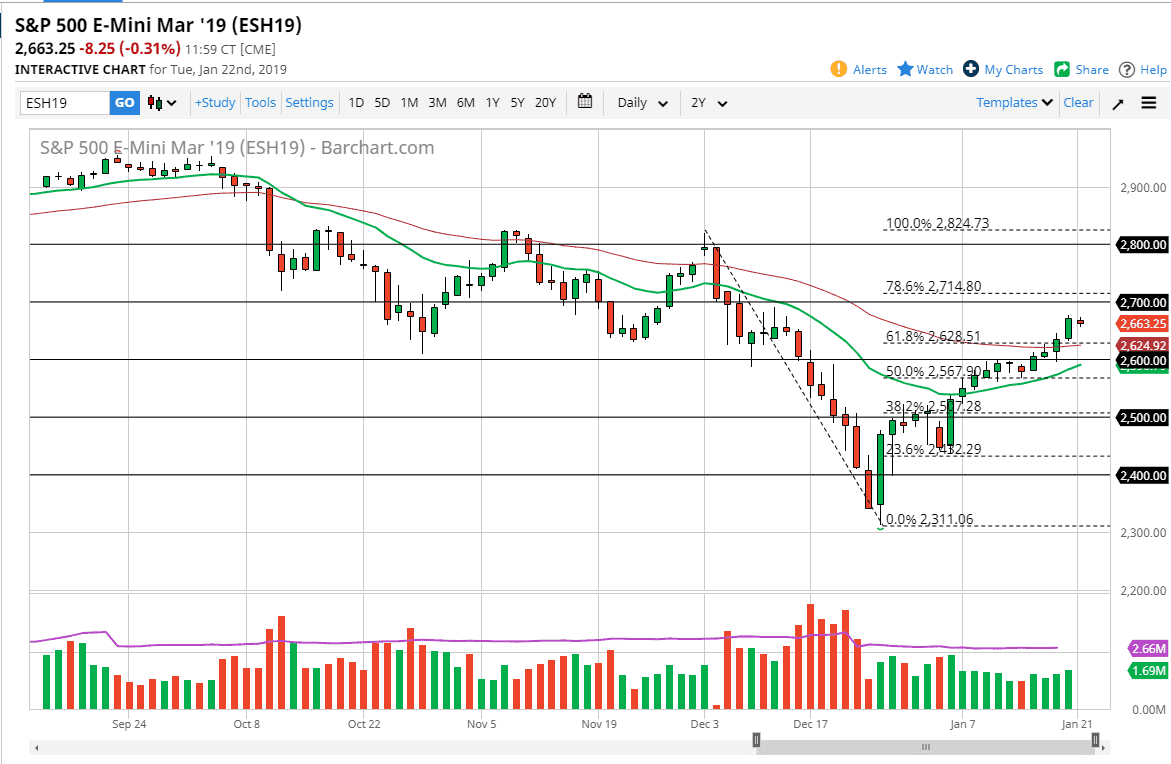

S&P 500

The S&P 500 fell slightly during the trading session on Monday, in Globex trading. With the Americans away for the Martin Luther King Jr. holiday, volume simply wasn’t there and therefore you can’t read too much into the price action. We have seen a lot of resistance just above previously though, so wouldn’t surprise me at all to see the 2700 level, some issues. If we can break above the level, then I think we could go much higher. At that point I would be looking towards the 2800 level. If we pull back from here, then the 50 day EMA, pictured in red, should offer support. I believe that since we are in the middle of earnings season it is going to be difficult to continue going higher in the short term, but obviously a break above the 2700 level opens the door to higher levels again. Volume to the upside has been much lower than the down, which is something that concerns me as well.

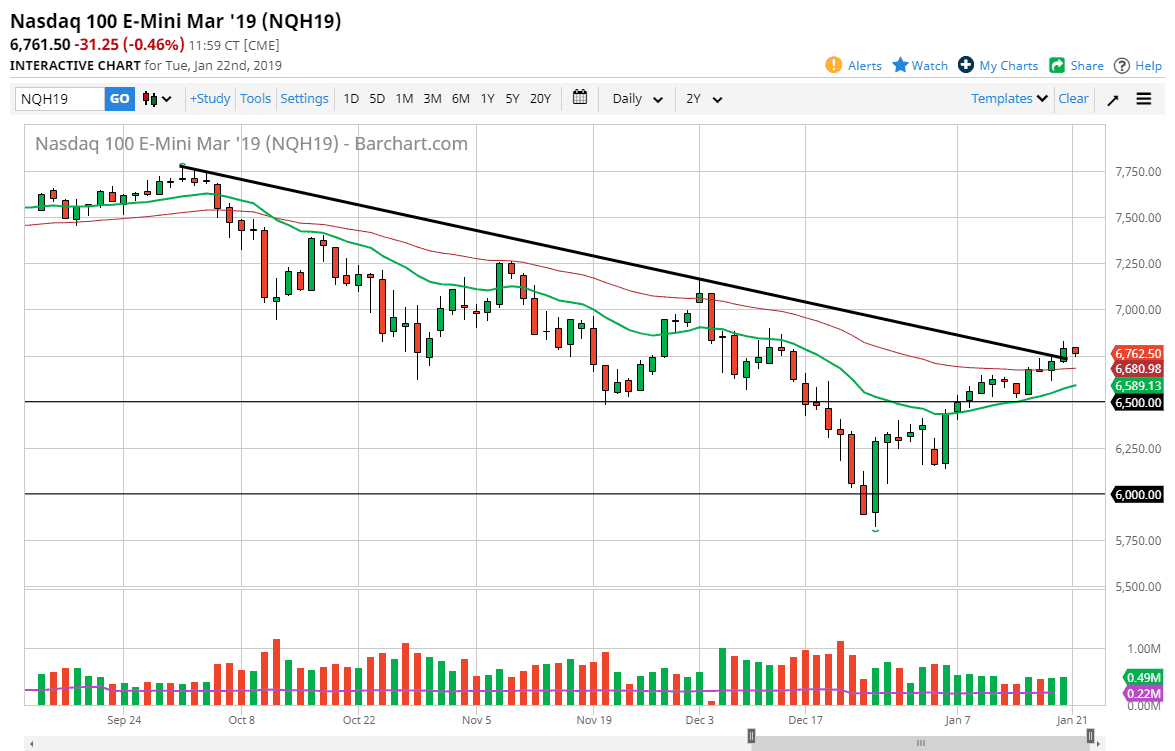

NASDAQ 100

The NASDAQ 100 fell a bit in electronic trading as well, but again we had no underlying trading, as the holiday had people away. The downtrend line had been broken on Friday, and now it looks like we may test that line for support, something that you would expect. Beyond that, we have the 50 day moving average just below, so I do think that we are about to see this market go higher. That being said, keep in mind that the NASDAQ 100 is very sensitive to the US/China trading situation, so if we get good news that should send the NASDAQ 100 much higher. At this point, I believe there is a bit of a “floor” somewhere closer to the 6500 level and I would be stunned to see the market break down below there. If we do, then the market will roll over completely.