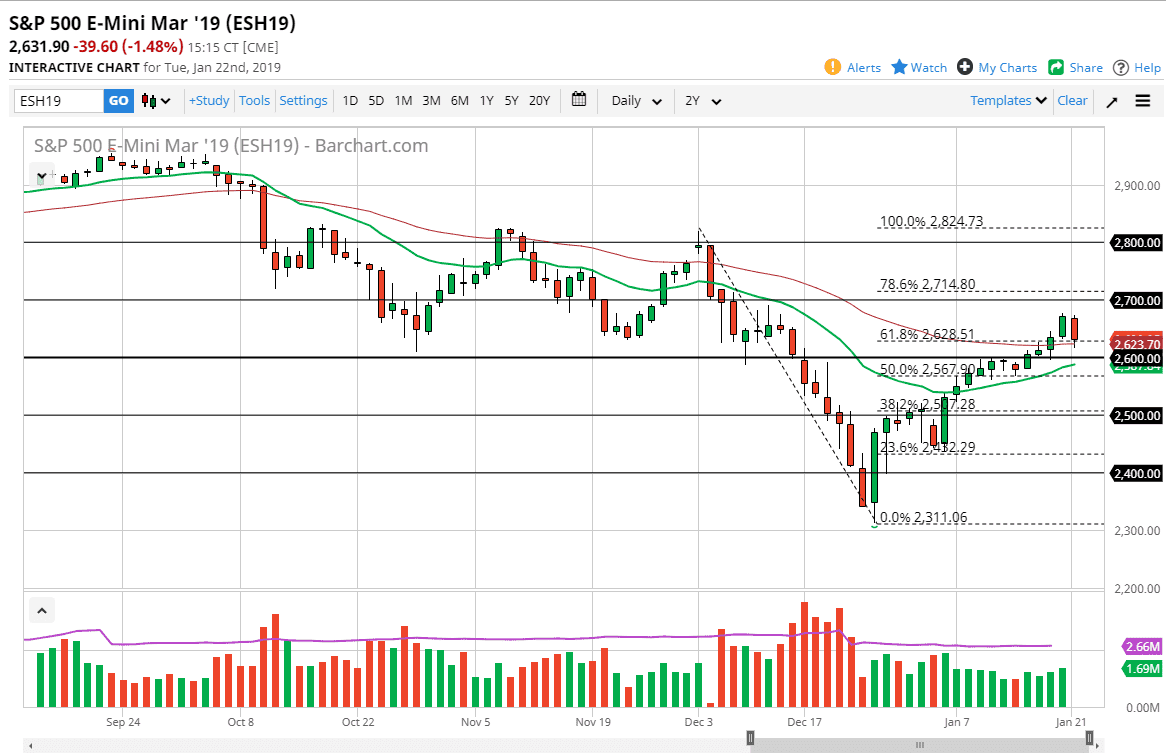

S&P 500

The S&P 500 fell hard during the trading session on Tuesday as Americans came back to work. It looks as if we are trying to figure out whether or not we have legs for the next run higher. The 2600 level underneath seems to be supportive, and it should be noted that the buyers came back in towards the end of the day to pick up the market at the 50 day EMA, so I don’t think that it’s time to start selling off, I think it’s simply a matter of a pullback looking for support. I prefer short term long positions on tiny pullbacks but recognize that we will more than likely see a lot of back-and-forth in this 100 point range. If we do break above the 2700 level, then I think we could go much higher. Until then, I think we are simply bouncing around looking for direction.

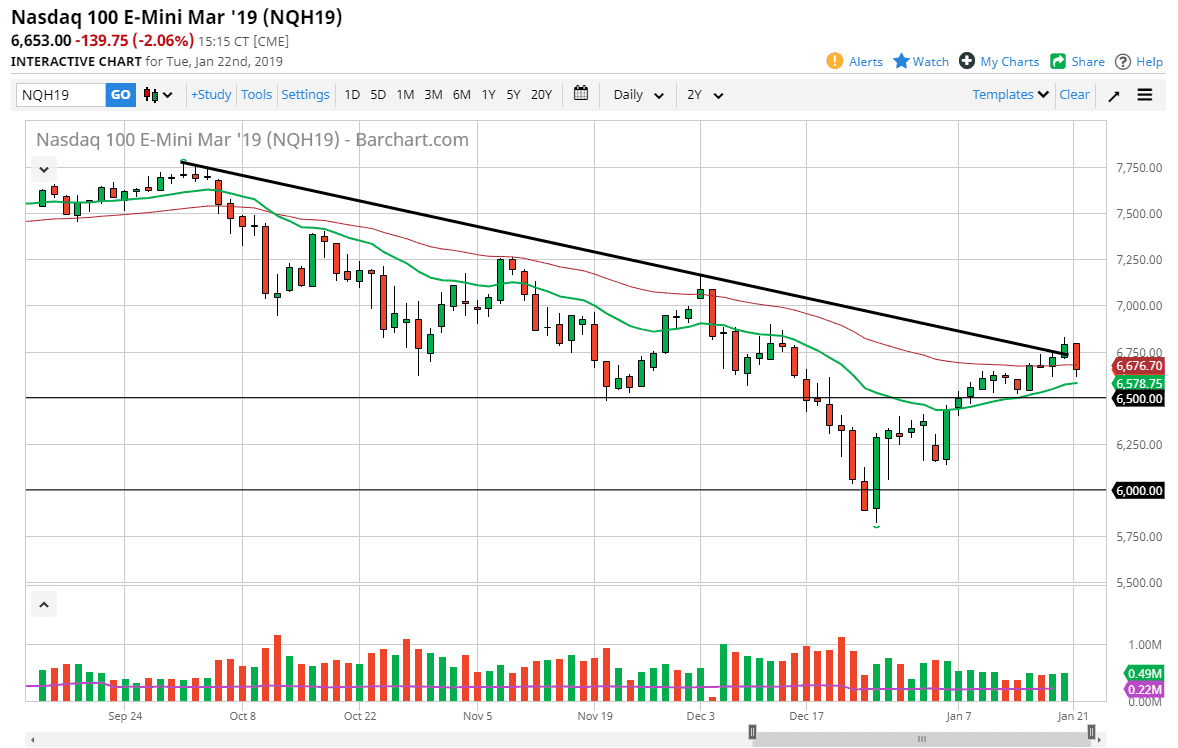

NASDAQ 100

The NASDAQ 100 broke down significantly during the trading session on Tuesday, forming a very ugly candlestick, which shows a significant amount of resistance right at the trend line. I think as long as we can stay above the 6500 level, it’s likely that we will find buyers to try to send this market back to the upside. However, if we were to break down below the 6500 level, that would be a very negative sign and could have the market falling back towards the 6000 handle over the longer-term. A lot of this could have been done due to negativity coming out of the US/China trade situation during the day, but at the end of the session we had a negative candle that is simply a small pullback so far. This is why I look at the 6500 level with such importance. I suspect that we will have buyers in that general vicinity.