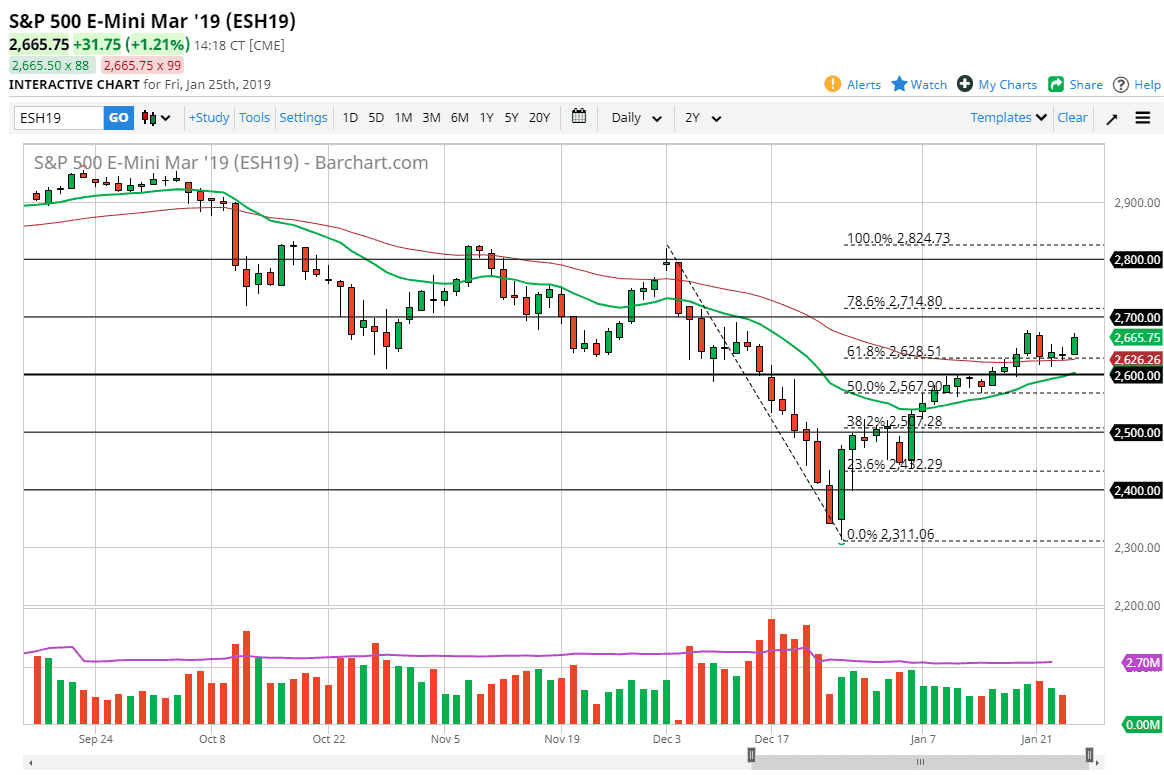

S&P 500

The S&P 500 rallied significantly during the trading session on Friday, reaching towards the highs again but you can see that we could break out. Beyond that, the 2700 level will also offer resistance. Nonetheless, I do think that the market is trying to build up enough momentum to break out, and as soon as we get above the 2700 level it’s likely that the market will go towards the 2800 level next. Alternately, if we were to break down below the 2600 level, then the market probably could go down to the 2500 level. Overall though, I do think that the market probably has more buyers and sellers, and with the partial government shutdown now being debated for at least three weeks, I think that we may have market participants looking for a reason to go long. While we are in this 100 point range though, I would be a bit cautious.

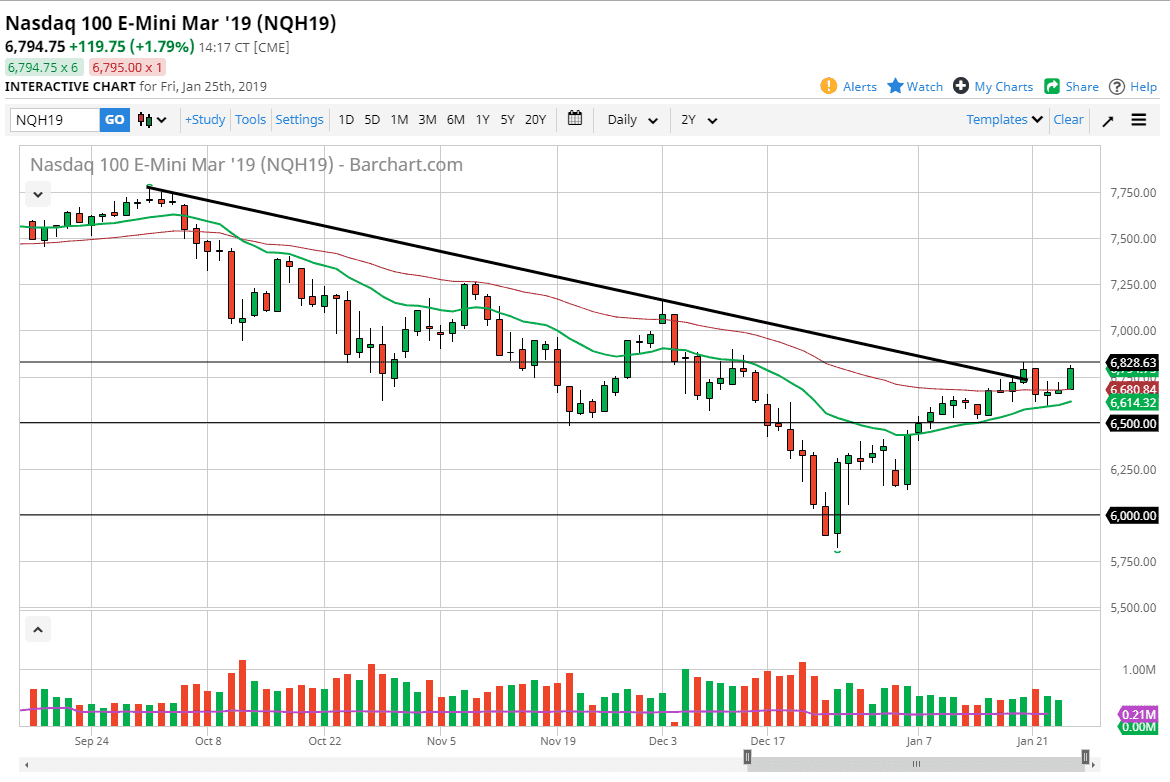

NASDAQ 100

The NASDAQ 100 rallied during the day as well, reaching towards the 6825 level. There is a lot of resistance in the area, but we have broken above a major downtrend line so I do think that the NASDAQ 100 could cause the S&P 500 to rally in sympathy as this market will probably rally due to the technology sector. In fact, this next week is going to be crucial for technology so I think this could be a big move waiting to happen. To the downside, I see a lot of support at the 6500 level, so if we were to break down below there it would be a very negative sign. At this point though, I would say the market is at least “leaning” towards the upside.