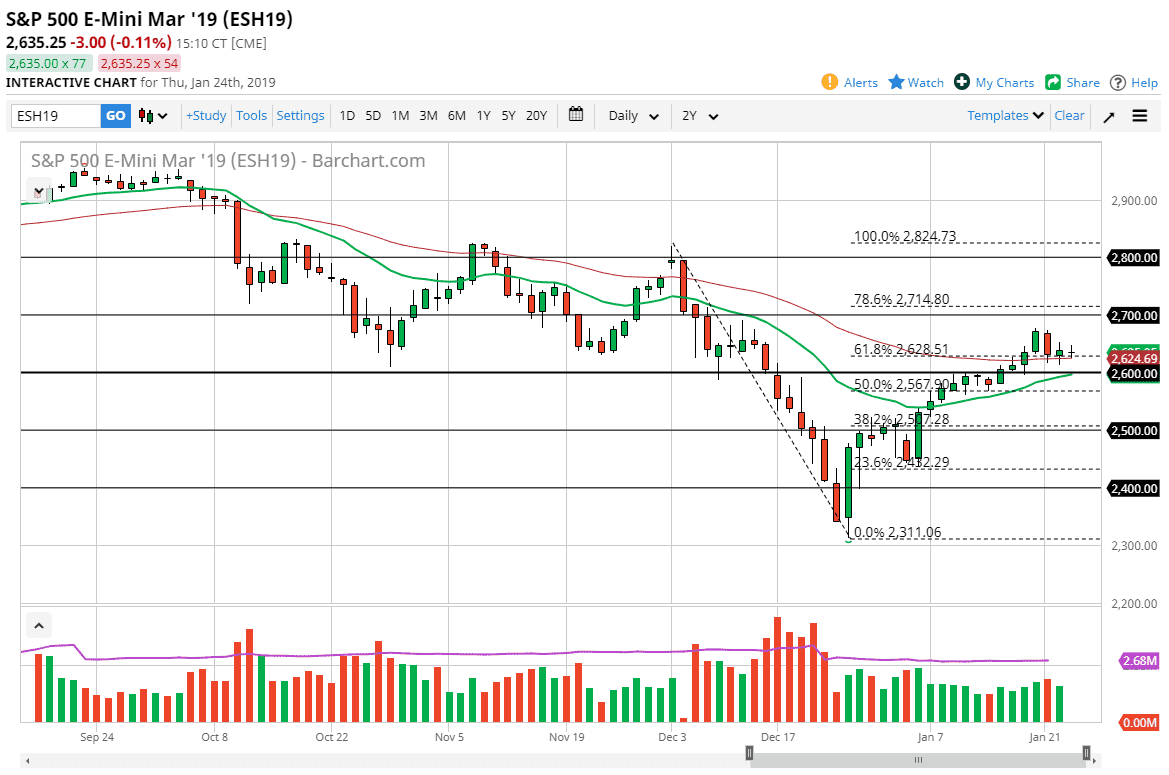

S&P 500

The S&P 500 went back and forth during the trading session on Thursday, essentially going nowhere. The 50 day EMA offer support, as we are basically between the two major levels in the form of 2600 and 2700. Ultimately, I think we are essentially in an area where we are trying to figure out what to do next, and that there is a significant amount of confusion and risk at the moment. All things being equal, I would prefer to be out of the stock market as we are testing the 61.8% Fibonacci retracement level of the massive fall at the same time. If we break down below the 2600 level, then I think the market probably goes down to the 2500 level. Alternately, if you can break above the 2700 level, then I think the market is free to go to the 2800 level. Until we break one of those levels, and choppiness will continue.

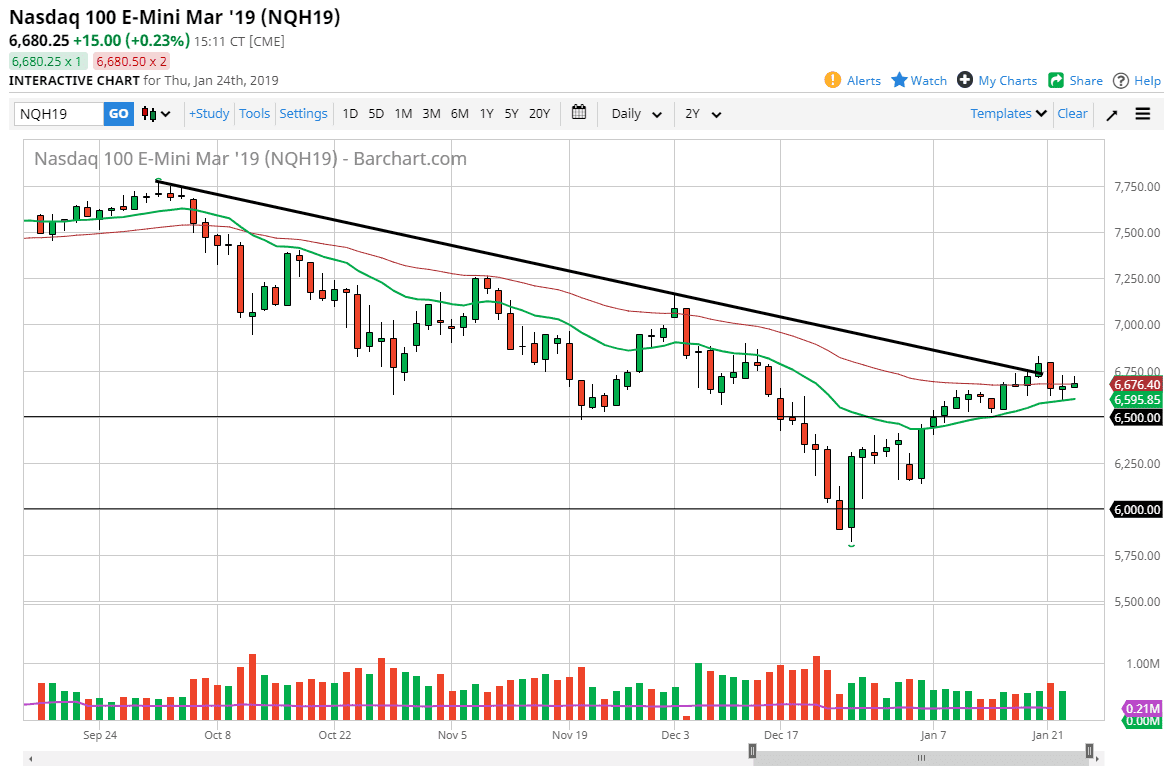

NASDAQ 100

The NASDAQ 100 initially tried to rally during the trading session on Thursday, testing the 6750 handle. There is also a downtrend line that is in the neighborhood, so I think part of this is simply the market trying to figure out what to do over here as well. If we can make a fresh high above the candle stick for Tuesday, then this market should go much higher. Otherwise, I think that we roll over to the 6500 level. This is a market that is at a significant pivot point, as we decide where we go next over the longer-term. The NASDAQ 100 tends to be especially sensitive to the US/China trade relations, so keep that in mind. Beyond that we are in the middle of earnings season, so both of these indices will be subject to that noise.